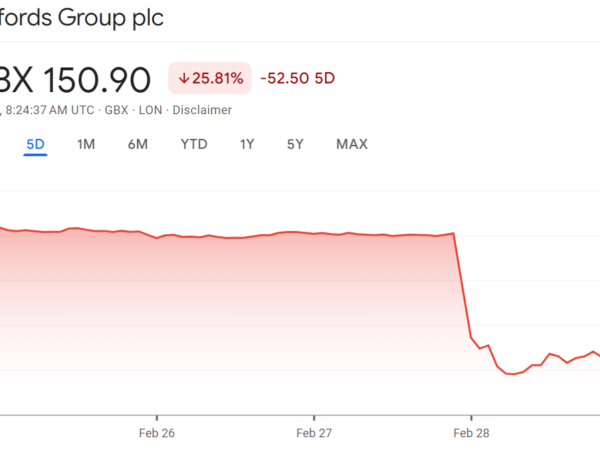

Goodyear share price plummets after quarterly results

On the evening of 31 July, Goodyear presented its Q2 2024 financial results, some of which showed significantly improved operating results and profit margins. But this didn’t impress investors, who from the figures identified something of particular significance to the tyre maker’s future development. Analysts subsequently reported that Goodyear is cutting costs everywhere on its return to long-term profitability. This is starting to have an impact on sales, particularly in the US domestic market.

Pirelli

Pirelli

Hella

Hella