Tyre makers & the Russia dilemma

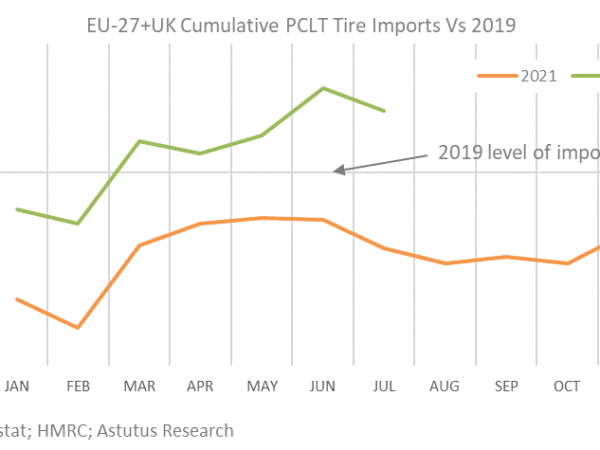

Many tyre makers have faced difficult decisions in the weeks and months since Russian troops first marched across Ukraine’s border on 24 February. Companies such as Nokian Tyres, Bridgestone, Continental, Michelin, Yokohama and Pirelli have needed to decide whether to continue operating their Russian plants. Four of these manufacturers are turning their backs on Russia or considering doing so, but two apparently are not.

Tatneft

Tatneft

Ernie Journeys; Unsplash

Ernie Journeys; Unsplash Egor Fin; Unsplash

Egor Fin; Unsplash Bridgestone

Bridgestone Michel Bossart; Pixabay

Michel Bossart; Pixabay Astutus Research

Astutus Research