Lanxess debuts sustainable tyre antioxidant

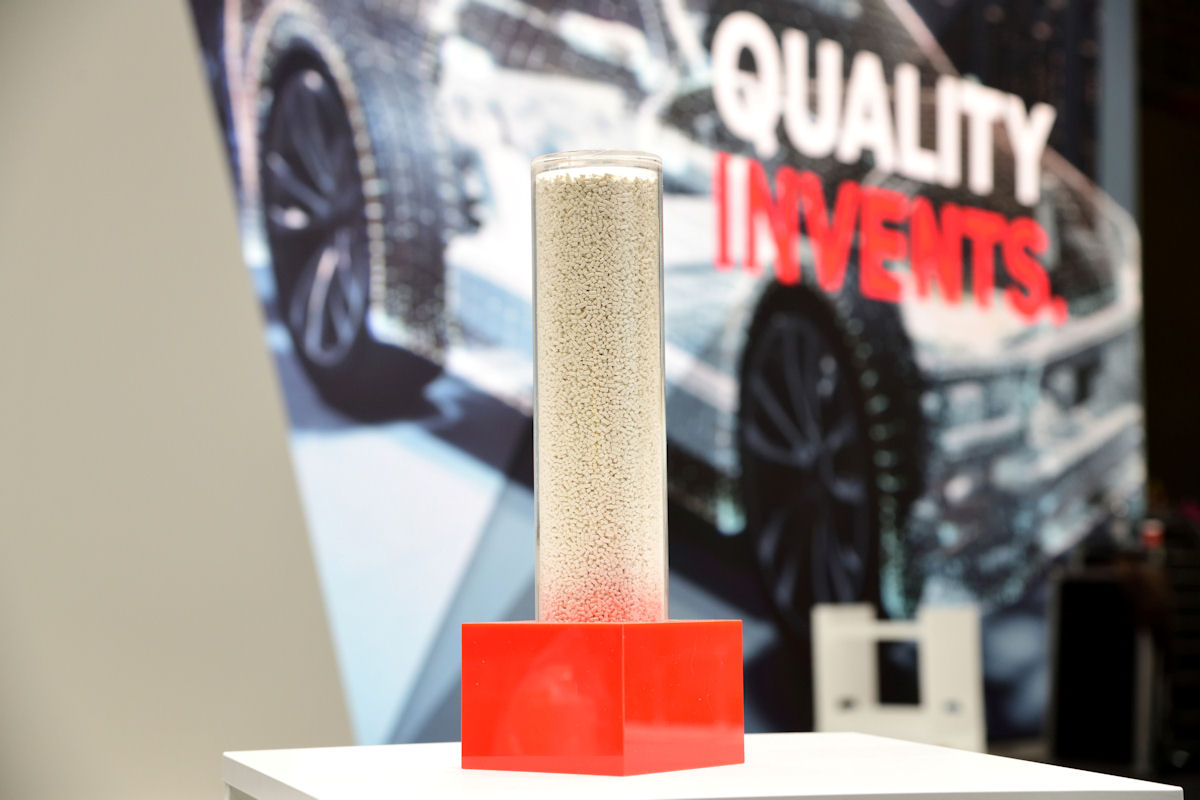

With its newest rubber additive, Lanxess aims to support tyre makers who wish to produce “more sustainable, longer-lasting tyres.” Introducing the Vulkanox HS Scopeblue antidegradant, a sustainable variant of the proven antioxidant Vulkanox HS (TMQ) that manufacturers already use to protect their tyres from adverse effects of oxygen and heat.