Doublestar, Guizhou Tyre, Linglong, Triangle, and Aeolus publish results forecast

Doublestar, Guizhou Tyre, Linglong, Triangle, and Aeolus recently disclosed their semi-annual results forecasts. Doublestar was in the red in the first half of 2023. The other four tyre companies estimated that their performance would rise. Tyrepress China found that adjusting market and product structure became essential reasons for the net profit growth of several Chinese tyre companies. At the same time, the decline in raw material prices and shipping costs benefited tyre manufacturers in the first half of the year.

Guizhou Tyre

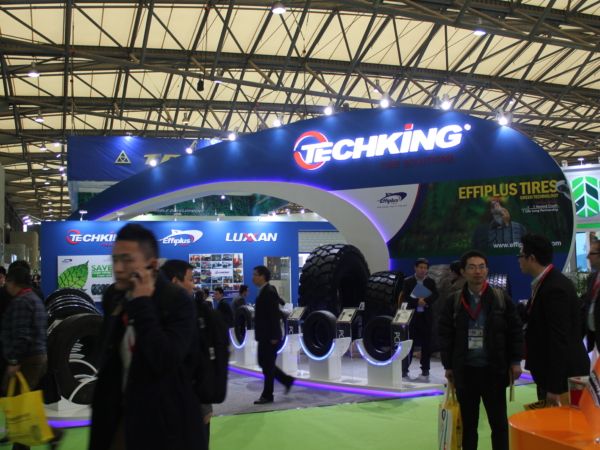

Guizhou Tyre Techking

Techking Christian Lue; Unsplash

Christian Lue; Unsplash Guizhou Tyre

Guizhou Tyre Sailun

Sailun Linglong

Linglong Online investor Q&A

Online investor Q&A Hammerling

Hammerling

Guizhou Tyre

Guizhou Tyre Guizhou Tyre

Guizhou Tyre Mylene2401; Pixabay

Mylene2401; Pixabay Guizhou Tyre

Guizhou Tyre