Now Pirelli’s been sold, who’s next?

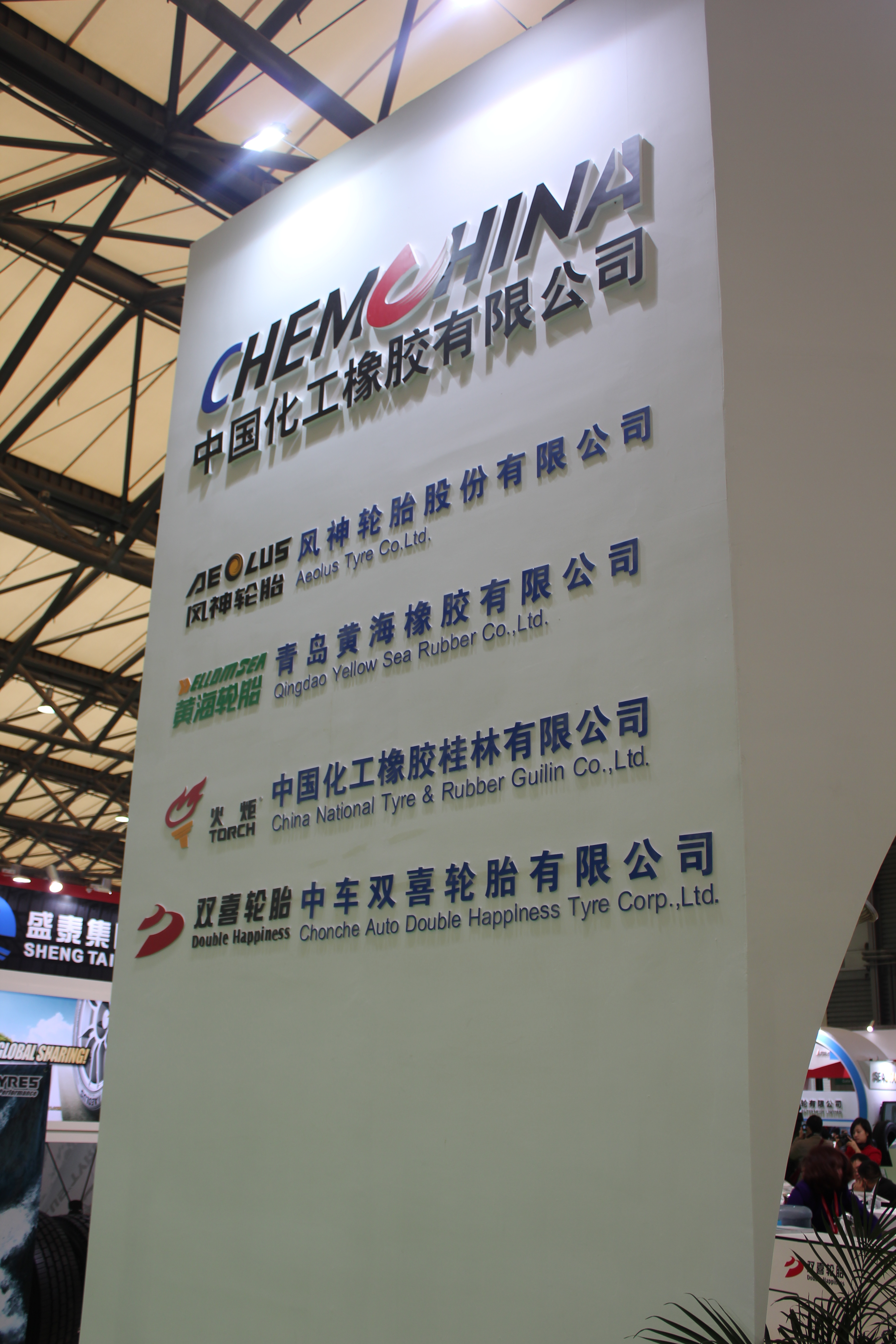

In case you haven’t heard, as much as 65 per cent of Pirelli is in the process of being sold to ChemChina. It’s a complex plan and there’s a long road ahead, but the deal has been done and so takeover wheels are in motion (see page 28 for complete coverage of this part of the story). So what’s next? The deal can’t fail to have an impact at Pirelli, but what about the other top five tyre manufacturers and beyond? We hinted at market consolidation in this column last month, with reference to restructuring proceedings at Shandong Deruibao Tire Co., Ltd and possible contagion in China; and Pirelli CEO Marco Tronchetti Provera made the market aware of that he was planning to sell his stake within two years in January 2014. But few would have named this particular bidder and this particular timing. Now we are faced with the possibility, even the likelihood that the Pirelli/ChemChina deal is going to precipitate further micro and macro consolidation within the tyre market – even a re-shuffle of the tyre industry’s top 10.