Online Tyre Business 2020

A Tyrepress Digital Feature, supported by

Online tyre prices went up as lockdown bit

Lockdown has led to increased demand for tyres online, but how has each platform reacted?

In October’s magazine, Tyres & Accessories takes a closer look at the latest developments in the multifaceted online tyre business. This article specifically looks at online tyre buying and pricing in conjunction with tyre pricing and selling-way data specialists Encircle Marketing. However, this is just one dimension in the online tyre business. In addition to online tyre retail, there is also the question of online marketing, an area in which social networks are playing an increasing important role (see separate article for further details). And on top of this, there is the electronic infrastructure necessary for the tyre business to participate – beginning with increasingly smart web sites and going onto integrated pricing and marketing tools.

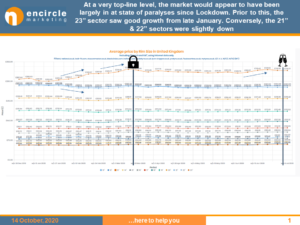

For now, however, our focus is on the UK online tyre retail business and specifically what has happened before lockdown, while the population was largely confined to their homes and as lockdown eased in July. “At a very top-line level, the market appears to have been largely in a state of paralysis since Lockdown”, Encircle’s analysts wrote in a report published in the summer. Prior to this, the 23-inch sector saw good growth from late January. Conversely, the 21- and 22-inch sectors were slightly down (see chart 1). But there is clearly more to the story.

Tyrepress podcast: Mike Welch

Read this feature and more in Tyres & Accessories, October 2020

Overall, social media appears to be the one place where coronavirus and Covid-19 made little impact during the course of 2020. However, that doesn’t mean that things have stood still. (Photo: Gerd Altman; Pixabay)

As Tyres & Accessories annual global social media ranking enters its seventh edition, this year there is a new winner. Last year’s champion, Pirelli, has fallen two places to third position. At the same time, Sumitomo Rubber Industries’ Falken brand rose an impressive eight positions to take the top spot. And Pirelli wasn’t the only well-known name to downshift, with two other brands taking retrograde steps. At the same time, in a reflection of what has taken place in the UK-only ranking, the top 10 has a new entry, with previously 10th-ranked MRF being overtaken by another large Indian tyremaker.

So what’s behind Falken’s rapid ascendancy? First of all, a little background. The reasons for the move are not clear, but – for whatever reason – Falken’s UK operation transferred support its support to the company’s Falken Tyre Europe-based handles during the last year or so. This, in turn, meant Sumitomo-owned brands global focus shifted towards the Falken Tire moniker.

Michelin continued to dominate the 2020 UK social media ranking (Photo: Photo Mix; Pixabay)

For the fourth year in a row, Michelin can be found at the top of Tyres & Accessories’ 2020 UK social media ranking. Indeed, such is Michelin’s dominance in the annual table, only Goodyear (in 2012) and Dunlop (in 2016) have done enough to overtake the UK arm of the French tyre brand since our research began in 2011. In both cases, Michelin still managed to take second place.

There are reasons why Michelin has dominated the UK social media ranking and a closure look at the table sheds light on what those reasons are. Apart from the fact that the Michelin brand regularly tops unprompted brand awareness data and has been shown to be in the top two brands for the last few years of Brand Finance research, our analysis shows that the company’s particularly strong showing in RightRelevance’s Automotive Manufacturing topic metric (84) as well as a near-perfect performance in Kred’s Automotive topic (99.6), has a lot to do with it.

2020 vision impossible in an unpredictable year

(Photo: Free Photos; Pixabay)

It is somewhat ironic that the number 2020 has inherent associations with perfect vision and yet this year has turned out to be the most unpredictable in a lifetime. For example, no-one saw President Trump’s twitter-borne sideswipe at Goodyear’s tyres coming last month – how could they? However, on a more serious note, the effects of uncertainty has real-life impact. And this month has seen more than its fair share of such harsh realities in the tyre industry.

Bridgestone is rolling out its Mobox tyre subscription model across 31 of its ETB centres (Photo: Bridgestone)

DriveRightData is partnering with Bridgestone, providing tyre identification and product matching capabilities data for the tyre manufacturer’s recently-launched Mobox monthly tyre and car maintenance subscription service. DriveRightData information supplied includes brand name, product name, description, tyre and tread images, tyre size, pressure, rim size, load and speed index, run-flat capability, EU required labelling information and barcodes.

Bridgestone and ETB Autocentres recently introduced the Mobox all-inclusive monthly tyre subscription service in the UK. First piloted in 25 First Stop stores across France in October 2017, MOBOX has now been expanded to over 700 shops in France, over 120 shops in Spain, 300 shops in Germany and over 230 shops in Italy.

Bridgestone will be using GoCardless to facilitate the recurring payment function necessary for its Mobox tyre subscription service. Already available in France, Germany, Italy and Spain, Mobox customers in the UK can pay via GoCardless for a “frictionless payment experience.” Furthermore, because of the end-to-end integration of the GoCardless API, Bridgestone will have access to real-time information on the status of mandates and payments – in turn, reducing costs and time spent on administration.

GoCardless research shows that almost half (48%) of UK consumers say bank debit is their favoured payment method for recurring payments. It’s also clear that consumer behaviour is shifting to a subscription-based model. Zuora’s ‘End of Ownership Report’ highlights three quarters (74%) of consumers believe people will subscribe to more services and own fewer physical goods in the future.

David Anckaert, vice president Commercial Europe at The Goodyear Tire & Rubber Company, is banking on the continued growth of B2C online tyre buying (Photo: Goodyear)

Goodyear has been marketing its passenger car tyres in Germany directly to end users for fitting by a listed partner for roughly six months. And for years before that there has been a noticeable trend towards online selling. Following on from our online preview article, Tyres & Accessories’ German group publication Neue Reifenzeitung interviewed David Anckaert, vice president Commercial Europe at The Goodyear Tire & Rubber Company and began by asking: is it too early to draw initial conclusions? And where’s next?

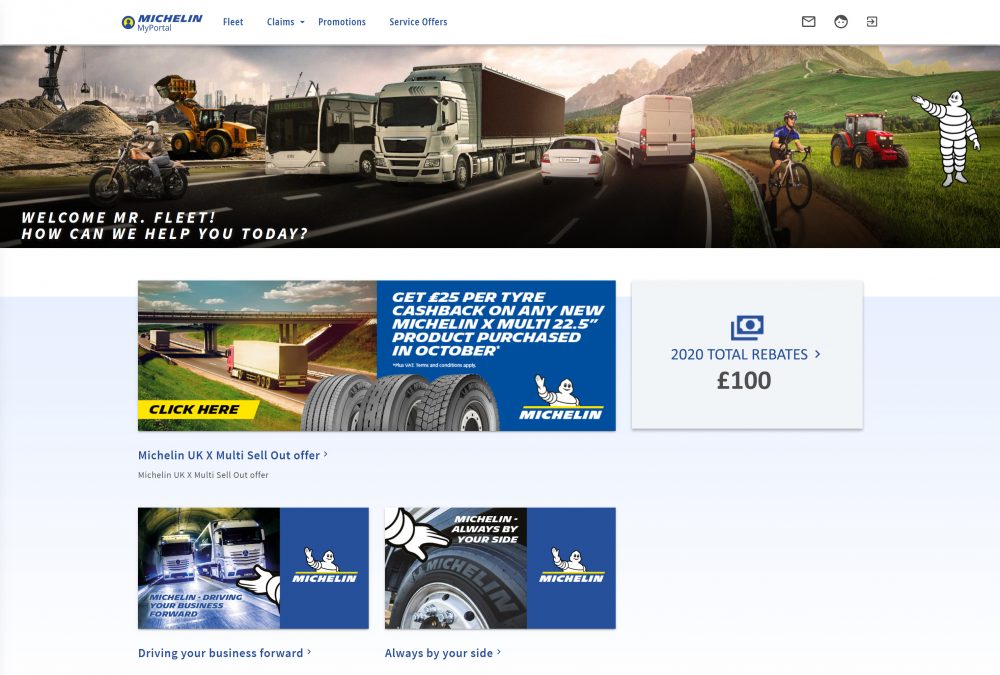

Michelin MyPortal replaces Michelin MyAccount, launched five years ago (Screensthot: Michelin)

Michelin has launched a new web portal that gives commercial vehicle customers quick “direct access to expert online tyre advice, the latest promotions, services and news about its tyre range”, according to the company. Michelin MyPortal replaces Michelin MyAccount, launched five years ago, and has been designed to provide users with “additional benefits and improved functionality”. Available to truck, bus and coach fleets across the UK and Ireland, Michelin MyPortal is designed for the company’s transactional customers. It gives users the ability to select which tyre campaigns they take part in, with resulting cashback promotions paid directly into their bank account for maximum speed and efficiency.

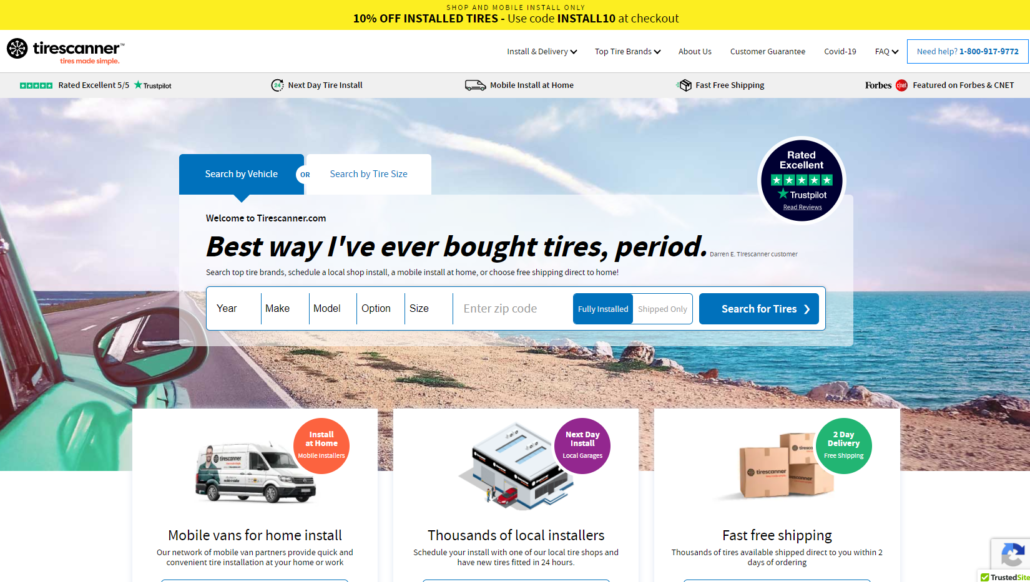

Tirescanner is now present in most of the main conurbations in the US and therefore covers 50 states, 43 of which with mobile coverage (Image: TireScanner)

The last time Tyres & Accessories interviewed online tyre entrepreneur, Mike Welch, his latest venture Tirescanner was making in-roads in the US tyre retail market. Such was the concept’s growth that Welch had been pitching the business to investors in a bid to move onto phase two of Tirescanner’s development. Roughly a year later, T&A asked how things are progressing:

“Going well…we’ve been in a process for the last six months of scaling some of the key parts of the model – mobile being a big part of that. We are up to 200 van locations now and we’ve been recruiting a key team (we’ve got some announcements around that).”

In the USA, largescale garage chain Monro Inc. has completed the rollout of its collaboration with Amazon.com to provide tyre installation services at all of its 1,200+ store locations in 32 states.

The Amazon tyre fitting concept was announced in July 2018. Throughout the goal has been to make Monro’s tyre installation services available to customers who purchase tyres online from Amazon.com and select the Ship-to-Store option. Specifically, back in 2018 this meant Monro expected to make about US$120 per installation for an Amazon customer, compared with a company average of above $160. Roll-out has been completed on schedule and the company is reporting that increased traffic has been “driven by integration with online tyre retailers”. However, there has been no confirmation of whether or not Monro has achieved its installation value goals.

eBay Motors partners with TrueCar in the U.S. to offer buyers helpful tools when shopping for new vehicles. (PRNewsfoto/eBay Motors)

eBay France has partnered with the 350-branch strong Feu Vert garage network to fit tyres purchased online. The development was hinted at last year’s Equip Auto show when the head of spare parts and accessories for cars and motorcycles in the French, Spanish and Italian markets, Francesco Faà di Bruno, announced that negotiations were underway. Now, Ebay has confirmed, the agreement is final.

Linglong’s partnership with Tencent is designed to bring both consumer-facing and industrial benefits (Photo: Linglong)

On July 10, Linglong Tire signed a strategic cooperation agreement with Tencent Cloud and Huazhi. As a result, the three parties will cooperate on smart marketing and industrial digitalization based on “the world’s first industrial Internet platform for the tyre industry, aiming at helping Linglong realize the transformation from traditional manufacturing to intelligent manufacturing, while seizing the aftermarket and improving the overall digital marketing and service level.”

Hassen holds a bachelor’s degree in Electrical and Electronics Engineering from the University of Leeds, UK. (Photo: Apollo tyres)

Apollo Tyres has appointed Hizmy Hassen to the newly-created position of Chief Digital Officer (CDO). Hassen will be based at the company’s London office, and will be responsible for leading the strategy and operations of Apollo Tyres’ digital journey, including responsibility for Information Technology. Hizmy Hassen will report to Neeraj Kanwar, vice chairman and MD, Apollo Tyres Ltd.