Global TPMS market could be worth >$13 billion by 2032

The global Tyre Pressure Monitoring System (TPMS) market was worth $6-8 billion in 2023 a figure that could double by 2032, according to the latest reports published by two market research firms. The worldwide TPMS market reached a value of US$5.87 billion in 2023, according to Research and Markets. Furthermore, the market is projected to grow at a compound annual growth rate (CAGR) of 9.4 per cent between 2024 and 2032 to reach a value of $13.2 billion by 2032.

Continue Reading

The top UK tyre eTailers 2024

Following similar research last year, in July 2024, we took a closer look at tyre etail again. Building on the foundation of last year’s research premiere, this year we once again triangulated our analysis across three poles: third-party data, industry expertise and our own research. The difference is that this year we have improved our methodology by broadening out the number of data sources we included in out third-party stage. Indeed, this time round we tripled the number of data sources used for the third-party phase of our analysis. Since eTailers don’t publish their monthly traffic data, this is the best way to get a robust calculation of where these companies are up to. The short story is that we have a new winner this year and new entrants to boot.

Continue Reading

Top 10 tyre comparison sites 2024 (UK)

Our third and final category takes a close look at tyre comparison websites because all the data suggests that pre-sale research is growing in influence as a strategic part of the increasingly important online tyre business. Our methodology is basically the same as our initial tyre retail category inasmuch as we began with two third-party online traffic data sources, verified this via discussion with an industry expert and then contextualise our findings here in this article.

Continue Reading

ETEL/Kwik Fit extends lead at top of 2024 UK tyre retail ranking

After a few years of rapid growth designed to challenge ETEL’s position at the top of the UK tyre retail tree, this year’s data shows that the force of that challenge has diminished and European Tyre Enterprises Ltd (ETEL) is actually extending its lead. The fiercest competition is at the edge of the top five where two manufacturer-connected tyre retail chains have really upped the ante and both have expanded rapidly compared with last year’s table. HiQ comes out as this year’s fastest rise and there have also been significant movements in the mid-table positions as well as some surprising changes towards the end of the top 25.

Continue Reading

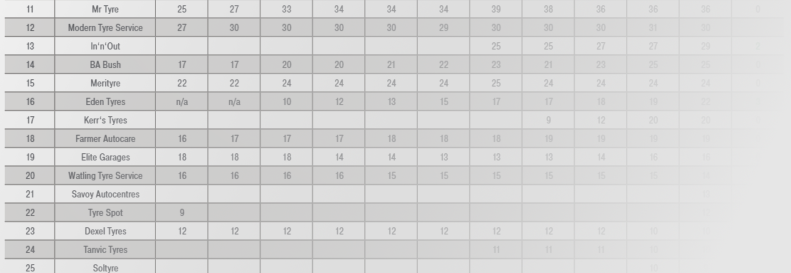

Solidarity and consistency: most mid-sized tyre retailers stand firm – positions 11 to 15

Continuing our 2024 UK tyre retail ranking, here we look at positions 11 - to 15 of the top 25. At the top of this section, the addition of one branch to Mr Tyre’s total means 11th-placed Mr Tyre is creeping up on the top 10 and is now just one centre away from tying for 10th place.

Continue Reading

Kerr’s Tyres and Elite Garages continue growth – Tyre Retail Ranking 2024, places 16-25

Coverage of this years UK tyre retail ranking begins with the news that Kerrs Tyres and Elite Garages are the fastest movers in positions 16 to 25. However, Eden Tyre Services maintained its total of 24 centres after several years of consistent growth, remaining in 16th position.

Continue Reading

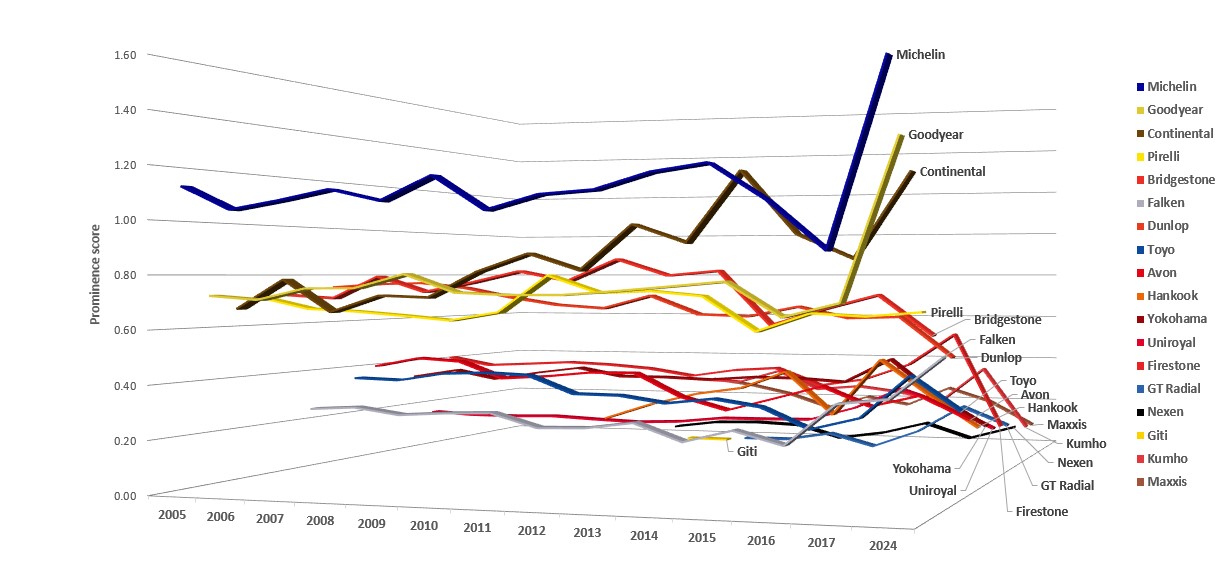

Online branding methodology: how Stobbs worked it out

Following the publication of our latest online branding research, we wanted to give readers access to how the calculations were made. So, here is Stobbs online branding methodology, heres how they worked it all out. When it comes to the calculation of online prominence, brand mentions are identified by matching the content of the webpage HTML using regular expressions (Regex), a formulation which allows wildcard-based searching and is able to identify brand references within longer strings (such as the URL of the page).

Continue Reading

Michelin most prominent and best sentiment tyre brand in 2024

In 2005, Tyres & Accessories published the first in what would become a 12-year series of online brand prominence and sentiment analyses relating to the best-known tyre brands. That research was conducted in association with Envisional and latterly NetNames. Now, one of the brains behind the original data has developed “a new and improved methodology for quantifying brand prominence and sentiment”. Here, David Barnet, now brand protection strategist at intangible asset management specialists, Stobbs, presents the results of a new study looking at the online prominence and sentiment of tyre brands.

Continue Reading

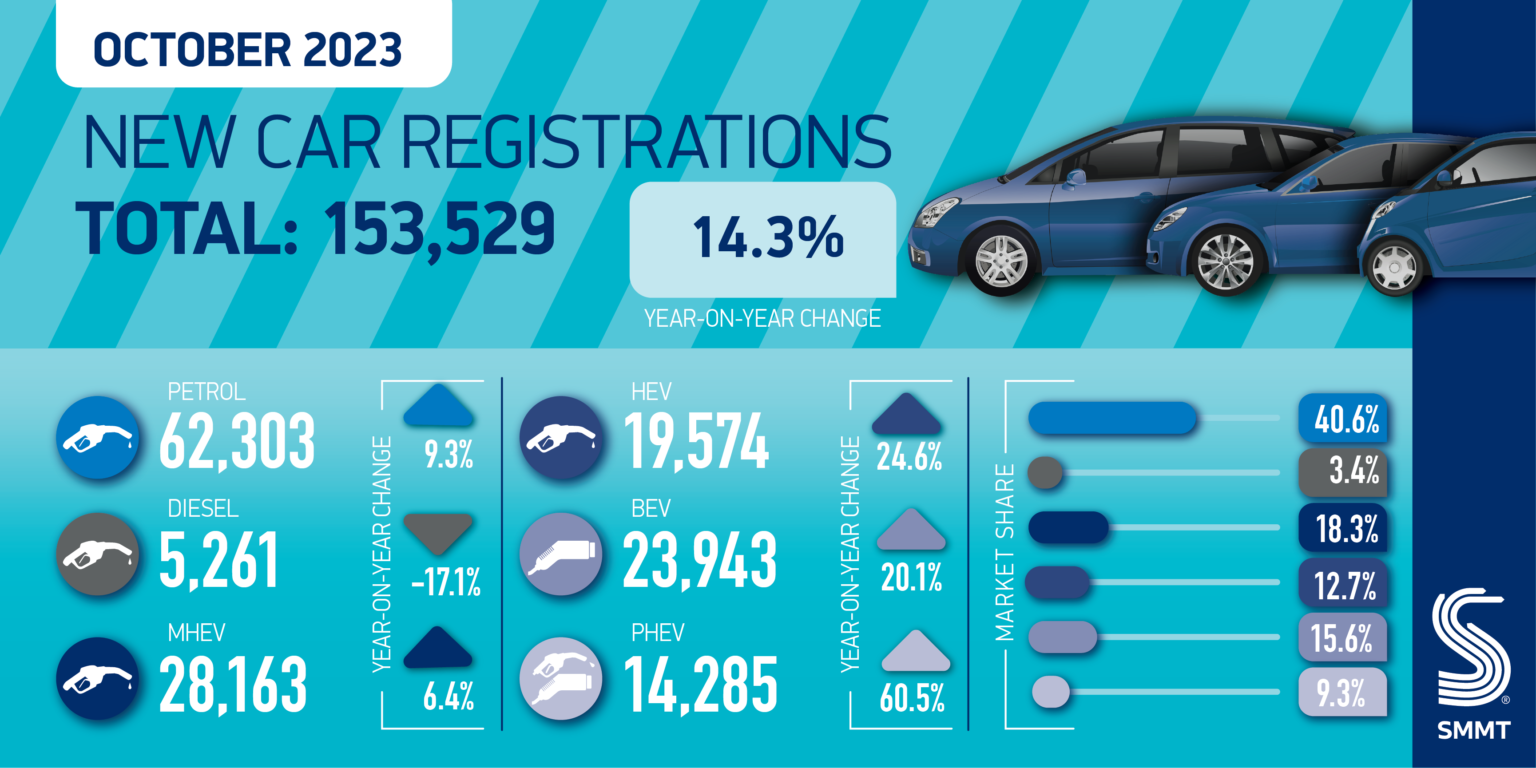

New car sales growth continues in October – SMMT revises annual outlook upwards

October’s new car market grew by 14.3 per cent to reach 153,529 registrations, 7.2 per cent above pre-pandemic levels and marking the best performance for the month since 2018, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). The 15th month of consecutive growth was driven almost entirely by large fleet registrations, which grew 28.8 per cent to reach 87,479 units. Private demand was stable at 62,915 vehicles, a 0.3 per cent increase, while the much smaller business sector saw registrations fall -15.2 per cent to 3,135 units. With the sustained increase in new car registrations, overall vehicle uptake is now up 19.6 per cent in the first 10 months, with the market currently enjoying its best year since 2019.

Continue Reading

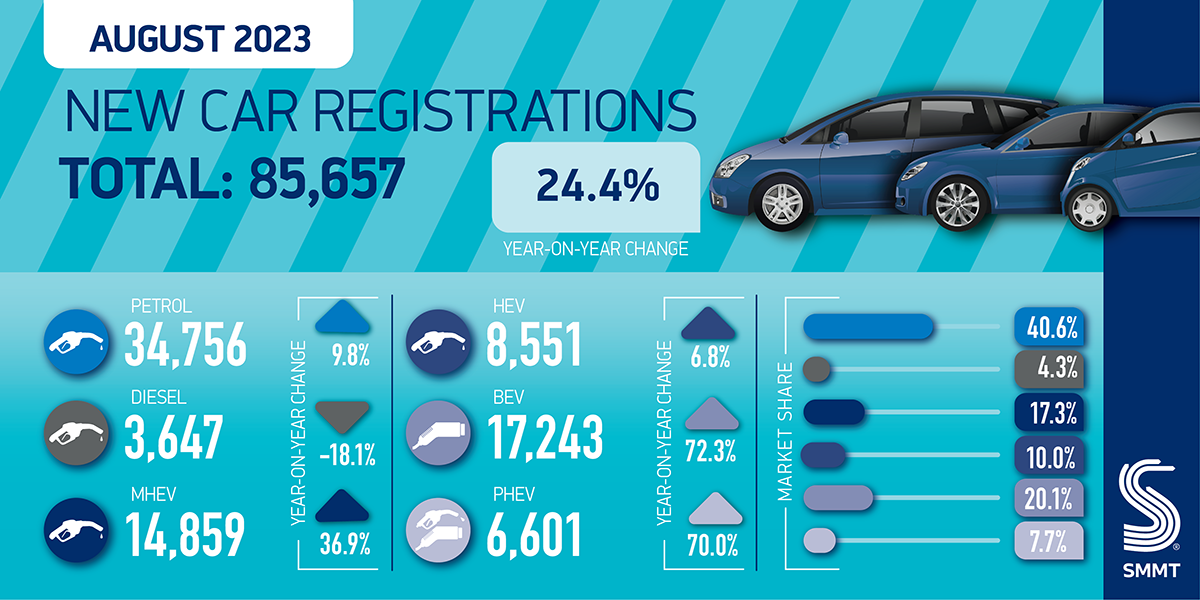

Electrification growth boosts new car sales in August

The new car market grew 24.4 per cent in August with 85,657 new vehicles registered, according to the latest SMMT figures. While August is typically a quieter month with many buyers choosing to wait until the September number plate change, an increase of 16,799 units means the sector is now entering a second year of growth. Despite this improved performance, the market still remains -7.5 per cent below pre-pandemic levels. The increase was fuelled by a surge in registrations by large fleets, rising 58.4 per cent to 51,951 units, while business registrations grew 39.4 per cent to 1,635 units. Conversely, private demand softened by -8.1 per cent, compared with a supply-constrained 2022 market.

Continue Reading

The UK’s top 10 tyre retail web sites 2023

There’s no denying that the tyre business has become more digital and connected than ever before, but there are a number of sides to that equation. We know that between 60 and 80 per cent of tyre-buying consumers were doing pre-sale research online before the pandemic. Similarly, industry insiders have been saying that 10 per cent of tyres are bought online for something like a decade now. But anecdotal evidence from tyre retailers themselves reveals that, amongst those working for the large chains at least, many customers walk through the door to receive a tyre change that has already been booked online. Apparently, some of the younger generation just walk in and hold up a QR code on their phone! This month’s Tyres & Accessories looked into these kinds of questions, asking what it means for the tyre business to be digitally native. And it starts with a brand-new ranking of the leading tyre retail, e-tail and tyre comparison websites.

Continue Reading

Top 10 tyre retailers 2023: Halfords closing in on pole position

Kwik Fit and its other ETEL-related brands (Tyre City, Tyre Pros and Central Tyre) have dominated the UK tyre retail landscape for years. More recently, Halfords has made our annual tyre retail ranking a two-horse race. However, Michelin’s ATS Euromaster network remains a significant player and other chains such as the Micheldever- and ultimately Sumitomo-owned Protyre have grown consistently over a long period of time. But none of that tells the whole story. While big chains generate significant levels of value and volume, franchise networks like HiQ and First Stop represent another dimension. And medium-sized chains are often so good at what they do that they end up being bought by larger businesses at a premium. And yet none of that reflects the importance of the vast majority of the market – the independent tyre businesses with one or two centres. That’s why June’s Tyres & Accessories aimed to present a more panoramic view of the undeniably indispensable tyre retail business. Here, T&A presents our annual tyre retail ranking as a way of keeping you informed of the lay of the land in the ever-changing tyre retail landscape.

Continue Reading

Tyre retail ranking 2023, 11-25: In’n’Out continues to grow

11th-placed Just Tyres maintained a total of 38 tyre retail locations, according to our 2023 table. However, that figure is one centre lower than it was this time last year. Nevertheless, the total remains one branch greater than five years ago.

Continue Reading

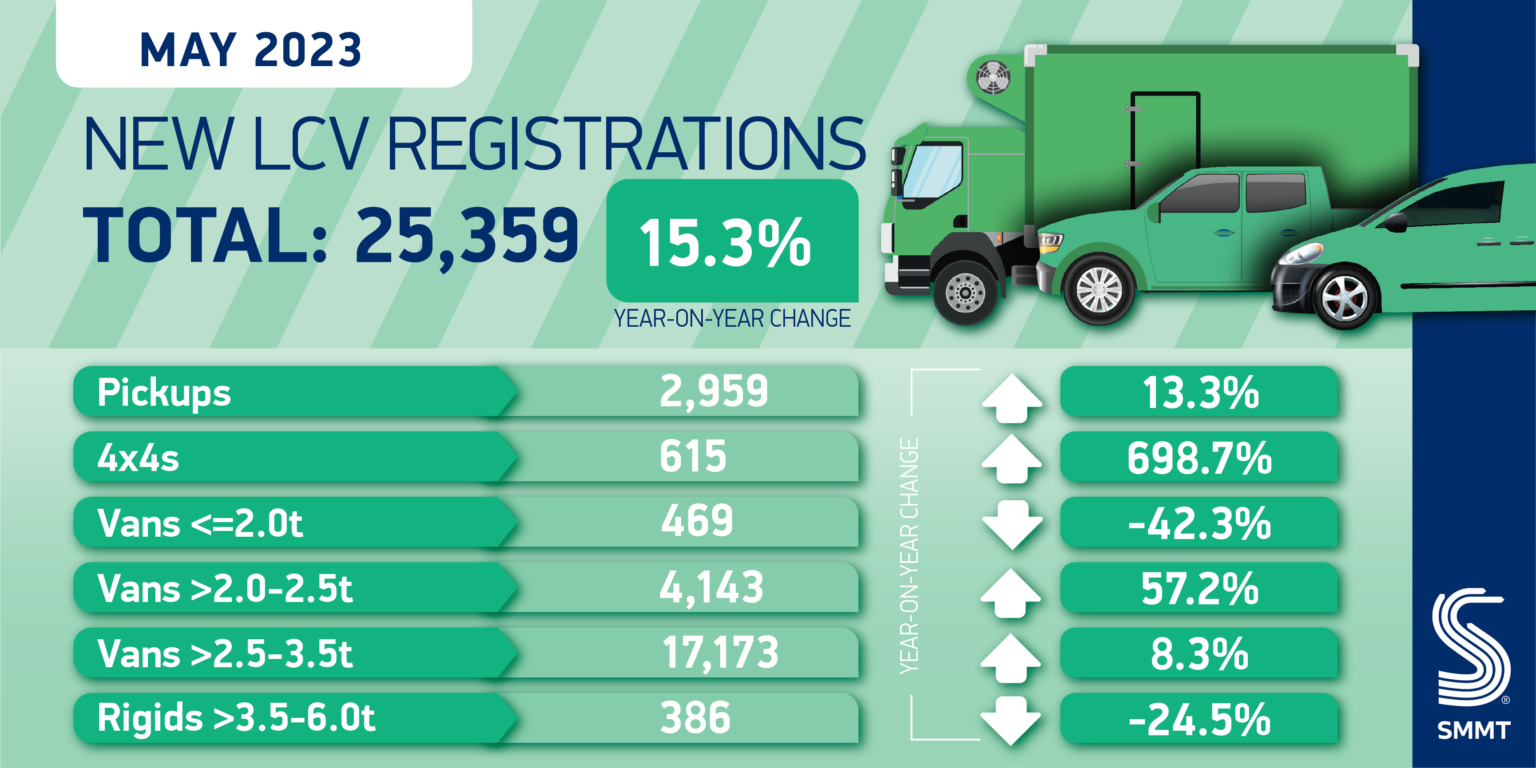

May van sales buoyant as supply pressures ease

The number of UK light commercial vehicles (LCVs) registered in the UK grew by 15.3 per cent in May compared with last year, reaching 25,359 units, according to the latest SMMT figures. It represents the fifth consecutive month of rising deliveries as the market rebounds from a tough 2022 as supply chain challenges continue to ease, although registrations remain -13.0 per cent below the pre-pandemic 2019 level.

Continue Reading

Budget segment making inroads in UK high rim diameter tyre market – GfK

The long-term trends associated with the UK’s ultra-high performance tyre segment have continued to develop in line with expectations, but the latest data from market analyst GfK reveals the unspooling effects of three segment defining factors: car-makers’ increased specification of 17” and 18” tyres on mass market, sub-premium models; the broader context of the UK’s high inflation-low growth economic environment; and the rising availability of low-cost tyres from manufacturers outside the premium (and even mid-range) tier. The last of these trends show why the term “ultra-high performance tyres” (or UHP tyres) is inherently suspect, just as “performance tyres” previously became a term applied to the majority of car tyres. The data we discuss in this article refers to high rim diameter products, encompassing everything from 17” up to the specialist products pushing well into the 20s. The tyre demands of new cars in the last decade and more have trended upwards to make the lower end of this range a regulation fitment on family hatchbacks and saloons.

Continue Reading