World’s largest tyremakers 2024: Stable “balance of power” and ambitious manufacturers

Three manufacturers from the top 20 have managed to move up two positions in our latest ranking, with the Sailun Group moving into the number 10 slot, while Nexen Tire benefited from the removal of Cooper Tire & Rubber; Giti Tire, meanwhile, dropped two places

Three manufacturers from the top 20 have managed to move up two positions in our latest ranking, with the Sailun Group moving into the number 10 slot, while Nexen Tire benefited from the removal of Cooper Tire & Rubber; Giti Tire, meanwhile, dropped two places

Our latest “world’s largest tyremakers” data based on the key figures for the 2023 financial year sheds light on several developments that have recently characterised the tyre market. On the one hand, there is the development of sales, which have at best moved sideways for many manufacturers compared to 2022. On the other hand, there is also the development in terms of ranking: here it is clear that companies from China are increasingly operating on an equal footing with the long-established manufacturers from Europe, America and Japan and now even have a new number 10 in the race with the Sailun Group. However, it is also clear that our ranking shows a stable “balance of power” overall.

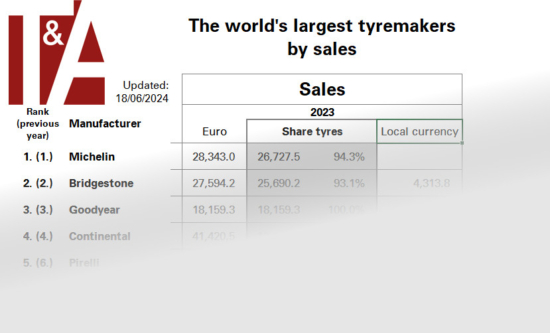

The quartet at the top of the ranking, which has been published annually since 2007, remains unchanged for 2023 in terms of order: Michelin continues to be the world’s top-selling tyre manufacturer and is already a good one billion euros ahead of Bridgestone, thus maintaining its lead in terms of sales over its Japanese market companion. Michelin is therefore leading the ranking for the fourth year in a row after the French company overtook Bridgestone with its figures for the 2020 financial year. In 2018, Michelin took over the Canadian speciality tyre supplier and billionaire Camso and was almost on a par with Bridgestone in terms of sales the following year, only to finally take first place a year later. The quartet is completed by Goodyear and Continental in third and fourth place.

The new/old number five is Pirelli. The Italian tyre manufacturer was able to displace Sumitomo Rubber Industries, the Japanese manufacturer behind the Falken brand, after Pirelli had only ranked seventh in 2020. The Italians’ year-on-year growth seems impressive and is proof of the success of its premium strategy. While Pirelli reported a turnover (with tyres) of just 4.3 billion euros in 2020, that figure is already 6.65 billion euros in the current ranking, almost 55 per cent higher. At the same time, however, there are ‘only’ 210 million euros in tyre sales between Pirelli and Sumitomo Rubber Industries, so future changes position appear inevitable.

One of the most impressive changes reflected in the past financial year and thus in the latest ranking is the emergence of the Sailun Group. Representatives of the manufacturer recently underlined their ambitions to become one of the world’s top 10 tyre manufacturers at Tire Cologne in an exclusive interview with our publishing group (see the Tire Cologne feature in this month’s magazine). There were already hopes in Cologne that this would become reality just a few weeks later with the company figures that have now also become known from China, but this could not yet be confirmed. The Sailun Group – previously number 12 in the ranking – was not only able to increase its turnover by a good 11 per cent within a year, it was also able to push Toyo Tires out of the top 10 and at the same time Cheng Shin Tires (manufacturer of the Maxxis brand) from 11th to 12th place.

Only two other companies in our list of the 20 tyre manufacturers with the highest turnover managed to jump two places. One of them is Nexen Tire. On the one hand, the South Korean manufacturer clearly outperformed the US manufacturer of OTR and agricultural tyres and wheels Titan Tire in terms of sales, but at the same time also benefited from the fact that we no longer list Cooper Tire & Rubber separately in the ranking as of this year, as the company has been part of the Goodyear Group since summer 2021, which in turn has contributed to a significant increase in sales (since 2020: plus 80 per cent).

© 2024 Profil-Verlag GmbH; Tyre Industry Publications Ltd.

Giti Tire also jumped two places, albeit downwards. While the Singapore-based manufacturer, which produces in China and Indonesia, was still in 14th place in the 2022 ranking, albeit by a very narrow margin, it was only enough for 16th place according to the sales figures for 2023. While Giti Tire was only able to increase its annual turnover by around 50 million euros, Kumho Tire from South Korea and MRF Tyres from India grew significantly faster, by 130 and 220 million euros respectively.

This does not mean that MRF Tyres has succeeded in becoming the number one among the four manufacturers from India shown in the 2024 chart, as they had proclaimed with their stand at Tire Cologne; MRF Tyres is still 43 million euros away from its domestic competitor Apollo Tyres. Nevertheless, MRF Tyres is also clearly one of the manufacturers that is on a growth course, as 10 years ago it was only ranked 19th.

A summary of the figures in the current ranking clearly shows that the group of the 20 tyre manufacturers with the highest turnover in the world is – roughly speaking – developing in step with each other. While their total tyre sales, as we have been compiling them for years, have risen by 29.1 per cent over the past 10 years from 110 to 142 billion euros, the same growth also roughly applies to the groups of the 10, four or even three largest manufacturers, as well as to the group of manufacturers between eleventh and 20th place, where growth since 2013 has been 29.2, 29.6, 26.8 and 28.6 per cent respectively. That once again underlines the finding that the global tyre market is very competitive, and tyre manufacturer groups are growing according to the data, in some cases significantly, but that hardly changes the roughly structured “balance of power” of the companies we have grouped together in the market.

And this “balance of power” has been relatively clearly defined for years. If you put the tyre sales of Michelin, Bridgestone and Goodyear in relation to the 142 billion euros that the group of the 20 largest tyre manufacturers generated last year, you can see the dominance of the top three: their share of sales is 49.6 per cent at 71 billion euros, and 10 years ago it was 50.5 per cent at 56 billion euros. If you put Michelin, Bridgestone and Goodyear in relation to our top 10, they are also still in a good position with a current 60.2 per cent share of sales compared to 2013, when we calculated their share at 61.3 per cent.

Click here to find our back catalogue of leading tyremaker data.

And lookout for further analysis of the leading global players as well as the rising Far Eastern tyremakers in the July issue of Tyres & Accessories magazine as well as online at tyrepress.com

Comments