SUV tyre pricing between 2021 and 2024

Weighted average based on the same unique basket of 4x4 dimensions (across all brands), by tyre brand (Source: Encircle Marketing)

Weighted average based on the same unique basket of 4x4 dimensions (across all brands), by tyre brand (Source: Encircle Marketing)

SUV tyres have not only become a fixture in the wider car tyre market in recent years, they also remain a significant margin opportunity for manufacturers and distributors alike. However, while this section of the market has been a bastion of the premium tyre brands throughout most of that time, the latest research suggests the budget SUV market segment is growing largely at the expense of the mid-range. With that in mind, in our April 2024 edition, Tyres & Accessories takes a look at the latest SUV tyre news, trends and products. Throughout the rest of the section we look at vehicle market trends, which pertain to size choice and volume demand, as well as the latest product and OE fitment news. Here, working in partnership with the market research specialists at Encircle Marketing, we take a look at SUV segmentation from a pricing perspective.

In years gone by, we have often looked at market trends from a sell-out sales perspective, opting to analyse a wide sample retail data as a way of looking at overall market trends. Since that data has consistently shown a trend towards the growth of lower segmented products, this time round we look how those trends are reflected in terms of sell-out pricing.

Over the years we have witnessed a number of price-impacting macro-economic events such as Brexit, the Covid-19 pandemic, the war in Ukraine and the resultant inflation and cost-of-living crisis that has come in its wake. For those reasons, not only are we looking at the market from a price perspective, the data supplied by Encircle Marketing stretches over a number of years in order to consider SUV tyre market pricing across the medium term context. On this occasion, all the data is taken from online pricing offered by UK-based online tyre retailers. The big picture is then broken down, first by 4×4 segmentation and then, within that, by size, tyre brand and retail channel.

Brand-specific pricing policies

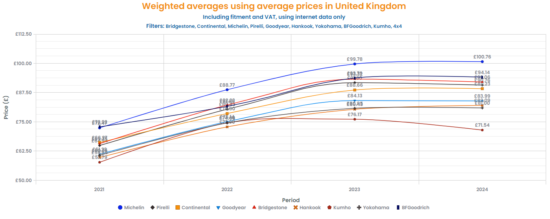

Chart 1 shows a weighted average based on the same unique basket of 4×4 dimensions (across all brands), the brands shown come under nine well-known tyre brands (namely BF Goodrich, Bridgestone, Continental, Goodyear, Hankook, Kumho, Michelin, Pirelli and Yokohama). And data is taken over four years (2021 to 2024, so far, inclusive).

The first thing you notices is that the overall trend is towards higher prices. In order to be more specific, the most expensive 4×4 tyre brand in the sample (Michelin) ranged in price from £72.49 to £100.76, up 39 per cent. Meanwhile, the lowest price tyre brand in the period amongst those sampled was Kumho, which ranged from £56 to £71.54, up 27.75 per cent. Referring to the ongoing European Commission price-fixing investigation might be considered a side point, but both the bread of pricing between top and bottom as well as the difference in overall rate of change would seem to undermine suggestions that leading tyre brands worked together during the period to standardise 4×4 tyre pricing at least.

Look closer and you can see that the pricing strategy of individual brands within the sample timeframe was also markedly different. By way illustration, it is worth noting that in 2021, the brands were stacked like this (by price, from top to bottom): BF Goodrich, Michelin, Continental, Bridgestone, Pirelli, Goodyear, Yokohama, Hankook, Kumho. As of the end of the first quarter of 2024, it is now: Michelin (2021: 2), BF Goodrich (1), Bridgestone (4), Pirelli (5), Continental (3), Goodyear (6), Hankook (8), Yokohama (7), Kumho (9). Virtually every brand occupies a different position in the ranking now compared with 2021. Only mid-table Goodyear and Kumho at the bottom of the range of brands sampled stayed in the same position. In other words, each tyre brand followed a different price strategy.

Size matters

Chart 2 breaks the average UK 4×4 online sell-out pricing down by size. Again there is wide range between the top and the bottom of the chart. And, likewise, there was significant uplift in pricing over the period.

255/55 R19 V (111) XL was the most expensive size, with prices starting at £166.51 in February 2021, rising to a peak of £197.79 via a low of £158.88 along the way. 255/55 R19 finished the period at £177.20, therefore up 11.53 per cent.

At the opposite end of the spectrum, 235/60 R18 V (103) started at £128.40, dipped at £121.38 along the way in July 2021, before peaking at something like £158 in March 2023 and ending the period at £140 in March 2024. In other words, the price of 235/60 R18 tyres went up 9 per cent in the period.

While the price trajectory of the uppermost and lowermost sizes are relatively clear, and while 235/55 R19 V (the second most expensive size follows 235/60 R18 relatively linearly until summer 2022 when the price gap between itself and the top roughly doubles), there is extremely fierce competition on the sizes in-between.

The two trends that the first two charts have in common is that prices of the most premium products have consistently risen faster than the less-premium products.

Increasingly competitive retail market

Breakdown Encircle Marketing’s data by retail channel and – initially at least – similar patterns remain visible. However, the retail-specific data tells a different story towards the end of the period. The trend may be erratic, but the data points to one particularly price-heavy retailer during the during the first roughly two-thirds of the period. During the same phase, two or three retailers group together at the bottom of the price spectrum, with everyone else duking it out in-between. In the final third, which brings the UK online 4×4 tyre pricing comparison up to the present day, all bets are off; there are new price leaders and the price differential between top and bottom has narrowed significantly. However, amidst all the turmoil, one retailer remains comfortably mid-market and therefore relatively price-stable throughout.

Whichever way you cut it, two points are consistent throughout. Firstly, the highest price points grew fastest throughout while, conversely, price rose slowest in the lowest price positions. And secondly, the is a wide range of variety in price policy by brand, size and retail channel. When you compare the data with other sources that suggest that there has been fastest growth in the budget segment amidst the cost-of-living crisis, the fact that budget tyre prices have risen slower goes a long way to explaining why de-segmentation appears to have taken place.

Comments