Pirelli financial performance the strongest of European premium tyre brands – analysts

Initiating detailed coverage of European tyre manufacturers, analysts at Jefferies Equities Research fated Pirelli as their top pick, followed by Continental and Michelin. “Continental is trading on the largest discount to Michelin in years and the ex-tyres business is at the lowest multiple (2x EBIT) in three years. Pirelli is at a two per cent discount to Michelin versus a premium for >90 per cent of the last three years.

The tyre industry delivered “a strong performance in the face of record headwinds between 2020 and 2022”, according to Jefferies. The success of the three surveyed tyremakers is said to have been “pricing actions taken in replacement tyres to mimic longer-term contracts on the OEM side of the business (rise and fall clauses for input costs).” At the same time, price rises are now the subject of an EU antitrust investigation with ‘public announcements’ a key focus: “We look for read through from the 2015 Competitions and Market Authority (CMA) inquiry into UK retail energy. The CMA review found that although the outcomes were consistent with coordination, they can also be observed in markets without coordination.”

Price and mix accounts…accounts for 90% of Pirelli’s FY2023 EBIT

Referring to the ongoing tyre market shift to larger rim sizes and technology-enabled tyres, at trend which is supported by the shift to electric vehicles, which also increases the importance of lower noise and low rolling resistance, the analysts found:

“The earnings impact of price and mix for Pirelli…accounts for 90 per cent of Pirelli’s full-year 2023 [pre-tax profits] EBIT [Earnings Before Interest and Taxes].

“This same metric is 43 per cent of tyres EBIT for Continental (32% of the group) and 30 per cent of the group for Michelin.”

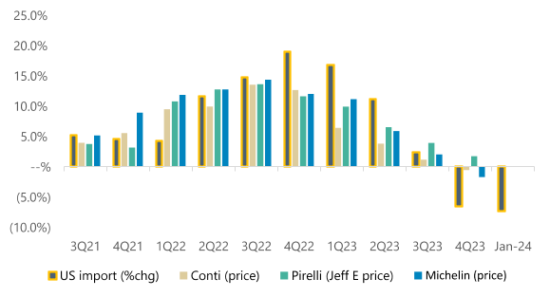

When it comes to tyre pricing, Jefferies focused on trade data, which has a strong correlation with reported pricing, and look at the well-documented raw material movements to estimate the impact of raw materials. Trade data indicates pricing will shift to a headwind of 5-8 per cent in 2024, with Continental’s tyre business and Michelin showing pricing was a -0.5 per cent and -1.7 per cent headwind in 4Q, respectively.”

However, that is likely to increase and “we estimate raw material prices will be a high single digit tailwind (6-9%)” first-half 2024 figures. However, at current spot prices, this is expected to reverse in the second half.

Foreign exchange has had a material impact on earnings in previous years of between 5 and 20 per cent. Foreign exchange ranges have the biggest negative impact on Pirelli (3-4%), with a smaller impact expected for Continental & Michelin (1-2%).

Here’s how Jefferies summarised the three companies under its coverage in the investor’s note published 7 April 2024:

“Pirelli is focused on operating in profitable niches and has the highest earnings exposure to the positive mix trends. Capital will be used internally to focus on deleveraging in the near term and the shares are trading at a discount to Michelin for the first time in three years (EV/EBIT).

“Continental’s tyres business is the value driver with strong margins and ROIC. The portfolio actions underway will drive value for the underperforming businesses one way or another and little is priced in at 7.4x EBIT. We assume at Buy with the widest valuation disparity with Michelin in several years and estimate ex-tyres are trading on 2x EBIT.”

Rating Michelin “underperform,” the Jefferies analysts wrote: “Has a strong market position in vehicle tyres, an excellent and highly profitable position in speciality and the strongest balance sheet. The divestment of the retail network in the US is a positive step towards improving returns and there is a runway for growth in non-tyre. The stock is trading at the highest premium to Continental and a premium to Pirelli for the first time in 3 years, we see limited valuation upside.”

Comments