New car sales – best March performance for five years

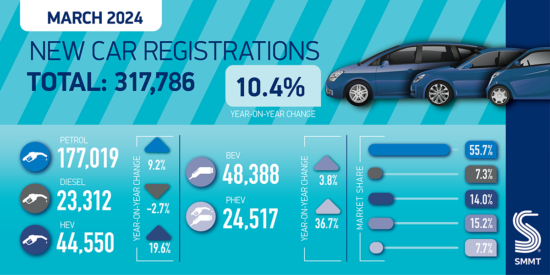

The UK new car market clocked up its 20th consecutive month of growth in March, with a 10.4 per cent rise in registrations. In what is typically the busiest month of the year due to the new number plate, 317,786 new cars reached the road with a 24 plate – the best March performance since 2019, although still -30.6 per cent below pre-pandemic levels.

Growth was again driven by fleet investment, up 29.6 per cent as the sector continues to recover following the constrained supply of previous years. Registrations by private buyers fell by -7.7 per cent, with a challenging economic backdrop of low growth, weak consumer confidence and high interest rates. The small business registration segment, meanwhile, declined -8.0 per cent.

Petrol cars retained the lion’s share of the market, at 55.7 per cent, with registrations up 9.2 per cent year on year, as diesel volumes fell -2.7 per cent to account for just 7.3 per cent of demand. Uptake of hybrid electric vehicles (HEVs) reached record levels, rising by 19.6 per cent to 44,550 units and 14.0 per cent of the market, while the biggest percentage growth was recorded by plug-in hybrids, up by more than a third to 24,517 units, or 7.7 per cent of all new registrations. Conversely, while battery electric vehicle (BEV) registration volumes were at their highest ever recorded levels, market share fell by one percentage point from the same month last year, down to 15.2 per cent. Registrations rose 3.8 per cent, with only fleets showing any volume growth.

The fall in BEV market share within a growing market underscores the need for government to support consumers to speed up fleet renewal. Large fleets continue to drive BEV uptake, thanks to compelling tax incentives but while registration volumes increased in March, market share declined. A tough economic backdrop makes it ever more challenging for consumers to invest in these new technologies.

Manufacturers themselves are offering generous incentives, helping more drivers switch to zero emission vehicles and deliver government and industry carbon targets, but this cannot be sustained indefinitely. A full market transition needs incentives not just for fleet and business buyers but private retail buyers as well, something that would bring the UK into line with other major markets. Temporarily halving VAT on BEVs, revising the threshold for the expensive car supplement on Vehicle Excise Duty next April, and abolishing the ‘pavement penalty’ on public EV charging by equalising VAT rates to 5 per cent in line with home charging, would make a significant difference to consumers, helping more of them move to zero emission vehicles sooner

Mike Hawes, SMMT Chief Executive, said: “Market growth continues, fuelled by fleets investing after two tough years of constrained supply. A sluggish private market and shrinking EV market share, however, show the challenge ahead. Manufacturers are providing compelling offers, but they can’t single-handedly fund the transition indefinitely. Government support for private consumers – not just business and fleets – would send a positive message and deliver a faster, fairer transition on time and on target.”

NFDA calls for price incentives as private demand lags behind fleet

Commenting on the March SMMT figures, Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK, described them as “a remarkable milestone for the industry”.

While March sales rose by 10.4 per cent over the same period last year, sales to private buyers decreased by -7.7 per cent; fleet registrations were up by 29.6 per cent.

Robinson concluded; “it is encouraging that the first quarter of 2024 has demonstrated continuous growth in new car registrations and electric vehicle sales. With March being a plate change month, this month’s growth appears to have been given a boost with the introduction of the ’24 plate.

“Despite the robust growth being demonstrated by the sector, it was disappointing that the Government offered little support to the industry in the recent Spring Budget which could have aided in accelerating this momentum further. Notably, there was no mention of price incentives for EVs, particularly as manufacturers seek to meet the targets outlined by the ZEV mandate.

“Private demand continues to be superseded by fleet, as has been the case in recent months, in which incentives could act to encourage private buyers.

“NFDA will continue to press the Government on current issues affecting the industry to ensure the best outcomes for dealers and consumers.”

Comments