Halfords shares plummet after consumer tyre-related profit warning, but Autocentres remain ‘bright spot’

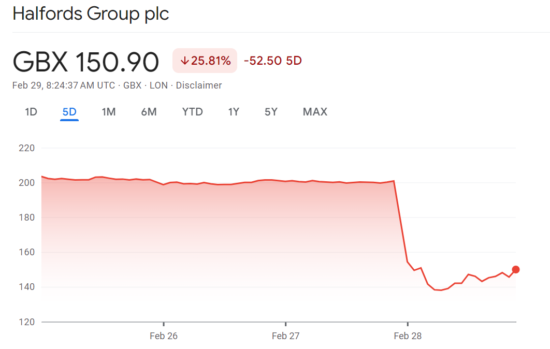

Source: Google Finance 29/02/2024

Source: Google Finance 29/02/2024

Halfords Group’s share price fell by around a quarter in response to an unexpected profit warning notice on 28 February, which suggested Halfords would make substantially less profit than the firm forecast roughly a month earlier. At least part of the reason for the profit warning was softening demand in the consumer tyre sector. Halfords stock recovered slightly in early trading on the morning of 29 February, however the five-day chart shows that the company’s share price remains around a quarter down.

With Halfords executives warning of lower pre-tax profits, financial analysts have also reduced their full-year 2024 estimates. Looking further forward, some analysts have suggested that Halfords Group’s full-year 2025 figures will be even worse, which goes some way to explaining the sharp decrease in Halfords Group’s share prices.

For example, Zeus research cut its Halfords Group (profit-before-tax) PBT estimates by 24.6 per cent to £37.1 million in full-year 2024 and by 32.0 per cent to £40.0 million in full-year 2025 figures. However, the same analysts remain optimistic that “eventually” demand in “markets such as cycling retail and consumer tyres should recover to pre-Covid levels, with Halfords then benefiting from its strong and growing market share.” Zeus also continues to see “long-term value in the increasing shift to a services model and from its nascent software business, Avayler.”

Halfords Autocentres “the one bright spot” in trading update

Zeus described the most tyre-related area of Halfords Group’s business – Halfords Autocentres – as “the one bright spot in the announcement”, with the financial analysts further arguing that Halfords Autocentres “should eventually lead to more stable Group sales and profits as this segment grows.”

Probably as a result of its faith in Autocentres and Avayler, Zeus remains positive about investing in Halfords: “we think much of the investment case…still stands. Halfords has made substantial strategic progress in shifting to a higher-margin services model, which should lead to more stable revenue and profits over time…Further, we think the Avayler software business has strong long-term potential, particularly after the investment and endorsement from Bridgestone.”

To what end? “In our view, these factors should drive long-term profit growth and value creation, which could make the business an attractive takeover target”, Zeus analysts concluded. With current Halfords Group share prices trading at a discount, that last comment highlights the ongoing possibility of an offer for Halfords Group.

Comments