Latest new car registrations: ‘best November for four years’

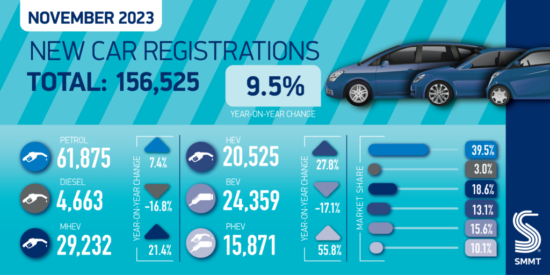

The UK new car market grew by 9.5 per cent in November to reach 156,525 units, according to figures from the Society of Motor Manufacturers and Traders (SMMT). In the market’s best November for four years, registrations almost returned to pre-pandemic levels, down just 96 units (-0.1 per cent) on 2019.

Growth was driven entirely by fleets investing in the latest vehicles, with registrations rising 25.4 per cent to account for 93,049 units and 59.4 per cent of the market. Private demand was depressed, dropping -5.9 per cent to 60,506 registrations, while business uptake fell -32.7 per cent to 2,970 units. Year to date, however, the overall market remains up 18.6 per cent at 1.762 million units, with a return to growth in the corporate market fuelling a recovery that has been underway for 16 months.

November proved a strong month for both hybrid electric vehicles (HEVs) and plug-in hybrid vehicles (PHEVs), rising by 27.8 per cent and 55.8 per cent respectively. Fleets also continued to transition to battery electric vehicles (BEVs), buoyed by compelling tax incentives. Of the 24,359 new BEVs reaching the road in November, 77.4 per cent were taken on by fleets and businesses. While overall BEV volumes fell by -17.1 per cent, leading to a reduced market share of 15.6 per cent, last November was atypical with significant deliveries following supply chain disruptions. Year to date, BEV uptake is up 27.5 per cent with a 16.3 per cent market share – expected to rise to 22.3 per cent next year.

However, with new regulation coming into force in January mandating that 22 per cent of each manufacturer’s new vehicle registrations must be zero emission, sustained recovery depends on inspiring consumers with fiscal incentives, as well as greater investment in essential charging infrastructure that gives drivers confidence. Halving VAT on new BEVs and reducing VAT on public charging to 5 per cent in line with home charging would increase the attractiveness of driving electric and make the zero emission transition more accessible to a larger number of consumers.

Even more urgent is the need to delay tougher new UK-EU Rules of Origin which will begin on 1 January 2024. Failure to postpone these rules would see EVs traded both ways incur tariffs that would raise prices for consumers at a critical moment in the transition. With less than four weeks to go, carmakers and governments on both sides of the Channel have called for a common sense approach to retain the current EV battery rules for a further three years, which will support consumer choice and affordability.

Mike Hawes, SMMT Chief Executive, said: “Britain’s new car market continues to recover, fuelled by fleets investing in the latest and greenest new vehicles. With car makers gearing up to meet their responsibilities under new market legislation, and COP28 currently underway, now is the time to take sensible steps that will multiply that economic growth and minimise carbon emissions. Private EV buyers need incentives in line with those that have so successfully driven business uptake – and workable trade rules that promote rather than penalise the transition.”

Market continues strong year but electric market needs stimulating, says NFDA

Commenting on the November figures, Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK, said: “As we approach the end of the year, the latest figures for November are testament to what has proven to be a year of growth for the sector.” Robinson added: “At the Autumn Statement there was no mention of EV price incentives or any further clarity on EV charging infrastructure from the Chancellor. In a recent survey to members 50 per cent of respondents identified that an introduction of private EV incentives would be most beneficial to them. NFDA urges Government to listen to the needs of consumers, and the sector, if we want private EV buyers to match fleet adoption.

“The fall in private electric vehicle sales for November is unsurprising with the upcoming ZEV mandate implementation set for January, although NFDA would argue that this is not a true reflection of the market and consumer demand for EVs remains strong. Manufacturers have crucial sales targets to reach from January 2024 and will be strategically planning for the mandate to come into effect; as the customer-facing side to the industry, Electric Vehicle Approved (EVA) dealers will continue to support consumers on their transition to electric through expert levels of knowledge and high levels of service.”

Comments