Goodyear values Dunlop at ~$0.7 billion

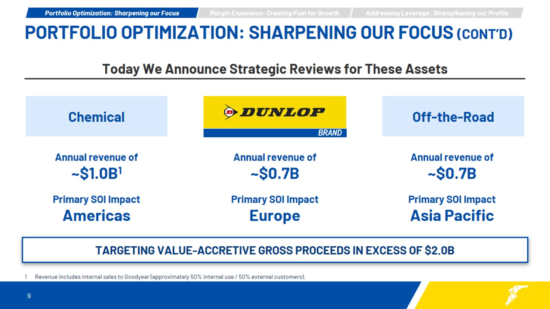

Following the news that Goodyear is planning to raise around $2 billion from the sale of Dunlop as well as its OTR tyre and chemicals businesses, the company revealed further details during a follow-up conference call. The financially biggest part of the recently-unveiled Goodyear Forward business transformation plan is the proposed sale of Dunlop, plus the OTR tyre and chemicals businesses. Goodyear estimates that these areas are worth around $0.7 billion, $0.7 billion and $1 billion in annual sales respectively.

It is worth clarifying that the sales of these three businesses fall into two different categories. Firstly, executives are describing the Dunlop exit as a brand and IP (intellectual property) sale. That contrasts with the OTR tyre and chemicals businesses sales, which are fundamentally “hard asset” sales.

Starting with Dunlop, current CEO Rich Kramer and CFO Christina Zamarro outlined that – while Dunlop tyres are made across the Goodyear manufacturing estate – the “vast majority” of the company’s Dunlop brand sales are in the Europe Middle East and Africa (EMEA) region.

The point is that the strategic sale of Dunlop allows better differentiation in the Goodyear brand basket, with Kramer specifying that – in North America, at least – Goodyear would be distinguished as the company’s premium brand and Cooper its clear mid-tier offering. When it comes to the other group brands and private label brands that Goodyear produces, there was the clear heads-up that the company is addressing its “low margin business” with a “fix or exit” mentality. That specifically means a commitment to “reduce exposure to lower-tier products and low-margin customers. And to “exit product lines where margin potential is structurally limited”.

Dunlop sale “furthest along”

Asked whether there has already been interest in acquiring Dunlop, Kramer stated: “There is interest out there. I can say that confidently.”

On the subject of the timing of asset sales, Christina Zammaro explained that something like six to nine months is likely. The sale of the chemical business is likely to be relatively simple, but it is the Dunlop sale that is said to be furthest along. However, being a brand and IP sale, the process could be more complex and could involve something like an off-take agreement, Zammaro explained. The clear, albeit unspoken, indication is that Goodyear is already in talks on the subject of the sale of Dunlop.

When it came to who might be interested in buying Dunlop, analysts suggested the two most logical parties: Sumitomo, which makes Dunlop tyres in certain international markets such as Japan, and unnamed Chinese players that stand to gain much in terms of brand value were they to acquire such a well-known name as Dunlop. Nevertheless, the executives didn’t give any further details as to who they are talking to or official confirm that talks were underway.

Commenting on the impact of the Dunlop sale in the EMEA region, Kramer added: “[it] allows us to focus on higher margin segments in EMEA…Something that will make our EMEA business stronger.”

On the subject of the sale of the OTR tyre business, one Ryan Brinkman of JP Morgan asked why Goodyear was planning to sell that area and not another B2B operation like aviation tyres.

The answer? The capital required to achieve the scale necessary for greater competitiveness “is not achievable”. Furthermore, aviation tyre production is said to be “completely co-mingled in passenger car tyre production and therefore not severable”.

Little mention of distribution

While the plans to sell Dunlop, the OTR tyre operation and the chemicals business are clearly well underway, talk of the sale of Goodyear’s North American retail business was noticeable by its absence. The idea was to sell Goodyear’s company-owned network and “monetize the value of Goodyear’s retail platform”. However, the Goodyear Forward plan has dispatched with this idea and rather offered a vote of confidence in Goodyear-owned retail, highlighting its potential in fleet, electric vehicle and last mile delivery markets.

Likewise, the TireHub distribution joint venture that Goodyear runs in partnership with Bridgestone wasn’t given much attention. In some respects, that’s to be expected because – of course – anything Goodyear says on that subject will have implications on Bridgestone.

Comments