Goodyear reports third quarter net loss of $89 million, sales down ~3%

Source: Goodyear

Source: Goodyear

Goodyear executives highlighted “improving industry conditions” and “solid operating results” in their third-quarter 2023 investor letter. High points include the Americas and Asia Pacific regions delivering margins above 8 per cent (the overall company’s goal for the second-half) during the quarter. Overall third-quarter segment operating income margin was 6.5 per cent, but the company “continue[s] to anticipate further gains during the fourth quarter.”

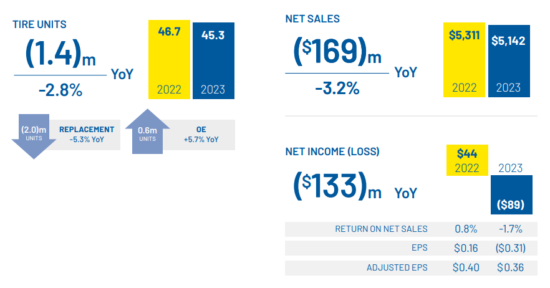

However, Goodyear still posted a third-quarter 2023 net loss of $89 million compared to net income of $44 million a year ago. This was reported due to “higher rationalization costs of $153 million, driven by a rationalization and workforce reorganization plan in Europe to improve our cost structure and a plan to change our operating model in Australia and New Zealand to a third-party distribution and retail sales approach.”

Meanwhile, third quarter 2023 sales decreased 3.2 per cent compared to the previous year “driven by the impact of commercial truck industry weakness and lower other-tyre related sales (mostly the effect of lower third-party chemical sales).”

Crucially, revenue per tyre – a key Goodyear improvement metric – increased 2 per cent, excluding the impact of foreign exchange.

Source: Goodyear

Tyre unit volume in the quarter totalled 45.3 million units, down 2.8 per cent from the prior year. Global replacement volume dropped 5.3 per cent, driven by falls in the Americas (down 1.2 million units, 4.9 per cent) and EMEA (down 0.8 million units, 4.9 per cent). According to Goodyear, the Americas decline reflects the impact of increased low-cost imports in Latin America, the residual effects of the tornado on the company’s facility in Tupelo, Mississippi and continued weakness in the commercial truck industry. These headwinds were partly offset by strong growth in premium segments of the US market. The European result reportedly reflects “continued channel destocking during the quarter”.

However, global OE volume increased 5.7 per cent, driven by market share gains in Asia Pacific.

EMEA net sales up, but operating income down

In the Europe Middle East and Africa (EMEA) region, third quarter 2023 net sales amounted to $1.4 billion, up $16 million or 1.2 per cent compared with the third quarter of 2022.

The increase in sales was driven by a 10 per cent increase in revenue per tyre, a figure that was offset by 4.9 per cent lower unit volumes.

As a result, segment operating income in EMEA was $22 million compared with $30 million a year ago, down $8 million.

However, the benefit of price/mix in the quarter was $59 million, driven by previously announced price increases in the region. Lower raw material costs impacted the quarter favourably by $34 million. These benefits more than offset ($45) million of higher costs.

Additionally, costs in “other tyre-related businesses” of ($7) million and ($6) million resulting from the fire at Goodyear’s Debica, Poland tyre factory also impacted results.

Consequently, Goodyear executives concede that “EMEA’s earnings remained below historical levels due to continued industry volume weakness and elevated inflation.”

Nevertheless, the results also reflect “strong price/mix performance and the benefit of lower raw material costs – which helped drive a sequential improvement in earnings.”

EMEA unit volumes down 4.9 per cent

Overall volume in EMEA was down 0.8 million units, or 4.9 per cent below third-quarter 2022 levels. Replacement volume was 6.8 per cent lower (0.8 million units), while OE volume was approximately flat.

As far as the consumer replacement tyre volumes are concerned, Goodyear explained that demand in this area remained “soft” due to “continued destocking”, with executives adding: “We expect continued destocking in the fourth quarter.”

Still, Goodyear reports that the company’s EMEA market share remained flat compared to the previous year, including “strong Tier 1 performance”.

However, things were less stable in the truck tyre side of the business with “commercial truck volumes declin[ing] 11 per cent, also reflecting weak industry conditions and increased competition from low-cost imports.”

Goodyear CEO, Rich Kramer, concluded his letter on a couple of upbeat notes: “I am proud of everything our team is doing to execute and position us to win. I am excited about Goodyear’s future and our ability to capture value today while positioning for further success in the future….Our products have never been stronger and our positioning in the marketplace has never been better.”

Goodyear’s “Strategic and Operational Review Committee”, which was set up in the wake of Elliott’s high-profile letter is scheduled to report back on 15 November 2023.

Comments