Superior Industries Production Germany files for insolvency

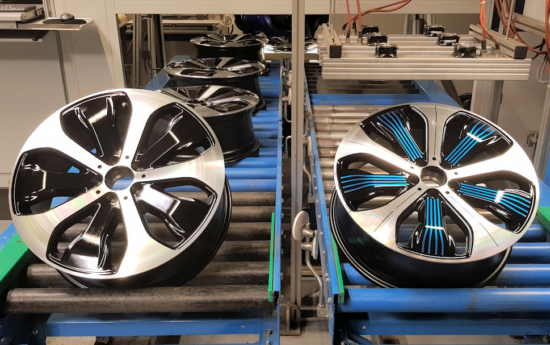

Plans affecting the Werdohl plant in Germany are part of Superior’s “transformation of the remaining 6%” of its footprint (Photo: NRZ / Christine Schönfeld)

Plans affecting the Werdohl plant in Germany are part of Superior’s “transformation of the remaining 6%” of its footprint (Photo: NRZ / Christine Schönfeld)

Earlier today, Superior Industries Production Germany GmbH (SPG), a wholly owned subsidiary of US-headquartered aluminium wheel supplier Superior Industries International, Inc. that was formed after the 2017 acquisition of Uniwheels AG, filed voluntary petitions for preliminary insolvency proceedings. Superior Industries calls this step a “strategic action” to “further enhance competitiveness.”

Superior Industries stresses that this court-administered reorganisation (or Protective Shield Proceedings) is “strictly limited” to SPG and its manufacturing facility in Werdohl, Germany. Operations in the USA, Mexico and Poland are not impacted, and the company’s other German operations and aftermarket business are not part of these proceedings.

The petitions filed with the Court in Neustadt an der Weinstrasse seek relief under Germany’s Insolvency Code pursuant to § 270, a section that states that a debtor is “entitled under the supervision of an insolvency monitor to manage and realise the insolvency estate if the insolvency court orders such debtor-in-possession management in the order opening the insolvency proceedings.” In a Form 8-K document filed with the Securities and Exchange Commission in the USA, Superior Industries explains that SPG is “seeking authorisation to continue to operate its business as a ‘debtor-in-possession’ under the jurisdiction of the Insolvency Court.

Aligning to an evolving environment

“We have made substantial progress in aligning our business to a rapidly evolving operating environment while elevating our footprint to a competitively advantaged position,” comments Majdi Abulaban, president and chief executive officer of Superior Industries. “Today, the vast majority of Superior’s capacity is high-performing and is strategically placed in two low-cost locations, Mexico and Poland, creating an attractive ‘local for local’ solution for our customers as they seek shorter supply chains to mitigate production risks. The action we are taking represents a continuation of our plan and the transformation of the remaining six per cent of our footprint.

“Our competitive differentiators, including our ability to capture customer demand for larger, premium wheels, will continue to support our business well into the future,” Abulaban adds.

Pruning underperforming areas

According to Superior Industries, this so-called strategic action in Germany is a “critical step” in its efforts to “strategically prune underperforming areas” of its global product portfolio. The measure is expected to improve the profitability of Superior’s European operations and reduce the approximately 400 bps margin gap that currently stands between value-added sales in Europe and North America.

In conjunction with the proceedings, Superior has developed a revised operating plan at its SPG facility. It says this plan will “reduce costs, enhance revenues, and to better address critical customer needs.”

Superior Industries expects to recognise a non-cash charge of approximately US$82 million in the third quarter of 2023, representing the excess of the carrying value of the net assets over the estimated preliminary fair value of its interest in SPG. The company also anticipates incurring cash charges associated with these proceedings of €15 to 18 million and a benefit to adjusted EBITDA, which it expects to be fully realised in 2024 on a run rate basis that reflects a payback of approximately one year.

Apollo Tyres

Apollo Tyres

Comments