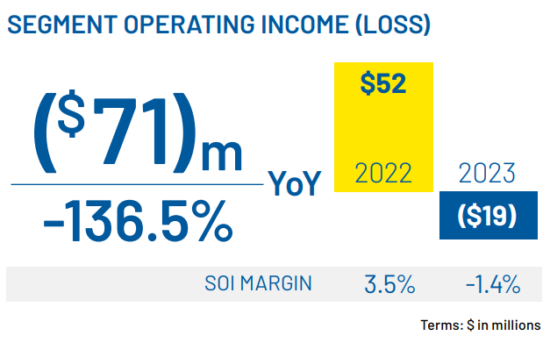

Goodyear EMEA lost $19 million in Q2 2023

Goodyear lost $19 million in the EMEA region in the second quarter of 2023, with segment operating income down $71 million or 136.5 per cent compared with the $52 million operating income achieved at the same point in 2022.

So what’s behind Goodyear’s EMEA losses? Firstly, the company sold “2.7 million units lower year-over-year”. Actually, consumer replacement sales were worse – down 3 million units – with a 0.3 million-unit (9.2 per cent) increase in OE sales helping out the overall total. This figure is particularly worrying when compared with Goodyear’s overall global replacement tyre unit sales decline, which amounted to 5.4 million. In other words, more than half of Goodyear’s lost unit sales were related to EMEA. Indeed, referring to EMEA, executives reported that “consumer replacement market demand was significantly weaker than we expected (ETRMA members down 12%) in Q2, reflecting continued strong destocking.”

Goodyear’s EMEA truck tyre unit sales were also hit, with volumes declining approximately 22 per cent (0.3 million units) during the second quarter of 2023.

Source: Goodyear

In other words, “EMEA’s consumer replacement volume trended below the industry” compared with “a very strong comparable in the second quarter last year” and “elevated imports”. Nevertheless, that means that the company has lost strategic ground in EMEA, with executives admitting: “We had planned for share loss in the quarter given last year’s outperformance.”

And that all meant Goodyear EMEA’s net sales of $1.3 billion decreased $156 million, or 10.4 per cent, compared with the second quarter of 2022.

The one silver lining in the overall cloudy results was the increase in revenue per tyre of 14 per cent (excluding foreign currency). In other words, Goodyear has to sell significantly more tyres to right its ship, but not as many as the company would have to if it wasn’t raising revenue per tyre at its current double-digit percentage rates.

Executives “making progress” with “manufacturing footprint review”

As long as Goodyear’s EMEA figures stay like this, the company is continuing with its “board-led” cost-cutting actions. Specifically, executives report that they are ”making progress on our manufacturing footprint review in EMEA with a goal to reduce our consumer tyre conversion cost per tyre by ~$3.00 in the region over the next five years…”

That particularly relates to Goodyear’s 31 May announcement that it is cutting tyre production by 50 per cent at its Fulda, Germany factory. The plan includes approximately 550 job cuts at Fulda, consisting of 375 associates and 175 contracted positions.

As far as manufacturing operations are concerned, the plan also cuts the number of tyre SKUs produced in Fulda by approximately 450, with approximately 200 of those SKUs being transferred to “other EMEA tyre manufacturing facilities”.

The company expects to substantially complete this rationalization plan by the end of 2024 and estimates total pre-tax charges associated with that action to be between $105 million and $115 million, of which $95 million to $105 million is expected to be cash charges primarily for “associate-related and other exit costs”.

The company expects to record approximately $65 million of pre-tax charges in the second quarter of 2023 and approximately $10 million of pre-tax charges in the remainder of 2023 related to this plan. The majority of the remaining charges will be recorded in 2024. The majority of the cash outflows associated with this plan will occur in 2024.

Ultimately, Goodyear aims to improve EMEA’s segment operating income by approximately $15 million in 2024 and by approximately $30 million annually thereafter as a result of these cost-cutting measures.

Comments