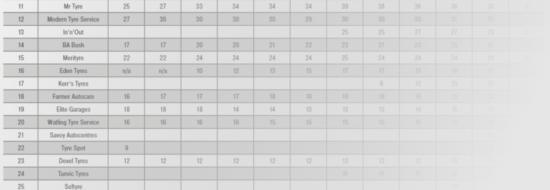

Tyre retail ranking 2023, 11-25: In’n’Out continues to grow

Continuing our coverage of the UK’s leading tyre retailers 2023, 11th-placed Just Tyres maintained a total of 38 tyre retail locations, according to our 2023 table. However, that figure is one centre lower than it was this time last year. Nevertheless, the total remains one branch greater than five years ago.

The largest tyre retailer based on the island of Ireland, 12th-placed Modern Tyre Service has 30 branches within the United Kingdom, according to the latest data. That’s one centre less than this time last year. However, Modern Tyre Service has 14 more locations in the Republic of Ireland, so the overall total of 44 locations should also be noted.

In 13th position, In’n’Out Autocentres now runs 29 branches across the UK. That’s an increase of two on the 2022 ranking. Back in 2018/2019, it was 25. So, the present total represents a steady growth path. And what’s more, In’n’Out was the only one to report a growth in total branch count this year in the 11-15 part of the top 25.

BA Bush and Son Ltd remains stable in 14th position on 25 branches, the same figure it had last year.

Likewise Merityre stayed stable at 24 branches, in line with the company’s long-term average of 23.72 tyre retail centres during the last 10 years.

Eden Tyres rises to 16th after Apex acquisition

Around 26 May, Eden Tyre completed the purchase of Apex Tyres in Peterborough, bringing the tyre retailer’s total branch count to 22. And what that means is that Eden Tyres is now seated in 16th position, up three places from 19th last year. As a result of changes both above and below Eden, that also makes Eden Tyres this year’s fastest riser in terms of ranking position.

Managing director, Matthew Eden, commented: “We are thrilled to get this deal completed. Apex Tyres has been a very well-known family business for over 30 years. It has an excellent reputation within the local area for providing great service and value for money. As a business, it has qualities and core values very similar to our own so we’re confident it will be a fantastic asset to the Eden group”, adding:

“We will continue to trade under the Apex Tyres name with the current team, most of which have been with the business over a decade.”

Meanwhile, Kerr’s Tyres, Farmer Autocare and Elite Garages all remained stable on 20, 19 and 16 branches respectively.

Watling Tyre Service now comprises 14 centres, down one from last year.

And Savoy Autocentres and Tyre Spot (21st and 22nd respectively) are worthy additions to our ranking, having been unfortunately overlooked in previous editions for a number of reasons including limiting the ranking to the top 20.

Indeed, such is Tyre Spot’s credence as a tyre retailer backed by a regional wholesale business, in November 2022, Tyre Spot was ranked 8th in the prestigious Ward Hadaway North East Fastest 50 Awards medium-sized business category and 38th overall after another record-breaking year for the family-run business.

Next, Dexel Tyres and Tanvic Tyres are in 23rd and 24th respectively both remaining stable on 10 branches a piece.

And the top 25 table is rounded off with Soltyre on 9 branches, down one from last year.

Just 2,641 tyre retail centres are represented in our chart, so when you produce a ranking such as this, oversights are always possible. However, the most glaring omission is the role of those outside the top 25. Sometimes the part played by the largest players can be overstated. It is true that the top five now account for roughly four-fifths of the total branch count of the top 25 UK tyre retailers. However, with anywhere up to 20,000 garages where you can fit tyres across the UK, even those large and very influential companies still only account for around 10 per cent of the market. And that means that 90 per cent of the market is made of nine-branch chains and smaller – many of them professional single-centre independents who also deserve their mention.

Cytonn Photography; Unsplash

Cytonn Photography; Unsplash First Stop

First Stop

Comments