A penny earned – Nokian Tyres returns to the black in Q2 2023

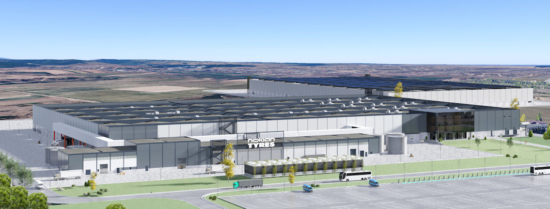

Production at the “world’s first zero CO2 emission tyre factory” will begin in 2025 (Image: Nokian Tyres)

Production at the “world’s first zero CO2 emission tyre factory” will begin in 2025 (Image: Nokian Tyres)

In spite of a steep year-on-year drop in operating profit during Q2 2023, Nokian Tyres believes it has made significant progress towards rebuilding the company following the decision to cut its ties with Russia. It expects a stronger second half to 2023 due to winter and all-season tyre sales and the contribution made by contract manufacturing.

During the second quarter of the year, Nokian Tyres achieved segments and overall net sales of 293.1 million euros in Q2 2023, 11.8 per cent lower than in Q2 2022. With comparable currencies, the decrease in segments net sales was 7.3 per cent, a decline caused by lower passenger car tyre supply volumes.

Segments operating profit amounted to 15.2 million euros, up from 0.9 million a year earlier, whilst operating profit declined 79.7 per cent year-on-year, to 9.5 million euros. For Q2 2023, -5.7 million euros was booked as non-IFRS exclusions, as opposed to 46.0 million euros in Q2 2022. Segments earnings per share were 0.05 euros, contrasting with -1.62 euros in the second quarter of last year. Earnings per share were 0.01 euros, as opposed to -1.67 euros.

Building the new Nokian Tyres

“During the second quarter, we progressed in our long-term journey to build the new Nokian Tyres in line with our plan,” states Jukka Moisio, president and chief executive officer of Nokian Tyres. “The car and tyre market environment is demanding, and during the quarter, we also faced some currency headwinds, impacting our net sales negatively. Segments operating profit turned positive as anticipated and segments EBITDA rose to 14 per cent.”

Moisio reports that Nokian Tyres progressed with its “strategic investments to build up new capacity in our core markets” in Q2 2023. “In May, we reached a significant milestone as we celebrated the start of the building work on our new passenger car tyre factory in Romania, which will be the world’s first zero CO2 emission tyre factory.”

H1 2023 financial results

For the six months to 30 June 2023, Nokian Tyres’ segments and overall net sales were 529.5 million euros, 19.2 per cent lower year-on-year. With comparable currencies, segments net sales decreased by 16.1 per cent due to lower passenger car tyre supply volumes.

Segments operating profit was 1.1 million euros, as opposed to 35.5 million euros a year earlier. The decline was driven by lower volumes. Operating profit was -9.4 million euros, contrasting with 68.4 million euros in H1 2022. -10.4 million euros was booked as non-IFRS exclusions, as opposed to 32.9 million euros a year earlier. Segments earnings per share were -2.50 euros, as opposed to -1.24 euros. Earnings per share were -2.58 euros (H1 2022 -1.33).

Cash flow from operating activities was -124.3 million euros (H1 2022 -223.7 million euros). The sale of Nokian Tyres’ operations in Russia was completed in March. The sale price was 285 million euros. Nokian Tyres no longer has any operations in Russia.

Towards a 2-billion-euro business

“In the coming months, our focus will be on adding new capacity, retaining a competitive premium product portfolio and serving our customers,” Moisio continues. “We have a clear action plan for growth and a strong team that can execute it. Our new financial targets indicate our ambition for the future. We in Nokian Tyres team have an inspiring journey ahead of us towards 2 billion euros business and strong profits in the long term.”

Comments