Goodyear: Steps towards Cooper integration synergies “successfully completed”

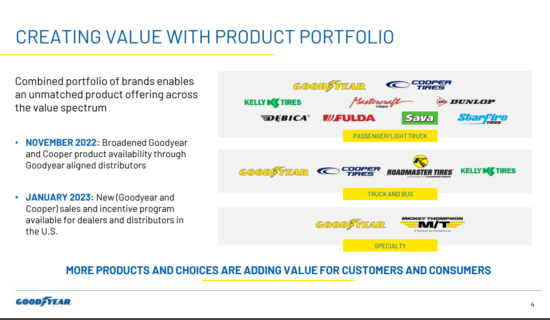

The brand ordering suggests that Goodyear and Cooper are being promoted at a similar level within the Goodyear group brand hierarchy, with Dunlop relegated to the second-tier level of Kelly and Mastercraft (Image: Goodyear)

The brand ordering suggests that Goodyear and Cooper are being promoted at a similar level within the Goodyear group brand hierarchy, with Dunlop relegated to the second-tier level of Kelly and Mastercraft (Image: Goodyear)

In April we took an in-depth look at the progress of the Goodyear-Cooper integration, roughly two years after the acquisition was announced (see ‘Mission “successfully completed”? The Goodyear-Cooper integration and its contradictions’, Tyres & Accessories, April 2023). Now, in parallel with the publication of the company’s first-quarter 2023 financial results, executives have sought to answer those questions with the publication of a “Cooper Tire Integration Update” on 4 May 2023. In short, the update states that “the combination has significantly strengthened [Goodyear’s] leadership position in the global tyre industry” and that the “results of the integration were better than expected when the deal closed in June 2021”. However, Goodyear has also been significantly loss-making for the last two quarters and admitted during the first-quarter 2023 results that it is being forced to review its burgeoning brand portfolio in light of its negative fiscal position.

Nevertheless, Goodyear said the company has “successfully completed the steps required to achieve the previously announced synergies”. Indeed, Goodyear is reportedly on-track to achieve around $250 million of synergies by the second quarter of 2023, a figure 50 per cent higher than originally anticipated. At the same time, the company reports that it achieved working capital savings of around $250 million, which are “generating tax benefits”.

Synergies 50 per cent greater than expected are clearly a good thing, but even the current total of $250 million of such savings generated doesn’t leave much change when the last two quarterly losses of $104 million and $101 million respectively plus record levels of borrowing are taken into account.

So, let’s take a look at the details. As we have seen, Goodyear is reporting $250 million of one-time working capital savings as well as the $250 million of synergy savings. The former is said to have been generated from “improvement in cash conversion cycle in Q4 2022”. Other cash-raising initiatives include: the sale of “duplicative assets”, the consolidation of logistics centres, and “terminated frozen, overfunded Cooper Tire pension plans”.

Goodyear’s Cooper Tire Integration Update is far from exhaustive when it comes to detail, but it does offer more detail than has previously been advanced.

Exiting duplicative assets” specifically means:

- June 2022: Pearsall, TX (proving grounds); June 2022: Cooper Shanghai Office;

- July 2022: Findlay Innovation and Testing Center;

- October 2022: European Technical Center;

- November 2022: Melksham, UK (motorcycle production)”.

In light of the most recent financial results, it wouldn’t be surprising if further manufacturing and R&D restructuring and closure actions were taken.

The consolidation of “multiple distribution centres around the world” is most likely a veiled reference to the news that Goodyear is closing its Phillipsburg, Germany logistics operation. But an earlier presentation slide also referred to Goodyear’s simplification of its distribution network by “exiting overlapping warehouses, streamlining customer supply”. “Spain, Q2 2022; Grand Prairie, Texas Q3 2022; Switzerland Q4 2022; Guadalajara, Mexico Q1 2023 and Albany, Georgia Q2 2023” are all mentioned in association with that language. Since the statement is explicit that executives are referring to “multiple distribution centres around the world”, the ongoing question is: which others will be affected?

Re-evaluating the brand portfolio

The Cooper integration presentation spoke of the combined business’s brand portfolio in glowing terms, suggesting that it “enables an unmatched product offering across the value spectrum.” Indeed, in November 2022, the company “broadened Goodyear and Cooper product availability through Goodyear aligned distributors”. And in January 2023, “broadened Goodyear and Cooper product availability through Goodyear aligned distributors”.

The problem is that the last two quarters of markedly reduced Goodyear group tyre volume sales do not suggest that having such a big brand portfolio is a secret bullet. Rather, Goodyear’s financial statement spoke of the need to review the wider company’s brand portfolio. Judging by the graphic accompanying Goodyear’s Cooper update, some of that evaluation has already been done. The brand ordering suggests that Goodyear and Cooper are being promoted at a similar level within the Goodyear group brand hierarchy, with Dunlop relegated to the second-tier level of Kelly and Mastercraft. In a similarly surprising move, Fulda is down on the third tier alongside Debica, Sava and Starfire.

It could be a coincidence, but it certainly isn’t in alphabetical order and – as you would expect – Goodyear is always listed first. If the diagram does indicate group brand priorities moving forward, the future of Dunlop and Fulda in the post-evaluation brand portfolio isn’t as positive as it might once have been.

Comments