Goodyear reports $101 million net loss in Q1 2023, EMEA cost cutting accelerated despite breakeven

(Source: Goodyear)

(Source: Goodyear)

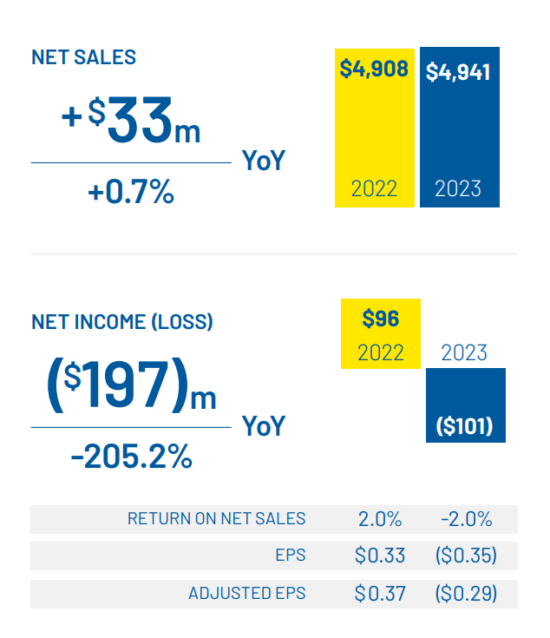

Despite a first-quarter 2023 net loss of $101 million, down $197 million compared with $96 million of positive income 12 months ago, Goodyear executives tried to shine a positive light on the US-based tyremaker’s latest financial results. Volumes may have been 3.2 million units lower than the same period last year at 41.8 million units, but net sales grew 1 per cent compared with the first quarter of 2022 and 4 per cent excluding foreign currency effects. And Goodyear EMEA is back to breakeven, but that wasn’t enough to avoid talk of accelerated cost-cutting measures.

As well as pointing to the ongoing war in Ukraine, channel destocking was given as the primary reason for the lower sales volumes at the heart of the negative figures. The fact that revenue per tyre (excluding currency impact) was up 12 per cent versus the first quarter of 2022 was given as another silver lining in the fiscal cloud. Meanwhile, the replacement industry in EMEA was said to have been particularly impacted by “the Russia/Ukraine conflict”, something that has brought with it “higher energy costs for consumers” and, one might add, manufacturers too.

Nevertheless, with announced price increases in January, Goodyear EMEA returned to breakeven profitability during the quarter. Furthermore, the region has also continued to record market share gains, with “strong growth in consumer and commercial OE”. Indeed, executives “expect EMEA’s segment operating income to improve and for the region to move toward recent levels of historical segment operating income by mid-year.”

Accelerated cost-cutting measures

But none of that is putting the brakes on Goodyear’s European cost-cutting measures, with “structural shifts in the macroeconomic and industry outlook in Europe” leading executives to “accelerate actions to reduce our cost structure in order to improve our margins over the long term”.

Following on from Goodyear’s fourth quarter investor letter, when executives announced a review of the company’s “European cost structure”, including “business transformation initiatives” and “manufacturing cost” changes, Goodyear executives have set a further goal to reduce “consumer manufacturing cost by ~$3.00 per tyre over the next five years.”

In order to achieve that, Goodyear says it will find savings of $75 to $100 million a year via “simplification and standardization…through leveraging our global business services organization, beginning in mid-2024.” Which sounds like the centralisation of some sales, marketing and administration functions including a reduction in total headcount.

At the same time, executives are also conducting a review of Goodyear’s EMEA manufacturing footprint “given lower industry demand, diminishing profit pools in the lower tier segments”. That explicitly includes “a comprehensive approach to reducing our high-cost capacity and modernizing our footprint in EMEA”. Which sounds like a reduction in European production capacity and its associated jobs.

Executives expect to, to some extent, “self-fund the planned restructuring” by “reviewing our portfolio of brands”, which sounds like a simplification of Goodyear’s complex and well-stocked brand basket. But at least we know that this particular review won’t feature the transition of Avon to the role of a two-wheel brand.

And finally, in addition to the aforementioned manufacturing review, Goodyear is linking certain “manufacturing assets” and “recently shuttered real estate” with the self-funded restructuring efforts. In other words, Goodyear appears to be planning to sell off some equipment and land. On the latter point, the land upon which Goodyear’s recently-shuttered Cooper plant in Melksham is built is most likely to be amongst those sold.

If it wasn’t already obvious, “The scope of this review is significant” and “these actions would be in addition to previously announced restructuring actions”, which will no-doubt have Goodyear EMEA employees raising questions about their own positions. Nevertheless, executives affirmed that they “remain committed to a profitable, value-generating business in EMEA”.

CAM

CAM

Comments