Goodyear has underperformed by 143% over 10 years – Elliott

(Chart: Elliott Investment Management)

(Chart: Elliott Investment Management)

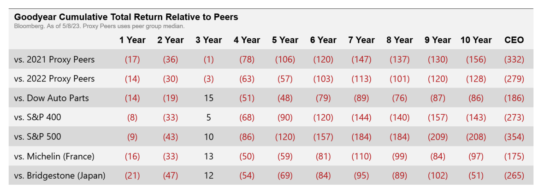

The specifics of Elliott Investment Management’s explosive open letter to the Goodyear board reveal that one of the company’s largest shareholders believes “Goodyear has underperformed by 90 per cent over the past five years and 143 per cent over the past ten years” relative to the S&P 400. And relative to proxy peers, key competitors and relevant indices such as the Dow Auto Parts Index, “the story of underperformance is similar”.

To that end, Elliots have produced a 10-year chart illustrating Goodyear’s cumulative total return relative to peers and even Michelin and Bridgestone specifically. That latter point is comparable with the five-year data we compiled in February, which showed that Japanese tyremakers are significantly outperforming Western tyre brands in terms of financial outcomes and that Michelin is top of the tree amongst Western brands.

The reason for Goodyear underperformance? “…the company’s poor stock performance is a direct result of its significant margin erosion, suboptimal go-to-market strategy and unfocused brand strategy, which have collectively led to a loss of investor confidence.”

That, in turn, is said to have led to a loss of investor confidence and – as a result – “The company now finds itself capital-constrained and unable to pursue value-creating opportunities, such as high-ROIC investments to support growing its valuable retail store platform.”

Low margins, under-utilised retail platform, undermined investor confidence – 3 marks of Goodyear’s current condition

According to Elliots, Goodyear’s legacy has been undermined by “industry-low operating margins; underutilized retail platform; and loss of investor confidence”.

Margins: Goodyear’s margins are reportedly the lowest in the tyre industry, trailing Michelin and Bridgestone, by around 700 basis points. “Not only has the company failed to close the margin gap versus these peers, but in recent years the gap has continued to widen.”

Underutilized Retail Platform: Goodyear currently owns around 1,025 “auto service retail stores”. That is clearly a strong point, but Elliots reports that the company “has failed to leverage its industry-leading consumer brand into growing a high-value retail platform”, adding: “Over the past five years, the number of Goodyear Auto Service stores has contracted, whereas public peers have grown their footprints substantially.” Their argument is that “Well-capitalized and efficiently operated automotive aftermarket service businesses trade in both the public and private markets at valuations dramatically higher than where Goodyear trades today”, but it is also worth pointing out that the experience of virtually every equity-owned tyre retail operation in the UK and Europe has been somewhat cyclic. In the first phase manufacturers seek to control distribution through ownership. Then others follow. At a certain point, equity ownership reaches critical mass and – for not unconnected reasons – profitability (or lack thereof) becomes unsustainable and the businesses are sold off to private equity or other third parties until the next round of acquisition. The more common approach since the last round of largescale equity ownership on this side of the pond has been to engage with distribution ownership via various flavours of franchising, sometimes combined with an equity ownership dimension.

Loss of investor confidence: On this point Elliott’s highlights that “Goodyear has…missed investor day targets set in 2016 by nearly 70 per cent and has consistently lowered and pushed out margin improvement promises. At the same time, Goodyear has increased invested capital by $4 billion since 2016, only for Net Operating Profit After Tax (NOPAT) to decline by 42 per cent (while peers’ NOPAT has grown).” The result, they say, is that market sentiment relating to Goodyear is “profoundly negative” and that the market has “orphaned” the stock. Those observations also highlight the highly leveraged nature of Goodyear’s operations, which are currently reporting record levels of borrowing.

Petlas

Petlas

Comments