Elliott proposes Goodyear back office cuts

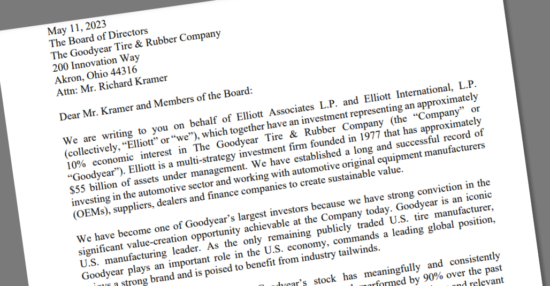

Elliott Investment Management’s letter to Richard Kramer and members of the Goodyear Board of Directors contains the reassurance that it does not seek “any reductions in plant capacity or factory workforce.” Comforting words perhaps for members of the 74,000-strong Goodyear Tire & Rubber Company team engaged in production within the company’s 57 factories, but office-based employees have less reason to breathe easy.

Towards the back of the presentation that accompanied this letter, Elliott states that reducing selling, general and administrative expenses (SG&A) to bring these “in line with peers” would result in a “43 per cent upside to Goodyear’s stock price.” Goodyear’s SG&A amounted to US$2,798 million in 2022 (up 3.7% year-on-year), with a margin of 13.4 per cent.

After comparing “Goodyear’s underperformance” with efforts made by Bridgestone to reduce SG&A since 2016, Elliott sees an opportunity to reduce Goodyear’s SG&A margin by approximately 114 basis points (1.14 per cent). When comparing Goodyear with Michelin, the shareholder sees a potential SG&A reduction margin opportunity of around 240 basis points.

Measures to reduce SG&A margin include eliminating “non-core” and “extraneous business lines” such as Goodyear Ventures and merchandising websites, as well as reviewing management incentives and fostering a “culture based on performance.” Elliott also mentions a third means of reducing SG&A margins: By “streamlining” Goodyear’s “back office.”

The shareholder explains that “based on analysis from a leading third-party operations consulting firm,” it anticipates potential G&A savings of more than 100 basis points by “reducing back-office functions” at Goodyear to bring these “in line with industrial manufacturing peers.” Elliott names IT, finance/accounting, human resources, legal and administration as departments where cuts could be made.

Google Finance

Google Finance

Comments