An olive branch to staff? Elliott Goodyear proposals don’t cut jobs

A slide from Elliott Investment Management's "Accelerating Goodyear" proposal

A slide from Elliott Investment Management's "Accelerating Goodyear" proposal

While Goodyear executives’ latest financial results include plans for a brand review and additional cost-cutting measures, the way forward suggested by one of the company’s largest shareholders apparently doesn’t include further job cuts: “For the avoidance of doubt, we are not calling for any reductions in plant capacity or factory workforce” Elliott Investment Management wrote in the 11 May 2023 letter.

Neither are Elliots calling for any increases in leverage: “On the contrary, the changes we are seeking at Goodyear would reduce leverage, accelerate growth and lay the groundwork for a more sustainable future.” Both points could be interpreted as an olive branch to staff who have been facing 500 or more job cuts and obviously have an interest in the ongoing financial security and success of the business.

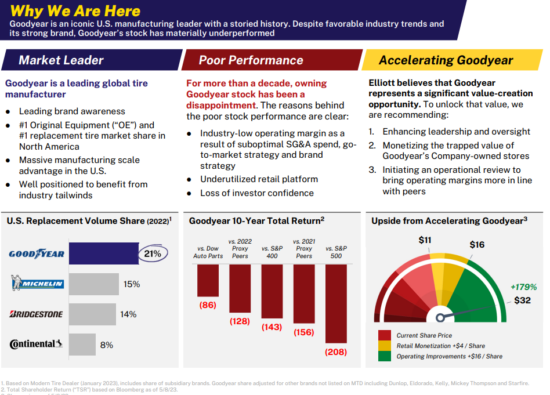

But how are Elliotts planning to improve the state of Goodyear? Having outlined the problems, the investors suggest the company sell its store 1025-branch strong retail network “We estimate that a sale of these stores would generate an increase of more than $4 per share in the company’s stock price, while allowing the retail platform to grow under more focused and better-capitalized ownership.”

In addition, Elliots advocates for the formation of “an Operational Review Committee”, adding: “We estimate that a comprehensive review of Goodyear’s SG&A costs could drive at least 114 basis points of margin improvement, while a redesign of Goodyear’s go-to-market and brand strategies could drive an incremental 271 basis points of operating margin expansion. Together, these initiatives could create more than $16 per share of value at the Company.”

It seems Elliot’s approach reflects the investor’s assessment of the circumstances: “Given the scale of the issues the company faces and the urgency of addressing them, we are sharing this letter and our related materials publicly at AcceleratingGT.com.”

The steps represent significant change for a company that, as the balance sheet testifies, is already experiencing turbulence, but the letter points to a short-term turnaround: “all of these steps are achievable in the near term.” Elsewhere it adds: “Our hope is to align in the coming weeks on the best path forward.”

Petlas

Petlas

Comments