Nokian Tyres: 18.8 million-euro Q1 2023 loss, but pricing should mitigate income problems

Nokian Tyres has presented its first quarterly results since the company sold its Russian operations to Tatneft its resultant production gap. In short, first quarter 2023 net sales were 236.4 million euros down 26.8 per cent compare with 322.9 million euros during the same period last year. That meant an operating loss of 18.8 million euros compared with 21.5 million euros of operating profit in the first quarter of 2022.

However, despite the first quarter loss, Nokian expects full year sales of between 1,300–1,500 million euros and segment operating profit percentage of net sales between 6–8 per cent.

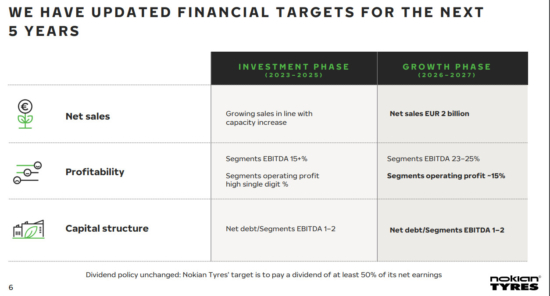

Executives also revealed that they are happy to take on almost three-times more debt than Nokian Tyres held in 2016 (in terms of the ratio between net debt and segment EBITDA) in order to close its post-Russia production gap and transition to the proposed new Nokian Tyres. Previously the company aimed to have cash at hand in order to mitigate the risks of exposure in Russia. Now that the tyremaker has exited Russia – Nokian Tyres executives explain – the company is able to build a “diversified debt portfolio”, according to executives. Executives also pointed to a renewed average selling price strategy designed to mitigate pressures associated with input costs and profitability.

Nokian Tyres president and CEO Jukka Moisio explained more: “….As we have communicated earlier, the first half of 2023 will be demanding for us as we are short of supply. This was reflected in our January–March 2023 segments net sales and segments operating profit negatively. The second half is expected to be stronger due to winter and all-season tire sales and contribution from contract manufacturing.

“In 2023, our focus will be on adding new capacity, retaining a competitive premium product portfolio and serving our customers. We have a clear action plan for growth and a strong team that can execute it. Our new financial targets indicate our ambition for the future. We in Nokian Tyres team have an inspiring journey ahead of us towards EUR 2 billion business and strong profits long-term.”

Nokian Tyres first-quarter 2023 financial results

| EUR million | 1–3 /23 |

1–3 /22 |

Change % |

CC* Change % |

2022 |

| Net sales | 236.4 | 322.9 | -26.8% | -25.1% | 1,350.5 |

| Operating profit | -18.8 | 21.5 | 56.7 | ||

| Operating profit, % | -8.0% | 6.7% | 4.2% | ||

| Result before tax | -22.5 | 18.8 | 11.2 | ||

| Result for the period | -357.7 | 47.0 | -175.5 | ||

| EPS, EUR | -2.59 | 0.34 | -1.27 | ||

| Segments net sales | 236.4 | 322.9 | -26.8% | -25.1% | 1,350.5 |

| Segments EBITDA | 18.5 | 61.5 | 127.9 | ||

| Segments EBITDA, % | 7.8% | 19.1% | 9.5% | ||

| Segments operating profit | -14.1 | 34.6 | 17.8 | ||

| Segments operating profit, % | -6.0% | 10.7% | 1.3% | ||

| Segments EPS, EUR | -0.11 | 0.19 | -0.86 | ||

| Segments ROCE, %** | -1.4% | 14.7% | 0.9% | ||

| Equity ratio, % | 67.8% | 70.0% | 64.9% | ||

| Gearing, % | 3.3% | 3.1% | 9.8% | ||

| Interest-bearing net debt |

46.8 | 52.6 | 140.9 | ||

| Capital expenditure | 34.4 | 14.1 | 129.7 | ||

| Cash flow from operating activities | -57.6 | -114.3 | -4.3 |

* Comparable currencies

** Restated rolling 12 months excluding Russia

The definitions of alternative performance measures (non-IFRS figures) are presented in the report by the Board of Directors in Nokian Tyres Financial Review 2022.

Comments