March new car market continues recovery with eighth month of growth

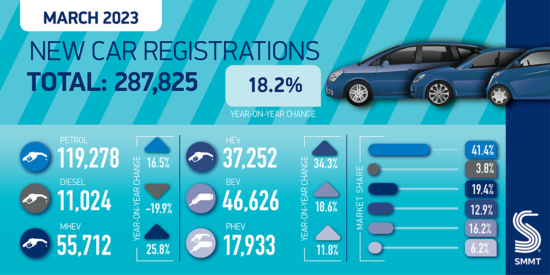

UK new car registrations in March bounced back by 18.2 per cent to deliver the best ‘new plate month’ performance since before the pandemic, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

The increase saw 287,825 units delivered, the eighth consecutive month of growth for the new car market, as supply chain challenges slowly continue to ease. As a result, the first quarter of 2023 is the strongest since 2019, with just under half a million new cars joining the road. This represents an additional £2.7 billion of deliveries, underlining the contribution the sector can make to UK economic growth, despite the market still being significantly below pre-pandemic levels, down 29.5 per cent on Q1 2019.

Registrations rose across all sales types, with deliveries to private buyers up by 1.4 per cent, and those to businesses with fleets of fewer than 25 vehicles up 26.0 per cent. Large fleets, however, were the predominant drivers of March’s growth, with registrations rising by 40,651 units, a 40.9 per cent increase to take an overall 48.6 per cent market share.

By segment, superminis posted the largest percentage growth – up 27.2 per cent, to remain Britain’s most popular car type. Lower medium and dual purpose vehicles were the second and third most popular respectively, with all three vehicle types combined representing 86.5 per cent of total registrations.

Petrol-powered vehicles remained the most popular fuel type, comprising 56.3 per cent of new units, while battery electric vehicle (BEV) deliveries reached a record monthly high of 46,626, representing growth of 18.6 per cent. Overall, the BEV market share remained almost the same as last year at 16.2 per cent and, with plug-in hybrid (PHEV) registrations growing by 11.8 per cent, plug-in registrations comprised 22.4 per cent of the market – a slight decline on 2022. The biggest growth, however, was in hybrids (HEVs), with a 34.3 per cent surge helping electrified vehicles account for more than one in three registrations for the month.

With the publication last week of the consultation on a Zero Emission Vehicle Mandate – due to come into force in less than nine months – the market will have to move more rapidly to battery electric and other zero tailpipe emission cars and vans. Models are coming to market in greater numbers, but consumers will only make the switch if they have the confidence they can charge whenever and wherever they need. Success of the mandate, therefore, will be dependent not just on product availability but on infrastructure providers investing in the public charging network across the UK.

Mike Hawes, SMMT chief executive, said; “March’s new plate month usually sets the tone for the year so this performance will give the industry and consumers greater confidence. With eight consecutive months of growth, the automotive industry is recovering, bucking wider trends and supporting economic growth. The best month ever for zero emission vehicles is reflective of increased consumer choice and improved availability but if EV market ambitions – and regulation – are to be met, infrastructure investment must catch up.”

NFDA “encouraged” by March figures

Commenting on the figures, Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK, said: “The first quarter of 2023 has been positive for UK new vehicle sales, it is extremely encouraging to see sales figures starting to emulate pre-pandemic trends, particularly for the plate change month of march and consecutive months of optimism and growth.”

Robinson added “As supply constraints start to ease and waiting times for products begin to fall, dealers are finding it easier to sell their stock to customers. Whilst there are a prominent range of pressures facing the sector, including unprecedented levels of inflation, cost of living crisis and the fall out of the Russia-Ukraine crisis still affecting global supply chains, cars are still regarded as a necessity to many, whether it be for commuting or day-to-day life, and this will always be the strongest asset for franchised dealers.

“NFDA expects current trends to continue into Q2, with electric vehicles maintaining popularity among consumers with growing market share. Ten years to date, alternatively fuelled vehicles (AFV) held a minute 1.3 per cent of the market share, selling 5318 units in March 2013. In March 2018, five years ago, AFV market share had grown to 5.1 per cent with 24,126 units sold. Today, it is extremely positive to see electric vehicles now a dominant driving force within the UK market, recording a market share of (35.4 per cent), with 101,811 units sold and franchised dealers are undoubtedly a pivotal factor in driving this trend. Franchised Dealers with their Electric Vehicle Approved (“EVA”) accreditation are at the forefront of EV retail and continue to help consumers enter and navigate the EV market.”

Comments