High-performance SUV tyres an increasingly all-season proposition

Cap: The Nissan Ariya, which Auto Express voted as its 2022 car of the year, comes factory-fitted with 235/55 R19 tyres – currently the second most popular size in the segment - and with 255/45 R20 as an option (Photo: Nissan)

Cap: The Nissan Ariya, which Auto Express voted as its 2022 car of the year, comes factory-fitted with 235/55 R19 tyres – currently the second most popular size in the segment - and with 255/45 R20 as an option (Photo: Nissan)

The years since 2020 have brought with them more than their fair share of upheaval. However, throughout that period the growth in importance of SUV and 4×4 tyre sales has continued basically unabashed. With that in mind Tyres & Accessories asked the market research specialists at GfK for their view on the latest headline trends in the UK market. However, while this article zeroes in on the UK market, the UK market position as an established leader in the wider European market take-up of SUVs – and therefore SUV tyres – means the trends identified are also relevant across the continental tyre markets.

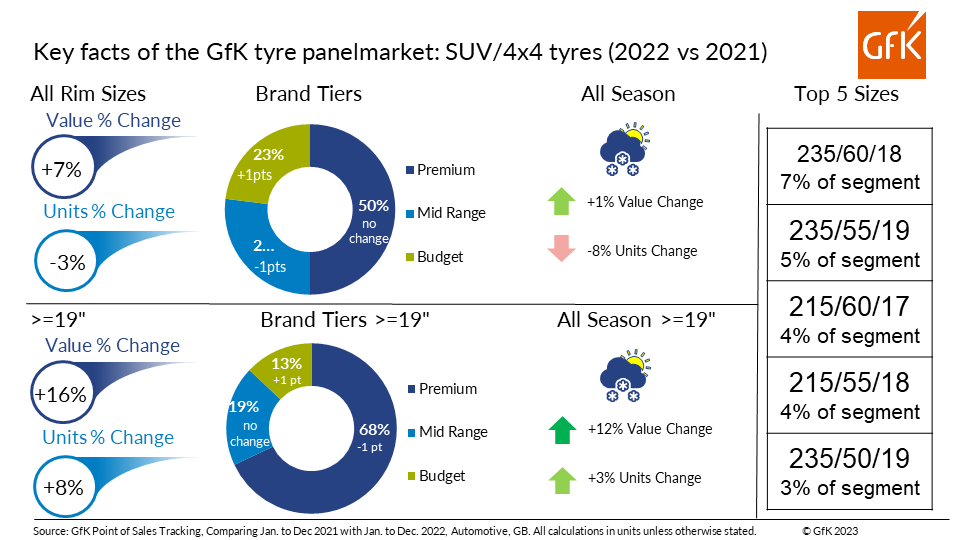

Specifically, the data we focus on was produced by GfK Point of Sales Tracking and compares the period between January and Dec 2021 with January to December 2022. All figures refer to the UK panelmarket and are based on tyre unit volumes as opposed to the market value of tyres sold (unless specified). In this article, we take a particularly close look at: rim size, brand tyres, the all-season SUV sub-sector and the top five SUV and 4×4 sizes. At the same time, we re-visit those same categories through the lens of greater-than-19-inch-and-above high-performance SUV tyre filter. And while the data primarily compares full-year 2022 figures with full-year 2021 data, since we have been analysing the state of the UK SUV and 4×4 marketplace for a number of years, we also set the data into a broader medium-term context.

First off, overall panelmarket volumes are down 3 per cent. That clearly isn’t great news for anyone in the tyre trade, but any immediate worries should be quickly moderated by the fact that the overall market value grew at more than twice the rate that volumes fell. In other words, there was net growth in the value of the SUV and 4×4 UK panelmarket in full-year 2022 figures despite a decrease in overall volume. The reason? High-performance SUV tyres appear to be supporting the growth of the segment as a whole. Looking at the same figure broken down rim by diameters 19-inches and above, volume grew 8 per cent. At the same time, high-performance SUV panelmarket tyre value grew at twice that rate, up 16 per cent year-on-year.

Compared with the previous full-year figures (which compared January to December 2021 with January to December 2020), the slow-down of the overall market looks more like a moderation of previously high levels of growth. Indeed, between full-year 2020 and 2021, SUV tyre panelmarket values were up 12 per cent along with volume growth of 8 per cent. During the same period, the high-performance SUV tyre sector panelmarket – which back then was measured as 18-inch and above – grew 16 per cent in terms of value and 13 per cent in terms of unit volume. In other words, the value of the overall segment continues to grow at a healthy rate because the value of the top-end of the segment continues to grow strongly in terms of value and healthily in terms of volume. Therefore, the change in overall UK SUV panelmarket volume can be described as a stabilisation rather than a contraction or correction.

Some signs of trading down

However, unsurprisingly considering the fall-out of the previous years of Brexit and the pandemic followed by the current cost-of-living crisis, there are indications that consumers are trading down when the market is viewed through the prism of brand tiers. On that point, the latest GfK data suggests the premium share has stood still at 50 per cent of the panelmarket. But, as in previous years, the mid-range is seen as being squeezed by the growth of the bottom end of the market, with mid-range down one percentage point to 27 per cent and the budget sector up 1 percentage point to 23 per cent. And when we consider the 2023 SUV tyre sector brand segmentation picture alongside last year look at the same thing, it is quickly apparent that mid-range share has stood still on 27 per cent. The only explanation for that disparity is that the percentage change refers to proportions less than 1 percentage point in size and therefore they have been subject to rounding. That being the case, overall SUV sector segmentation was relatively stable in the full-year 2022 data.

Break the same data down by rim sizes of greater than 19 inches in diameter and the desegmentation picture is somewhat clearer. Budget market share is up 1 percentage point to 13 per cent of the 19-inch-plus SUV panelmarket. During the same full-year 2022 period, mid-range share stood still on 10 per cent. The premium brands were the only segment to lose ground, falling one percentage point. However, that was from the dominant position of 68 per cent share. Since the previous year data is based on an 18-inch-and-above filter, no direct comparisons can be made, but a quick glance at the fact that there are now more 19-inch sizes leading the market than in previous years combined with the fact that budget brands are increasingly producing tyres in these large and technically demanding fitments explains where some of budget market growth is coming from.

All-season SUV tyre volumes down 8 per cent

This month’s SUV tyre feature expressly considers whether the SUV tyre market is becoming an increasingly intersectional niche, with vehicles and drivers demanding combined specialisms. With that in mind, the decision to analyse the proportion of SUV tyre unit sales that can be described as all-season appears to have been prescient.

GfK’s full-year 2022 panelmarket data shows that all-season SUV tyre volumes were down 8 per cent, but that value still managed to grow 1 per cent. That contrasts starkly with the full-year 2021 data, which saw value shoot up 14 per cent and unit volumes grow a similarly healthy 9 per cent.

However, when you look at the same data with the aforementioned 19-inch high-performance filter on, all-season SUV tyre sales are holding up better. Indeed, the full-year 2022 data suggests high-performance all-season SUV tyre share is up 12 per cent in terms of value and 3 per cent in terms of volume. That data once again supports the overall thesis of this month’s SUV tyre feature – that the SUV tyre segment is becoming increasingly intersectional, with tyre volumes and value being driven by high-performance, all-season SUV tyre products.

Two 19-inch sizes in the top 5

If any further evidence that the 4×4 segment is increasingly becoming the domain of SUVs was needed, that evidence can be found in the latest summary of top sizes. Here two 19-inch sizes can be found in the top five, including the second most popular fitment in the market.

As it was last year and the year before, 235/60 R18 was the most popular SUV/4×4 tyre size in the panelmarket in 2022. In terms of share, that size alone occupied 7 per cent of the market, up one percentage point from 6 per cent this time last year. And with a wide range of vehicles – including the Audi Q5 and Q7, the Honda CR-V, The Land Rover Discovery and Evoque, plus the Nissan X-Trail, VW Touareg and Volvo’s XC60 and XC90 all running on that size, 235/60 R18 is likely to a be a key replacement tyre size for some time yet.

If any further evidence that the 4×4 segment is increasingly becoming the domain of SUVs was needed, that evidence can be found in the latest summary of top sizes. Here two 19-inch sizes can be found in the top five.

235/55 R19 is now the second most popular size in the segment, up from third-place last year, with 5 per cent share. This time last year, 235/55 R19 also held 5 per cent share of the segment, so its rise in fortunes is a direct result of 235/60 R18’s gain at the top of the table. And with vehicles such as the Nissan Ariya, which Auto Express voted as its 2022 car of the year, factory-fitted with 235/55 R19 tyres (and with 255/45 R20 as an option), this is a size of the future which demonstrates that the trend towards larger diameter sizes is likely to continue.

Together the top two sizes now occupy 12 per cent of the market between then. While the make-up of the top two was different last year, the full-year 2021 data show that the previous year’s top two held 11 per cent of the market, up from 10 per cent the year before. In other words, there is an ongoing trend towards the popularity of certain key sizes.

215/60 R17 was the third most popular size, with 4 per cent share of the market, the same share it had in the full-year 2021 data.

215/55 R18 is now the fourth most popular size in the segment. Despite maintaining the same share as it had the year before (4 per cent), it now ranks two places lower than the second-place position held in the full-year 2021 data.

The lowest profile size in the top five, 235/50 R19 rounds off the table, with a segment share of three per cent. Not only is 235/50 R19 the second 19-inch size in the top five and relatively low profile, it is also a new entry into the top five. And therefore, its current segment share of 3 per cent is likely to be an increase on previous years. The arrival of 235/50 R19 also means last year’s fifth place (255/60 R18) has been pushed out of the top five.

Overall, the data is clear that SUV/4×4 tyre value continues to grow, despite what might be called the stabilisation of segment unit volumes. At the same time, there are several indicators that suggest high-performance SUV tyres are an increasingly all-season proposition. And that supports this section’s overall thesis that the highest value products, with the greatest opportunities for the value chain are those SUV tyre products that intersect across different specialisms such as high-performance, electric and all-season.

Comments