Next stop “Americas”: Linglong aiming for global production capacity top 5 by 2030

Linglong Tire chairman, Wang Feng, shared details of how the company plans to become a top-five player in the global tyre business in terms of production scale by 2030 (Photo: Chris Anthony/Tyre Industry Publications Ltd)

Linglong Tire chairman, Wang Feng, shared details of how the company plans to become a top-five player in the global tyre business in terms of production scale by 2030 (Photo: Chris Anthony/Tyre Industry Publications Ltd)

Alongside an exclusive tour of Linglong Tire’s new European production base in Serbia, Tyres & Accessories sat down with chairman Wang Feng in a conversation that covered topics including the company’s plans for its latest factory in Serbia, the location of its next manufacturing investment and the fast-growing tyre manufacturer’s strategic goals.

Our latest annual ranking of the world’s largest tyremakers puts Linglong in 12th place globally. For those unaware of Linglong’s position amongst the leaders of the enormous Chinese domestic market, 12th position might sound like an achievement already. However, the company is flying higher than that in marketing terms at least, with Brand Finance ranking Linglong ninth in the world in 2020. That position may have been challenged in recent years, but speaking to Linglong Tire chairman Wang Feng reveals that the company has even loftier aspirations.

Specifically, Linglong is aiming for a top-five position amongst global tyremakers in terms of production scale by 2030. Our 2022 ranking table, which is produced in the middle of each year and based on annual tyre-based turnover, shows that the top five is currently occupied by companies with sales north of 6.1 billion euros. During 2021, Linglong achieved sales equating to roughly 2.6 billion euros, so Linglong would have to more than double sales turnover during the next seven years in order to achieve that goal. But actually, the company is aiming for 11 billion euros of turnover by 2030. In other words, Linglong is aiming to roughly quadruple the size of its business during the next seven years and – were Linglong to achieve those ambitions – based on current turnover levels, an 11-billion-euro turnover could even challenge fourth-placed Continental in terms of the annual sales of its tyre-related business.

For anyone that thought a $999 million total investment in Linglong’s Serbia tyre manufacturing operation was big, the company’s 2030 goals put the European business into perspective as part of a wider global strategy. Still, Europe remains a critically important market, within which there are a number of strategic original equipment (OE) and replacement sub-markets.

So, how does that explain where the volume created by Linglong Serbia will be distributed? The short answer is that Linglong is targeting both OE sales and the various European markets. During our interview, Mr Wang pointed out that, internationally, Linglong cooperates with “many first-class automakers” including global OEMs such as Audi, Volkswagen, Ford, GM and Honda as part of its ongoing localisation and globalisation strategy: “If they [the OEMs] have factories in Europe will supply them from the Serbia plant…”

“Our first overseas plant was in Thailand…Our second [overseas] plant is in Europe [that is Serbia]…” Mr Wang, commented, casually adding: our third plant will be in the Americas

As far as distribution is concerned, all the European markets are valued: “Europe is a very important for Linglong”, Wang Feng explained, pointing out that the now-open European plant was initially being considered as far back as 10 years ago: “In 2010 we developed a global development strategy. At that time, we considered building a factory in Serbia.

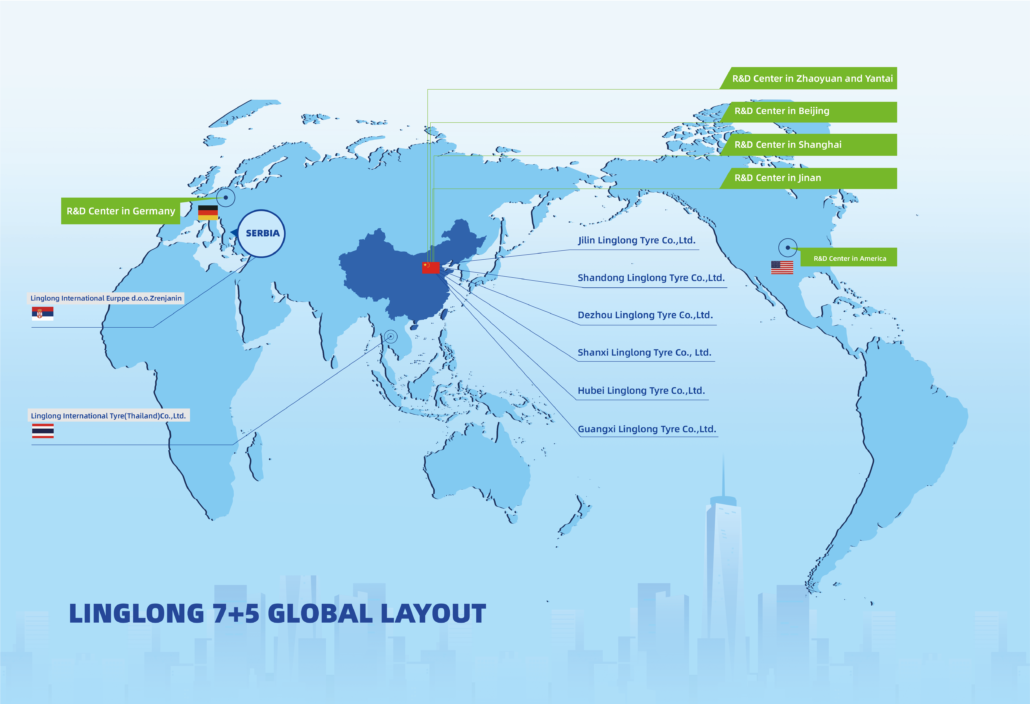

“In 2010, our global development strategy was 3+3. But in 2021 we adjusted it to 7+5 and that means we will have seven Chinese production bases and five overseas production bases.”

The reason for these particular numbers? In a word, demand: “because in China we have a large population as well automotive production and sales quantity…We considered domestic retail demand and OE demand and so we decided to build seven factories in China. Five are in production right now and the sixth domestic base will begin construction this year.”

Tyre factory in the Americas – decision slated for 2023

Continuing on the subject of Linglong’s next tyre manufacturing operation, “Our first overseas plant was in Thailand…Our second [overseas] plant is in Europe [that is Serbia]…” Mr Wang, explained, casually dropping in the news that “our third plant will be in the Americas”.

The final decision on the location of that plant has been scheduled for 2023, with construction work set to begin in 2024. “Research reports” relating to this project are currently underway.

What we do know is that the location decision will be made and announced in 2023, with construction work beginning in 2024. When the project does officially get underway, it will be a 12-million-passenger-car-tyre and 2-million-truck-tyres a year factory. Again, OE plays a significant part in the strategy associated with this particular tyre factory investment. Specifically, continuing his earlier comments on OE connections with the Serbia plant, Mr Wang said: “…if [the OEMs] have factories in the Americas, we will supply them from there…”.

No financial details have yet been released, but the way Linglong has invested in its Chinese, Thai and Serbia factories suggests the “Americas” project will attract a significant level of investment.

Separately to the official interview with Mr Wang, Tyres & Accessories has heard speculation that the smart money is on the factory ending up in Latin America. Put the official line together with the other assertions and one might speculate that Mexico is a likely candidate market for the new tyre factory investment. However, no official confirmation has been made and therefore the precise location is yet to be revealed.

Developing a global footprint

As well as the company’s ambitious sales goals and its targeted top-five position on the global ranking, Linglong is also aiming to significantly increase its tyre manufacturing ability:

“By 2030 our production and sales volume will reach 160 million, our sales 11 billion euros; making [Linglong] a world-class tyre manufacturer in terms of technology, management and brand.”

The obvious question is: what strategy will deliver those goals? “In order to reach that goal we have a ‘five forces’ strategy. The first is “strategy force”, the second is innovation, the third product, fourth marketing, and the last one brand.

With the Thai tyre factory in place, the Serbia factory coming on-stream and the plans for a new factory in the Americas in addition to a strong Chinese manufacturing base, Linglong is clearly developing a global footprint. But what does the opening of a new “overseas” tyre factory in Serbia mean for the existing Thai tyre production base? Previously, most Linglong tyres destined for Europe were made in the company’s Chinese tyre factories. However, the Thai capacity destined for Europe will now be transferred to Serbia (see separate article for further details of relating to our exclusive first-look at Linglong’s Serbia truck tyre production line).

Electric vehicles and smart tyres

With product development one of the five forces driving Linglong’s growth strategy, and in light of the differing views between manufacturers relating to whether or not electric vehicles (EV) should be fitted with bespoke EV tyres, T&A asked about Linglong’s policy and also what the latest developments were in relation to so-called smart tyres.

“For electric vehicles, we have special technology and products. This type of product has low rolling-resistance, low noise and are much safer. We have self-sealing tyres and also run-flat tyres. Furthermore, we have now provided OE services to BYD, one of the largest clean energy car companies [in the world]”. To put that last point into context, it is worth highlighting that – between January and September 2022 – Tesla sold 909,042 plug-in electric vehicles. Shenzen-based BYD by comparison sold 1.175 million, according to CleanTechnica.

When it comes to smart tyres, Wang Feng confirmed that certain Linglong truck tyres now feature chips that connect with users’ mobile phones, where “factors affecting safety” – namely pressure and heat – are monitored and analysed. This is designed to increase safety and reduce costs for fleets.

Linglong is currently cooperating with multiple large-scale logistics fleets in China on such “smart tyres”. This technology uses RFID chips (inserted into tyres as part of the manufacturing process) and TPMS (inserted into tyres after production) to collect tyre temperature, pressure, mileage and other data in real-time. When running pressure or temperature abnormalities are detected, the system sends alarm information to the driver and fleet management system to improve the safety of the vehicle operation.

Staying with the subject of technology, what is Linglong’s position in relation to online tyre retail and pre-sale research? Linglong is currently in the third phase of its online and offline marketing strategy.

In China, more than 30,000 tyre retailers are connected with Linglong’s own online and offline tyre marketing system which is designed to connect tyre retailers, wholesalers and the manufacturer. The idea is that, in this way, the benefits of cooperation are available to everyone.

Linglong has ambitious growth plans and – if the new Serbia tyre factory is anything to go by – there is no doubt that the company is willing to commit the necessary funds, personnel and know-how to seeing the company’s vision through to completion. However, the scale of the goals is so large that it is hard to see how the top-five vision can be achieved through organic growth alone. In any case, it will be interesting to see how Linglong progresses towards success in the months and years to come and towards the execution of its particular innovation, product, marketing, brand and OE strategy.

Following the construction of Linglong’s European production base in Serbia, the company is now considering options in “the Americas” (Image: Linglong)

Chengshan

Chengshan Sportauto

Sportauto

Comments