February UK new car market marks seventh straight month of growth

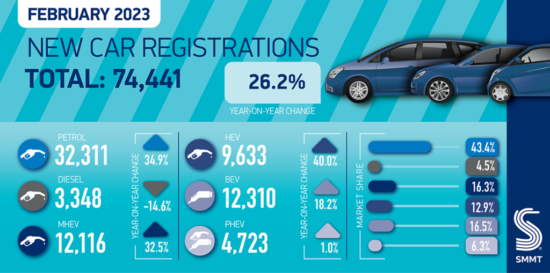

UK new car registrations grew by 26.2 per cent in February as 74,441 new cars joined Britain’s roads, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). While February is typically low volume ahead of the March plate change, this year it marked the seventh month of consecutive growth as easing supply chain shortages steered the market closer to pre-pandemic levels, down just -6.5 per cent on the same month in 2020.

The month saw almost universal growth across the market, with deliveries to private buyers up 5.8 per cent and those to large fleets up 46.2 per cent. Business registrations, which account for a fraction of the market, increased by 0.7 per cent, equivalent to just nine units.

There was also growth in all but two segments, with only registrations of executive and luxury saloon cars falling, by -15.4 per cent and -6.3 per cent respectively. Minis (up 66.1 per cent), multipurpose vehicles (41.9 per cent) and superminis (37.7 per cent) posted the largest percentage uplifts, with superminis remaining the most popular, accounting for a third (33.1 per cent) of all deliveries.

Hybrid electric vehicles (HEVs) recorded the most significant growth of all fuel types, up 40.0 per cent, followed by petrol, up 35.8 per cent with a 56.9 per cent market share, while diesel registrations fell by -7.0 per cent.2 Zero emission capable vehicles, meanwhile, continued their upward trend, with plug-in hybrids (PHEVs) rising 1.0 per cent and battery electric vehicles (BEVs) posting another strong month, up 18.2 per cent to account for one in six new UK car registrations.

Combined, plug-ins accounted for almost a quarter (22.8 per cent) of all deliveries in the month, with further growth anticipated. Indeed, nearly half a million (488,000) PHEVs and BEVs are expected to join Britain’s roads in 2023, as manufacturers bring more than 40 new plug-in electric models to the market. This will inevitably increase demand for charging infrastructure, however, and while the new £56 million LEVI capability funding is welcome, there remains a clear requirement for binding targets that ensure chargepoint rollout keeps pace.

As the new UK car market looks towards a year of double-digit growth, the Spring Budget is an important opportunity to shape Britain’s net zero progress and deliver an equitable transition for all. This should include a long-term plan for chargepoint investment, aligning VAT on public charging with domestic energy use, and reviewing the Vehicle Excise Duty premium that will unfairly penalise EV buyers switching to this inevitably more expensive technology in the future.

Mike Hawes, SMMT Chief Executive, said: “After seven months of growth, it is no surprise that the UK automotive sector is facing the future with growing confidence. It is vital, however, that government takes every opportunity to back the market, which plays a significant role in Britain’s economy and net zero ambition. As we move into ‘new plate month’ in March, with more of the latest high-tech cars available, the upcoming Budget must deliver measures that drive this transition, increasing affordability and ease of charging for all.”

NFDA ‘looks forward to steady improvement’

The news was welcomed by the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK, whose chief executive, Sue Robinson, said: “New car sales have continued their positive start to the year and we expect steady improvement in both new and used vehicles throughout the year.” Robinson added: “Steady macro-economic conditions should allow the new vehicle market to deliver a solid year. Franchised dealers continue to assist customers with choosing the right vehicle for their needs, finding appropriate financing schemes and the service plan.”

Comments