Price adjustments lift Michelin sales & income in 2022

Photo: Tyrepress / Stephen Goodchild

Photo: Tyrepress / Stephen Goodchild

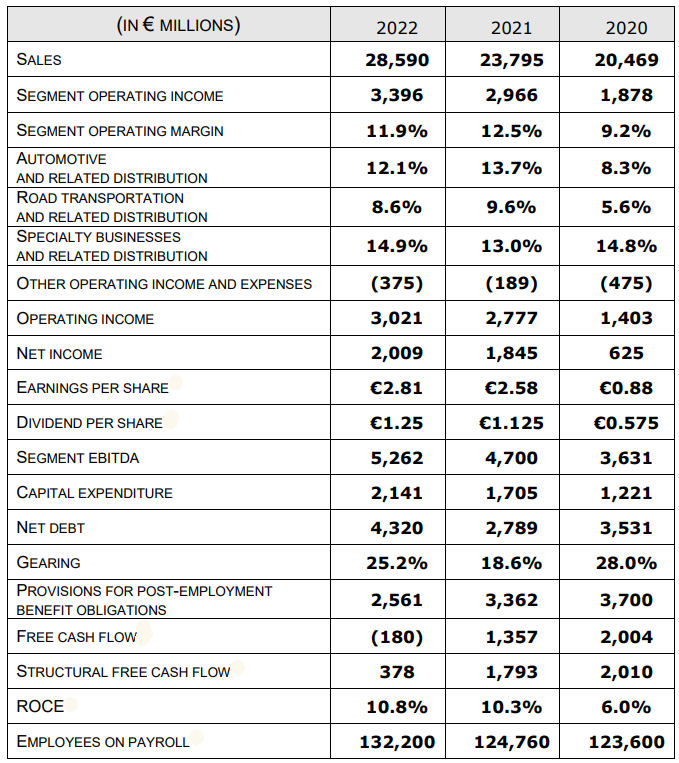

In spite of lower sales volumes, a combination of “firm pricing discipline” and “fast-growing non-tyre sales” helped Michelin increase its overall sales to €28.6 billion in 2022. The company achieved segment operating income of €3.4 billion, while net income reached €2.0 billion for the year, up 8.9 per cent on 2021.

Sales grew 20.2 per cent year-on-year “amid market turbulence and a highly inflationary context.” Indeed, this was the third consecutive year of difficulties within global markets, but the silver lining is that Michelin has “demonstrated the resilience of its business model” over the period between 2019 and 2022.

“In a chaotic environment impacted by a combination of systemic crises, Michelin delivered solid results in 2022,” comments Florent Menegaux, Michelin’s managing chairman. “With our future in mind, we maintained all of our industrial and R&D investments. I want to recognise our associates’ engagement which contributes year after year to our group’s successful development.”

Source: Michelin

Multitude of disruptions

Throughout 2022 and especially in the first half of the year, tyre markets were extensively impacted by a multitude of disruptions such as procurement difficulties in the automotive sector, complications within the global supply chain, renewed Covid measures in China and the outbreak of hostilities in Ukraine. Michelin notes that “all these factors and more helped to drive high volatility in sell-in demand throughout the year,” even though some sources of strain eased in the second half.

Automotive segment (RS1)

While the overall passenger car and light truck tyre market rose by one per cent over the year (but remained below its 2019 level), Michelin’s own sales volumes in the automotive and related distribution segment declined by four per cent over the year. After contracting 3.4 per cent in the first half of 2022, hard hit by the war in Ukraine and the health situation in China and related lockdowns, volumes were down another 4.5 per cent in the second six months, reflecting less favourable comparatives and the worldwide slowdown in demand caused by the economic environment.

Lower volumes didn’t stop sales in the automotive and related distribution segment rising by 17.8 per cent in 2022, to €14.1 billion, helped by the aforementioned pricing discipline. Operating margin decreased by 1.6 points, to 12.1 per cent.

Sales of tyres for 18-inch and larger rim diameters were up 5 points versus 2021 and accounted for 56 per cent of all Michelin-branded tyre sales. During an earnings call yesterday Menegaux commented that Michelin was “surprised by the speed at which we’ve been catching market share in 18-inch plus” while general manager and chief financial officer Yves Chapot noted that “five points is rather on the higher side of the range” of expected growth. The company anticipates further progress here in 2023 and is thus continuing its investment in this area.

Road transportation segment (RS2)

According to Michelin’s figures, the overall worldwide truck tyre market shrank by four per cent in 2022, dragged down by a 26 per cent plunge in demand within the Chinese market following a remarkably strong 2021. Excluding China, the global market was up seven per cent year-on-year and exceeded the 2019 level by nine per cent.

Michelin’s own volumes sold in the commercial vehicle (road transportation and related distribution) segment edged up 0.4 per cent as flat growth in the first half of 2022 turned slightly positive in the second half. The company “significantly raised its prices” to offset rising raw materials, energy, labour and other sales costs and also pursued a “selective marketing strategy” in value-creating segments, with a sharper focus on the Michelin brand. The result was 19.7 per cent year-on-year increase in sales.

Segment operating income amounted to €641 million or 8.6 per cent of sales, compared with €599 million and 9.6 per cent the year before. The operating margin decrease mostly reflects the dilution effect of price increases.

Specialty businesses (RS3)

Within the specialty tyre market, sales performance varied from segment to segments, but were up 20.2 per cent year-on-year overall. Sales within Michelin’s Specialty businesses rose 25.6 per cent year-on-year, to €6,990 million. Segment operating income amounted to €1,044 million or 14.9 per cent of sales, versus €724 million and 13.0 per cent the year before.

All the segment’s businesses contributed to the gain for the year:

Sales of mining tyres were heavily impacted by downstream supply chain disruptions and the war in Ukraine in the first half of 2022 but experienced a sharp upturn in the second half led by the recovery in maritime shipping capacity. In addition, with most mining customer contracts containing raw materials indexation clauses that kicked in on 1 July, the resulting price increases “gave a major boost” to segment sales in the second half.

Demand for agricultural and construction tyres was robust in the first half of the year, but both segments showed signs of cooling in the second. Against this backdrop, sales of these beyond-road tyres were additionally impacted by production difficulties as well as by a more intense competitive environment.

Despite unfavourable comparatives and a highly competitive environment, price increases ensured that sales of two-wheel tyres rose over the year. Michelin shares that the January 2022-introduced Road 6 motorcycle tyre “made a major contribution to both sales volumes and the mix.”

The commercial aviation tyre segment rebounded sharply from very favourable 2021 comparatives in a still fragile environment that continued to hold back growth in air transportation and tourism. The military and general aviation segments, which were very resilient during the Covid-19 crisis, continued to hold up well.

Non-tyre products within this segment fared well: Fenner’s conveyor belt operations expanded over the year, driven by the Australian mining industry, while high tech materials businesses showed a strong growth in every activity.

Click here for further information about Michelin’s 2022 financial results.

Comments