Japanese tyremakers lead the way in share price performance

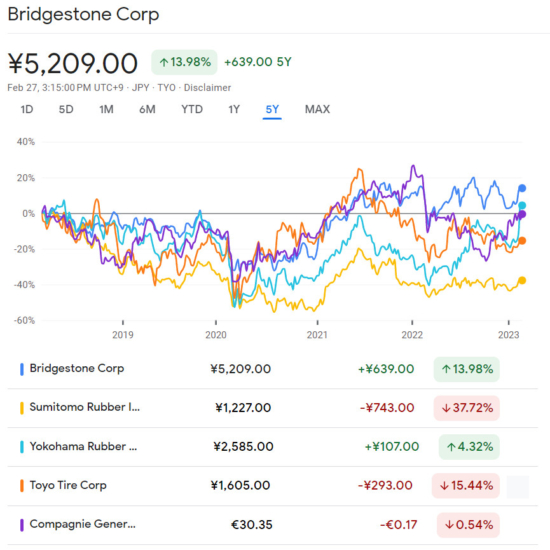

The leading Japanese tyre manufacturer’s five-year share performance compared with the leading Western tyremaker, Michelin (Source: Google Finance)

The leading Japanese tyre manufacturer’s five-year share performance compared with the leading Western tyremaker, Michelin (Source: Google Finance)

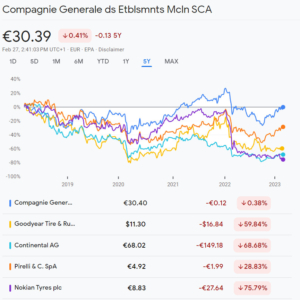

Full-year 2022 financial results show that – in terms of share price performance, at least – Japanese tyre manufacturers are leading the way on the global stage. Much has happened in the last five years, but five-year share price data is clear that the costs of chip shortages, shipping, dearer raw materials, pandemic and war have hit European and Western tyre brands harder than their Japanese counterparts. We compared the share performance of five of the largest European and Western tyre brands (namely: Michelin, Goodyear, Continental, Pirelli and Nokian) during the last five years with the leading Japanese-based tyre manufacturers (Bridgestone, Sumitomo Rubber Industries, Yokohama and Toyo Tires) in order to gain an insight into their relative performance.

During the last five years, Michelin’s share price has clearly weathered every storm we have all faced and has ended up broadly flat compared with this point five years ago. Michelin, however, is a real outlier amongst the European/Western group when the data is compared in that manner. Pirelli’s share price is the next-best-performing in the Western group during the period under review, with its share price down “just” 28.83 per cent. For Goodyear, Continental and Nokian, the last five years have brought with them share price deterioration of between 59 per cent and 75 per cent. Of course, share price performance is just one way of looking aT things. It should be noted, for example, that Continental has retained marketing-leading tyre profitability margins, strong European Original Equipment market share and robust retail price points throughout the period. However, it is always best to compare apples with apples.

Yokohama outperforms market, Bridgestone leads five-year performance

On that basis, the comparison data shows that Bridgestone leads the way globally, with its share price up almost 14 per cent compared with five years ago. Yokohama Rubber is the only other company out of the businesses that we compared with share price increases during the period. Specifically, Yokohama Rubber shares are up more than 4 per cent compared with five years. Sumitomo Rubber stock is down more than 37 per cent in the period, while Toyo Tires shares come in down 15.44 per cent. The latter may seem like a big drop, but taken in light of both the macroeconomic environment and five-year Western tyre brand stock performance, it is actually quite good. In fact, the worst-performing Japanese share price is some 20 percentage points clear of three-quarters of the Western stocks.

The top five European tyremaker’s five-year share price performance (Source: Google Finance)

Yokohama shares have performed particularly strongly in recent months, with current levels of around 2,582 yen more than 60 per cent higher than a year ago off the back of forecasts of an 8.1 per cent increase in operating profit margin in 2023.

In its coverage of Bridgestone’s full-year 2022 financial results, the Wall Street Journal’s Kosaku Narioka noted that Bridgestone shares rose sharply on Friday 17 February. Kosaku interpreted the move, which took place the morning after the Japanese tyre manufacturer released its full-year 2022 figures, as being a response to Bridgestone’s projections of a 12 per cent rise in net profit in 2023.

At that point, Bridgestone’s share price was trading at 5,108 yen. By the time we went to press on 27 February, it was an even higher 5,209 yen. By way of comparison, Bridgestone’s share price significantly outperformed the benchmark Nikkei Stock Average, which was down 0.5 per cent at 27,557.69.

It must be said that Japanese tyremakers blow that particular comparison out of the water across the board. On a one-year basis, all five Japanese tyremakers’ share prices report healthy increases. Yokohama’s stock is clearly booming (up 60 per cent) but both Bridgestone and Sumitomo Rubber stock is also up more than 10 per cent.

The reason? Long-term profitability and returning demand at the very same time European/Western tyre makers are – in several cases – struggling with both. Specifically, Bridgestone said it expects demand to recover for new cars as the shortage of chips that weighed on vehicle production in 2022 is likely to ease during 2023.

Meanwhile in Europe, Michelin reported that replacement passenger car tyre demand was down 16 per cent year-on-year in December 2022 and down 10 per cent year-on-year in January 2023.

The result is that both Bridgestone and Yokohama shares are trading at five-year high levels, while the best Western stocks are keeping pace with their historic successes.

This article is an example of the editorial comment that introduces every edition of Tyres & Accessories magazine. Not a subscriber? No problem, click here to become one.

Wheely-Safe

Wheely-Safe Michelin

Michelin

Comments