Goodyear reports losses of $104 million in Q4 2022, points the finger at Europe

Source: Goodyear

Source: Goodyear

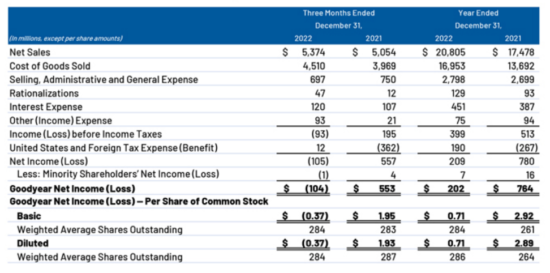

Goodyear reported net losses of $104 million (£85.81 million; 96.71 million euros) in its fourth-quarter 2022 results. By comparison, the same period of 2021 saw $553 million of income. Meanwhile, net sales grew six per cent to $5.374 billion in the period despite 3 per cent lower unit volumes compared with the same period in 2021.

Summarising Goodyear’s resultant earnings-per-share figures, financial analysts described the numbers as a surprise earnings miss: “Goodyear came out with quarterly earnings of $0.07 per share, missing the Zacks Consensus Estimate of $0.17 per share. This quarterly report represents an earnings surprise of -58.82%.”

Emphasising the deterioration in the company’s profitability, the Zacks investors’ note added: “A quarter ago, it was expected that this tyre maker would post earnings of $0.61 per share when it actually produced earnings of $0.40, delivering a surprise of -34.43%.” In other words, the previous quarter’s figures were already a third lower than expected. As a result, Zacks issued a “Strong Sell” marker for Goodyear stock and said “shares are expected to underperform the market in the near future.”

Meanwhile, Goodyear added the best part of half-a-billion dollars to its debt total, with total debt rising to $7.890 billion dollars as of 31 December 2022.

Akron points the finger at Europe

The lower-than-expected results impact Goodyear’s entire global balance sheet, but the fourth-quarter 2022 results publication make it clear that executives in Akron are laying the blame for the company’s fourth-quarter loss at the feet of the Europe Middle East and Africa (EMEA) region and specifically its European operations.

Of the five bullet points Goodyear executives offered as positive reflections on the first quarter, three explicitly excluded EMEA. When it came to negatives, the executives offered just one, even-more-specific point: “overall European results”.

For its part, EMEA reported net sales of $1.364 billion, down $21 million compared or 1.5 per cent compared with the same period in 2021. According to Goodyear, this reflects 7.3 per cent lower unit volumes and 20 per cent impact of current devaluation, partly offset by a 28 per cent increase in revenue per tyre.

But that was not enough to overcome a fourth-quarter 2022 segment operating loss of $80 million during the further quarter of 2022. In other words, in purely financial terms, EMEA contributed a large proportion of the overall $104 million loss.

Executives put this 295 per cent reduction in profitability (compared with the same period in 2021 down to: “volume [deterioration] in the replacement market, particularly in the winter segment and in commercial truck”, adding: “This deterioration also resulted in a higher mix of lower-margin OE and non-winter tyre volume…”

And what’s more, the outlook given isn’t exactly positive either. Executives are aiming for EMEA to return to breakeven by mid-2023, but that seems optimistic when you consider their tyre volume analysis.

EMEA tyre volumes were down 1 million units to 12.8 million tyres in the quarter, 7.3 per cent less than 2021 levels. Of these figures, replacement sales were particularly bad, 1.5 million units lower (down 13.7 per cent). Despite increasing 18.7 per cent, lower-margin OE volumes only partially off-set the deficit.

Goodyear argues that its fourth-quarter replacement performance reflects “elevated dealer inventories”, but with the executives expecting continuing soft volumes into the first quarter of 2023, it isn’t immediately clear how EMEA unit sales are going to increase.

Comments