Apollo Tyres’ 9M revenue up 19%

Apollo Tyres Ltd. maintained its market share within Europe’s passenger car and light truck (PCLT) market in the three months to 31 December 2022 (Q3 FY2023) despite declining approximately 14 per cent year-on-year in this market. The tyre maker primarily attributes this negative growth to high channel inventory, a mild winter and the economic slowdown.

All-season tyres continued to outperform the overall market and experienced the lowest decline in the PCLT segment. UHP and UUHP sizes accounted for around 45 per cent of Apollo Tyres’ PCLT sales volumes in Q3 2023, up from around 43 per cent a year earlier.

In Europe’s off-highway tyre segment, Apollo Tyres gained more than 400bps market share year-on-year during Q3 2023.

Revenue for Apollo Tyres’ sales and manufacturing operations in Europe (excluding Reifencom GmbH) rose seven per cent year-on-year in Q3 2023, to 180 million euros. The EBITDA margin dropped 486bps during this period, to 15.4 per cent.

The company maintained margins sequentially within its European Operations despite rising costs for raw materials and energy. While it expects the market slowdown in Europe to continue, margins should nonetheless remain “healthy” thanks to more favourable raw material and energy costs.

Total revenues up 13% in Q3 2023

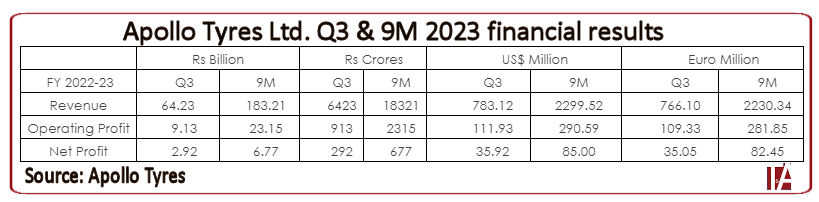

Overall consolidated revenue for Q3 2023 amounted to Rs 64.23 billion (£645.74 million), representing year-on-year growth of 13 per cent.

At home, the Indian manufacturer experienced a “revival” in demand for its passenger and commercial vehicle tyres within the original equipment segment but faced moderate demand in replacement markets. Despite “sluggish” overall demand in Q3 2023, the company’s revenue in India grew 12 per cent year-on-year, to Rs 42.47 billion (£426.94 million). EBITDA margin for the region grew 381bps to 12.9 per cent.

9M revenue grows 19%

For the first nine months of the fiscal year (1 April to 31 December 2022), the company’s revenue closed at Rs 18.321 billion (£), an increase of 19 per cent over the same period in the previous year. While Indian Operations saw a 21 per cent growth in revenue from operations in this period, European Operations grew “in double digits.”

Commenting on the company’s performance, Onkar Kanwar, chairman, Apollo Tyres Ltd, said: “The domestic demand has helped us tide over the recessionary trends elsewhere. Having said that, our European Operations have still outperformed the market in the first nine months of this fiscal. Input costs eased to some extent in the past quarter, helping improve our margins. The demand momentum in the medium term, looks positive, while there may be some headwinds in the near term.”

View Apollo Tyres’ Q3 FY2023 earning presentation here.

Enviro

Enviro

Comments