UK car production drops to three-quarter million mark

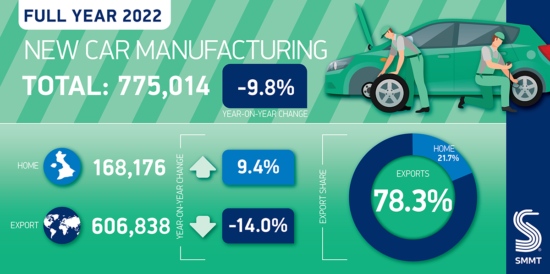

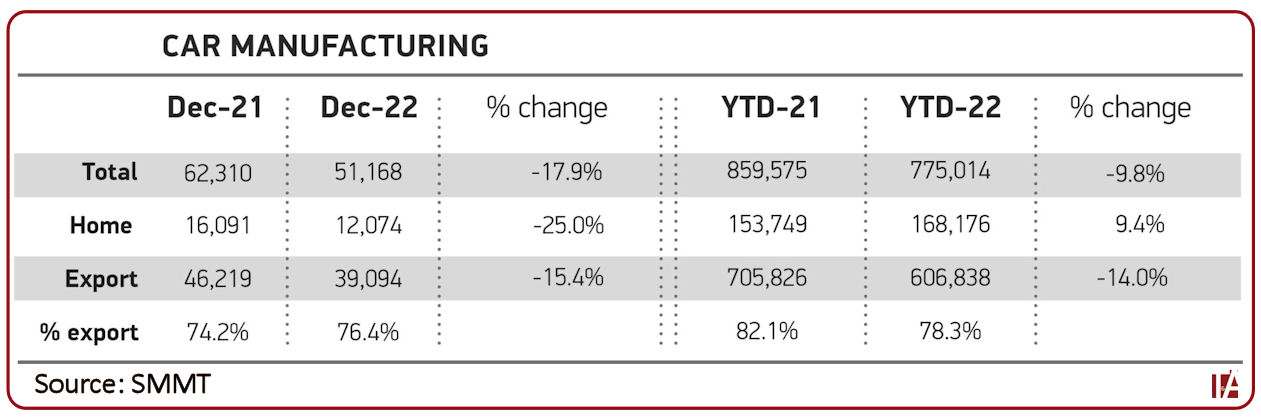

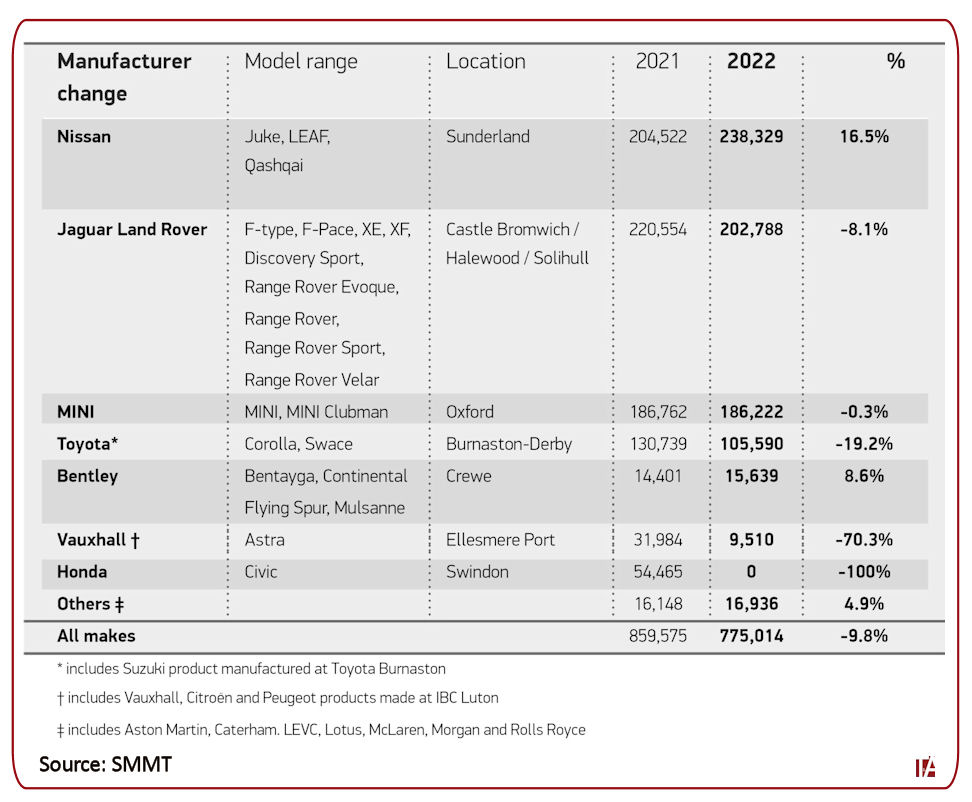

As is being reported around the world with varying levels of schadenfreude, last year UK car production reached its lowest level since 1956. A total of 775,014 cars were produced in the UK in 2022, 9.8 per cent less than a year earlier, 40.5 per cent below 2019 figures and way under half the record production of 1,971,311 achieved half a century ago. The Society of Motor Manufacturers and Traders (SMMT) strives to highlight the positive news within this result, and stresses that production of electric vehicles reached a new record during 2022. It is also looking forward to growth this year.

With overall output depressed, the SMMT’s finger of blame points at the “crippling global shortage of semiconductors” that limited the ability to build cars in line with demand, as well as structuring changes at two manufacturing sites and the impact of supply chain pauses in China due to Covid lockdowns.

Despite these challenges, UK factories turned out 234,066 battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) electric vehicles, with combined volumes up 4.5 per cent year-on-year to represent 30.2 per cent of all car production. Total BEV production rose 4.8 per cent, with hybrid volumes up 4.3 per cent.

UK output up, exports down

Total annual output for the UK market grew 9.4 per cent, but this was not enough to offset a 14.0 per cent drop in exports. Nearly eight in ten cars (606,838 units) were built for overseas markets, compared with 168,176 for British buyers.

The EU remained by far the largest export market despite a 10.0 per cent drop in shipments, with 57.6 per cent of exports (349,424 units) heading into the bloc. While exports to the US and China also respectively fell 31.6 per cent and 8.3 per cent, the number of cars sent to Japan (+5.7%), South Korea (+32.8%), Australia (+4.7%), Switzerland (+2.7%) and South Africa (+23.0%) all increased, although together these represented just 8.4 per cent of exports. Exports to Russia, a top-ten export market in 2021, plummeted 78.3 per cent, with shipments only made before the outbreak of war in Ukraine and subsequent cessation of business.

Since 2017, the value of BEV, PHEV and HEV exports has risen seven-fold, from £1.3 billion to more than £10 billion. As a result, electrified vehicles represent 44.7 per cent of the value of all UK car exports, up from just 4.1 per cent. The export value of BEVs rose more than 1,500 per cent, from £81.7 million to £1.3 billion. The industry will thus be closely following the fate of electric car battery firm Britishvolt following its entry into administration on 17 January. Recharge Industries, which has committed to building a gigafactory in Australia, has confirmed making a non-binding offer for the company.

We must make right decisions now

“These figures reflect just how tough 2022 was for UK car manufacturing, though we still made more electric vehicles than ever before – high value, cutting edge models, in demand around the world,” comments Mike Hawes, SMMT chief executive. “The potential for this sector to deliver economic growth by building more of these zero emission models is self-evident, however, we must make the right decisions now.

“This means shaping a strategy to drive rapid upscaling of UK battery production and the shift to electric vehicles based on the UK automotive sector’s fundamental strengths – a highly skilled and flexible workforce, engineering excellence, technical innovation and productivity levels that are amongst the best in Europe.”

Hope for 15% growth in 2023

Looking forward, SMMT takes heart in the production outlook that independent specialist AutoAnalysis published last November. This anticipates that easing semiconductor shortages will enable UK car and light van output to rise by 15 per cent to 984,000 units in 2023 (842,200 cars and 141,800 light vans). It foresees production volumes surpassing a million vehicles by 2025.

Comments