Recruitment roadblock reduces Halfords profitability, but tyres continue to drive growth

(Photo: Halfords)

(Photo: Halfords)

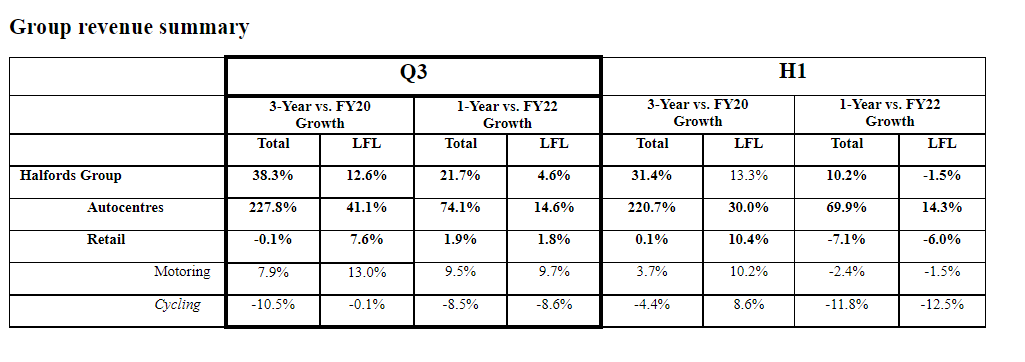

Halfords Group plc (Halfords)’s third-quarter 2023 trading update for the 13 weeks to 30 December 2022 show that group revenue grew 38.3 per cent and like-for-like group sales were up 12.6 per cent compared with 2020 levels. Other headlines included the news that Halfords’s services business represents 50.3 per cent of group revenue, and B2B, which includes the Avayler system 28.2 per cent. At the same time, Halfords hailed its “strong Commercial Fleet performance”, with this part of the business growing 138 per cent year-on-year. However, the company reduced its full-year 2023 underlying profit before tax (PBT) guidance from £60 million to £50 million.

The reason? “Macro-economic headwinds” are continuing to impact the cycling and consumer tyre markets segments. However, Halfords also reported that the company gained share across “all…measured markets including Cycling, Motoring and Tyres.”

Consumers trading down on tyres

Within that, the Autocentres business, which has driven overall group revenue and profitability growth for the last few years, warned that it had witnessed a de-segmentisation effect, with tyre consumers trading down tyre brands: “Autocentres [are] seeing higher proportion of sales in lower margin categories, impacted by the current nationwide shortage of skilled labour. This has had an effect on overall profitability.”

Indeed, as Halfords representatives mentioned in some detail in November, ongoing recruitment challenges are amongst the growing company’s biggest challenges: “…the labour market remains very challenging, and we have been unable to recruit enough skilled technicians in our Autocentres business which we now expect will limit growth of higher margin sales during the important upcoming Q4 MOT peak. In addition, we have also seen weakness in the consumer tyre market continue for longer than initially anticipated…”

Graham Stapleton, Chief Executive Officer, commented: “With unprecedented demand in our Motoring Services business, we are particularly impacted by the nationwide skills shortage, with recruitment proving to be extremely challenging in the current labour market. We are continuing to take a range of actions in order to fill 1,000 new automotive technician roles, which include our new Later Life Apprenticeship programme, as well as a focus on attracting more women and young people from disadvantaged backgrounds into automotive apprenticeships. We are confident that we can offer unrivalled career progression for automotive technicians, and that this will allow us to attract and retain talented individuals, thereby enabling us to better service the demand through FY24.”

Nevertheless, Halfords Autocentres is still experiencing phenomenal growth, with revenues up 41.1 per cent like-for-like compared with 2020 levels and up 14.6 per cent like-for-liked compared with 2022. With that in mind, the fact that overall lower technician capacity negatively impacted gross margin tells us that the combination of tyre brand desegmentation and reduced mechanical repair work is what is impacting profitability.

More specifically, Halfords reported that the consumer tyre market remains 13 per cent below pre-Covid levels as customers defer high ticket spends, something that is said to have impacted the performance of National Tyres. As a result, executives now expected end-user tyre demand to recover in during Halfords 2024 business year, which runs from April.

More positively, Lodge Tyre is said to be trading in-line with expectations following the acquisition in October 2022.

Source: Halfords Group

Halfords

Halfords

Comments