Does Apollo occupy 35% of the Indian tyre market?

At the start of 2022, several sources on social media shared a chart suggesting that Apollo Tyres is the biggest tyre manufacturer by market share. And what’s more, Michelin was nowhere to be seen. “Don’t believe every meme you see” is great advice for everyone, but for us “check your sources” is a basic rule of thumb. So, we had to take a closer look at those market share claims and found that, while there’s no smoke without fire and they do relate some truth, there is also a fair bit more to the story.

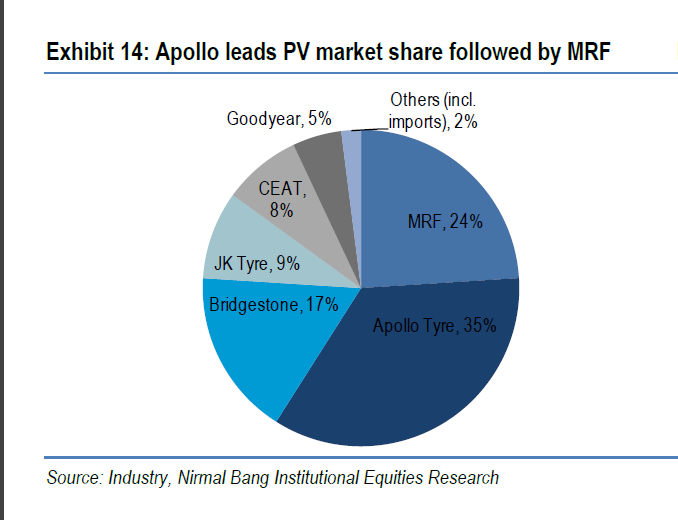

First, you have to clarify that the data is only really claiming to refer to the Indian tyre market. Indeed, the complete absence of Michelin and Bridgestone on the chart is nonsensical from a global perspective. However, even with that in mind, the suggestion that Apollo Tyres is 11 points clear of former market leader MRF is similarly surprising. So, once again, you have to qualify what you are seeing. The claim in question refers to Indian car tyre market share – something that is much clearer in some versions of the data than others. And that conclusion, it must be said, makes a lot more sense at first glance.

The first version of an infographic making such claims offered no attribution at all, which is always suspicious. Neither was it dated. Another bad sign. However, other versions of the meme introduced the dates September 2022 and December 2020 as well as the source “Groww”. Groww claims to be “India’s financial services platform” and boasts as many as 4 million customers. However, the data didn’t originate with them either. Rather, they cite Nirmal Bang purportedly “one of the leading stock broking companies in India”. This original source, together with Groww’s dated citations makes it much easier to critically evaluate the Indian passenger car tyre market claims.

Nirmal Bang’s initial report was authored by research analyst Anish Rankaway and research assistant Ronak Mehta in December 2022. Importantly, that sets it something like nine months into the global pandemic, which is important when you consider that the report sits under the headline “Ready to burn rubber” and begins with “we expect healthy overall growth in tyre demand” between 2021 and 2023 full years. In other words, despite arguably being written at the peak of the pandemic, the Nirmal Bang analysts are very positive about what will happen over the next three year period – the last of which is, of course, this year. So, while the data is relatively old and cannot take into account the macro-economic impact of Russia-Ukraine war because it simply hadn’t happened at the time the initial report was written, the December 2020 report remains relevant to the current market context to some degree.

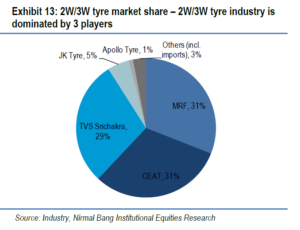

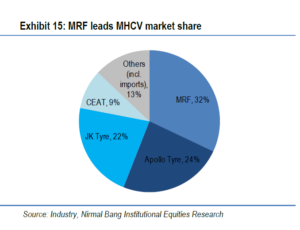

However, closer inspection of the December 2020 Nirmal Bang report reveals that it offers far more detail than the passenger car-only infographics spread around the Internet suggest. For example, it offers market share breakdowns across three of India’s main market sectors: 2 and 3-wheeler tyres, truck tyres and car tyres. But before that, it is worth taking a look at some of the key total market findings.

Firstly, the Indian tyre industry is coming out of a “capital expenditure-heavy phase” towards a more cash-rich/free-cash-flow positive season that will no-doubt lead to further investment and expansion in the medium-term.

Specifically, as of December 2020, the Indian domestic tyre industry’s capacity had increased at a compound annual growth rather (CAGR) of 14.5 per cent in the years between 2016 and 2020, compared with a CAGR of 5.8 per cent during the preceding five-year period. And what’s more, the CAGR of capacity increase far exceeds the circa 4 per cent CAGR increase in domestic tyre demand.

That means one of two things: that the Indian tyre market was playing catch-up in terms of serving domestic demand (something that is quite hard to believe) or that at least some of the capacity is intended for export markets. Apart from the fact that the Indian tyre market has been converting to radial tyre technology for the last decade or so, the latter explanation seems most plausible.

Nevertheless, a rapid rate of radialisation has taken place in India in recent years. Indeed, full-year 2020 numbers suggest radialisation was at 52 per cent in the Indian truck tyre segment, up from around 33 per cent in 2015. That figure is even higher when it comes to the truck OE tyre segment. There, radialisation had reached circa 77 per cent. Pure truck tyre replacement radialisation reportedly came in at around 46 per cent at the end of 2020. Meanwhile, light truck radialisation had reached roughly 40 per cent and 99 per cent respectively.

Back then, the prognosis was good, with expectations set for a V-shaped recovery despite the obvious impact of the pandemic and Covid-related lockdowns: “We expect healthy overall growth in tyre demand over full-year 2021-23 [period], as demand from original equipment manufacturers (OEMs) is expected to grow at a strong 18-20 per cent CAGR during the same period. Higher demand will be seen across all the automobile segments over a pandemic-hit low base of full-year 2020…”

Indian tyre sector positivity continues

Source: Nirmal Bang

Fast-forward to September 2022 and the same institution, albeit a different author – this time research analyst Varun Baxi – was saying some very similar things although with one or two added reservations in an investor note entitled: “Strong margin tailwinds along with volume growth puts the sector in a sweet spot.”

Freight and rising energy costs in the Indian tyre business’s European operation were singled out as specific risks for ongoing demand and profitability. However, there are also said to be “strong margin tailwinds along with volume growth” on the horizon, features that put the sector “in a sweet spot”.

The analysts’ thesis is that Indian tyremakers have been relatively quick to respond to high input prices with parallel price hikes. Meanwhile, many of the same costs have since levelled off, leaving the Indian tyremakers in a better position. More specifically, they highlight that MRF, which has historically been the number one Indian tyremaker and is still a market leader, “used to largely dictate pricing earlier”. However, that is apparently no longer the case, with the analysts observing: “due to lower investment in R&D it could not catch up with the trend of industry shifting towards radial tyres and ceded market share to Apollo Tyres and JK Tyres. The company is also said to lost ground in the two-wheel segment. The fact that “this has led to improving pricing discipline in the industry” suggests that MRF was not overambitious with the price levels with which it historically led the market.

Double-digit growth

Looking forward, analysts expect volume growth to remain strong. By strong, they mean in double digits in full-year 2023 and full-year 2024 results as a result of “good traction in domestic OEM and replacement segments and strong pick-up in exports thus further supporting the earnings trajectory.”

Exports, something that those of us in the European markets will be particularly interested to learn details of, are expected to benefit from the depreciation of the rupee compared with the dollar and euro.

Furthermore, the September 2022 report reiterates the earlier assessment that the 2017 to 2020 period was a season of capital investment that the isn’t continuing at present. “Going ahead also, the capex intensity is expected to remain benign as the next phase is likely to be a brownfield one since all three major players had invested in new plants in the last capex cycle – MRF in Gujarat, Apollo Tyres in Andhra Pradesh and CEAT in Chennai.”

Their conclusion? “…Apollo Tyres [is] our top pick in the sector.” Indeed, that conclusion represents both a cause and effect of recent changes in the Indian tyre market’s competitive landscape.

Historically MRF was dominant in two-wheel and truck and bus bia tyres. However, the company didn’t maintain that with the advent of radialisation – as we have seen – MRF lost ground in truck tyre and bus tyres and is “ceding market share in the two-wheel segment”.

According to the Nirmal Bang analysts, MRF’s volume growth over the last five years has been the slowest at 5 per cent CAGR. Apollo and Ceat’s figures are double that. The reason? “Both these players have been gaining market share on the back of higher R&D spends and improved distribution network. MRF’s R&D spend as a percentage of sales has been the lowest.”

To go right back to the beginning, the meme that started the whole conversation wasn’t clear and was incomplete, but it wasn’t wrong. There are good arguments to suggest that Apollo Tyres is Indian tyre market leader in passenger car tyres and thus the original meme has something right in the specific area it refers to. However, that information isn’t exactly fresh. Nevertheless, if things continue as the analysts suggest in their latest report it is all still very good news for Apollo Tyres who could break out even further.

Source: Nirmal Bang

Goodyear

Goodyear

Comments