Tyre makers & the Russia dilemma

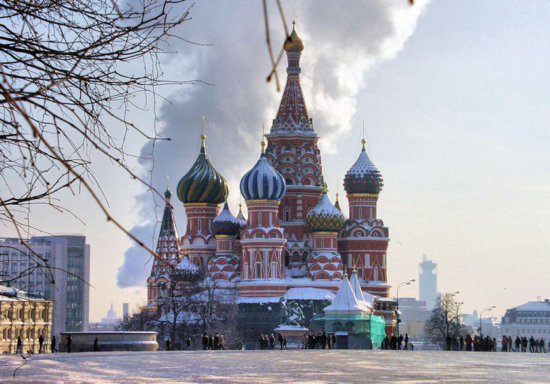

Several tyre manufacturers face the question of what to do with their tyre plants in Russia in light of the ongoing conflict & sanctions (Photo: NRZ/Arno Borchers)

Several tyre manufacturers face the question of what to do with their tyre plants in Russia in light of the ongoing conflict & sanctions (Photo: NRZ/Arno Borchers)

Many tyre makers have faced difficult decisions in the weeks and months since Russian troops first marched across Ukraine’s border on 24 February and in particular since the European Union announced a ban upon imports of tyres produced in Russia as of 10 July. Companies such as Nokian Tyres, Bridgestone, Continental, Michelin, Yokohama and Pirelli have needed to decide for themselves and their employees whether to continue operating their Russian plants. Several manufacturers responded to our questions about where they stand in this decision-making process. We discovered that four of the aforementioned manufacturers are turning their backs on Russia or considering doing so, but two apparently are not.

Nokian Tyres

Among the six European and Japanese tyre manufacturers that owned and operated production facilities in Russia to serve local and export markets, it’s well known that Nokian Tyres has been the most affected by the war and the EU sanctions against Russia. The Finnish firm nevertheless announced an end to its Russian engagement early on and was the first tyre maker to do so. News of Nokian’s “controlled withdrawal” at the end of June was followed at the end of October by the announcement that it had reached an agreement with the Russian oil company Tatneft to sell the Nokian Tyres plant in St. Petersburg, where around 17 million consumer tyres were produced annually. Russian competition authorities are currently reviewing the sale, which is expected to carry a price tag of about 400 million euros.

Bridgestone

Since 1 November it has also become clear that Bridgestone has relinquished any hope of being able to operate a reliable tyre business in and with Russia again. The Japanese manufacturer recently announced it had “initiated a process to find a local buyer for its Russian assets,” explaining it was doing so “in light of the general uncertainty and ongoing supply problems in Russia.” Any such transaction would include the sale of its tyre plant in Ulyanovsk, which was inaugurated as recently as 2016. Bridgestone suspended production activities at the site in early March, and now the Japanese are to withdraw completely from Russia.

Yokohama Rubber

Yokohama Rubber, on the other hand, responded that tyres are currently being made at its 2012-inaugurated plant in Lipetsk, Russia, where 800 people are employed. At the beginning of March, the company announced that production activities at plant were “temporarily” interrupted “due to problems with the supply of raw materials.” Yokohama Rubber later resumed passenger car and light truck tyre production in Lipetsk, although the manufacturer declines to specify the exact time period when production was interrupted. In any case, the quantity of tyres produced in Lipetsk since then is at the “lowest possible level to cover labour costs,” as far as this is possible given the supply of raw materials. According to Yokohama, about 8,000 tonnes of tyres were produced in Lipetsk in 2021.

In response to specific questioning, the Japanese tyre maker said there is “currently no information that can be officially published” on the future of its Russian business. However, Yokohama Rubber doesn’t deny that it is also considering a possible exit strategy: The sibylline comment from company headquarters is that “we are currently and will continue to make efforts to gather information and take appropriate measures, giving priority to our responsibility to all stakeholders, such as our employees, their families, customers, sales staff and business partners.” When interpretating this statement regarding “priority” it isn’t hard to reach the conclusion that Yokohama Rubber apparently plans to continue with its Russian plant in the future, at least as far as supplying the Russian market is concerned.

Michelin

Michelin, on the other hand, has “no news on the subject at present.” It published a statement regarding activities in Russia in mid-March, and the absence of further news indicates that Michelin has not produced any tyres at its Davydovo plant (annual capacity: 1.5 to 2 million passenger and light truck tyres) since that time. And since the end of June, it’s been known that Michelin is “considering transferring activities in Russia to local management by the end of 2022,” who will then operate the facility “independently of Michelin.” The French tyre maker considers it particularly important that this transfer creates “the best possible conditions for its employees.”

By summer 2022 at the latest, it became clear to Michelin that it was “technically impossible” to resume production at the site. According to the most recent information from Michelin headquarters in Clermont-Ferrand, the “goal of achieving this by the end of this year has not changed; we are continuing to work on transferring control.” Consequently, the tyre industry can expect to receive news from France in the coming days that Michelin is moving ahead with this.

Pirelli

It’s a different story with Pirelli, who stated unequivocally that it wants to hold on to its Russian commitment, at least in part. In response to our questioning, the tyre maker’s headquarters in Italy said: “We are keeping our facility in Russia, where we are safeguarding the jobs of more than 2,000 employees, and operating it with a reduced level of activity geared to the local market.” The “reduced level of activity” also means, as Pirelli wrote most recently in its quarterly report to 30 September, that it has “suspended investments in the two plants, with the exception of investments for safety.”

Pirelli operates two tyre plants in Russia, one in Kirov, a second in Voronezh. As of the end of September 2022, Russia accounted for about four per cent of group sales, producing mainly tyres with a diameter of 17 inches or less, “while Pirelli’s core global business is focused on the Premium and Prestige segments.” In light of the international sanctions imposed by the EU as of 10 July, which prohibit the import of Russian finished products into the EU and the export of certain raw materials to Russia, Pirelli has “focused production on the domestic market and identified alternative sources of import/export flows, with the gradual introduction of the supply of finished products from Turkey and Romania instead of exports from Russia to European markets, and the use of mainly local suppliers instead of European suppliers.” Despite the decision to maintain tyre production in Russia, Pirelli is “carefully monitoring the current scenario, also in view of the developments of this geopolitical crisis and the local market.”

Continental

German firm Continental is keeping a close eye on developments in and around Russia too, as it has operated a passenger and light truck tyre plant in Kaluga since 2013. A statement issued to us at the start of this week makes Continental’s position clear: “We are observing the current developments very closely and are currently examining all options for a controlled withdrawal of our tyre business from Russia.” The company also made similar remarks at the beginning of July. Continental declared it “supports and complies with all applicable sanctions and legal regulations imposed as a result of the war in Ukraine,” adding: “The current situation is extremely complex for international companies like Continental that have production facilities in Russia. Employees and managers of our subsidiary in Russia are threatened with severe consequences under criminal law if they refrain from serving demand there. For this reason, our subsidiary in Russia has independently resumed the production of passenger car tyres temporarily since April, depending on local demand.”

Comments