Gloomy November for van market

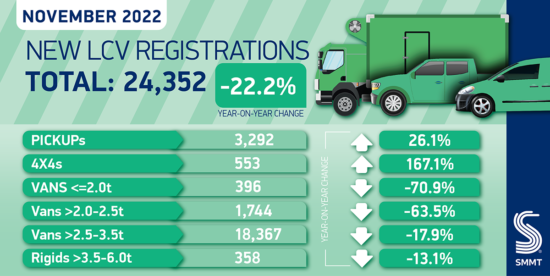

The UK’s new light commercial vehicle (LCV) market fell by -22.2 per cent in November, with 24,352 of the latest vans joining Britain’s roads, according to the latest data from the Society of Motor Manufacturers and Traders (SMMT). While the scale of the decline is artificially inflated in comparison with last year, which saw the best November performance in history, the total is the lowest recorded for the month since 2013, and is some -13.9 per cent below the pre-pandemic five-year average.

Despite strong order books throughout 2022, performance has continued to be hindered by persistent supply chain issues, which have restricted production globally and limited availability.

Declines were seen across most of the sector, with deliveries of vans weighing 2.0 tonnes or under-recording the largest decline of the month at -70.9 per cent, followed by those of mid-weight vehicles weighing up to 2.5 tonnes, which fell -63.5 per cent. The most popular segment, large vans weighing greater than 2.5 and up to and including 3.5 tonnes, declined by -17.9 per cent. Meanwhile, pick-ups grew for their second consecutive month and 4×4 sector lines grew for their third, with registrations up 26.1 per cent and 167.1 per cent respectively, although these smaller volume sectors are subject to volatility.

Battery electric van (BEV) registrations, however, continued to grow as more operators look to make the switch to the latest zero emission vehicles. Uptake rose by 14.8 per cent in November to reach 8.1 per cent of the market – up from 5.5 per cent in 2021. Increasing model choice and robust purchase incentives mean BEV volumes are up 46.5 per cent year on year from January to November, although concerns remain over a lack of public charging infrastructure particularly for commercial vehicles.

Operators have battled through challenging operating conditions to try and meet demand, but with semiconductor shortages holding back availability, the market has declined in each month of the year, with the exception of September. Registrations are down -20.1 per cent in the year to date at 260,314 units and some -23.2 per cent off pre-pandemic volumes. As supply shortages hopefully ease, however, growth is expected to return in 2023, which will help drive a wider economic recovery and support the achievement of the UK’s net zero goals.

Light commercial vehicle registrations are estimated to grow by 13.8 per cent in 2023, with BEV volumes expected to rise 60.7 per cent to take an 8.7 per cent market share. To harness the full benefit of this growth, government must take action to deliver economic recovery and encourage uptake as the sector continues to deliver its net zero transition. Measures that boost operator confidence are crucial to the transition to zero emission mobility and swift action must be taken to support BEV demand and crucial investment put in place to drive the rapid roll-out of suitable van charge point stations across the UK to bolster orders.

Mike Hawes, SMMT Chief Executive, said: “The UK van market has experienced a very difficult year, battling a multitude of challenges to meet demand, but has benefitted from an EV boost as operators increasingly make the switch to zero emission. As supply constraints ease, we look with some optimism towards next year and a return to growth. It is imperative, however, that government takes action to help accelerate commercial vehicle recharging infrastructure, so that the vehicles that k eep Britain moving can fully deliver on their ability to boost the economy.”

Comments