Top local players in Europe’s largest market

Bohnenkamp, based in Northern Germany, is the country’s 3rd largest tyre wholesaler (Photo: Tyrepress / Stephen Goodchild)

Bohnenkamp, based in Northern Germany, is the country’s 3rd largest tyre wholesaler (Photo: Tyrepress / Stephen Goodchild)

Readers with an interest in European tyre wholesale won’t have failed to notice a couple of recent developments in Germany. Best4Tires, the firm previously known as Reifen Gundlach, entered into a binding agreement to purchase German tyre wholesaler 1a Berlin-Tyre GmbH in June, and the following month Goodyear announced an expansion of its wholesale presence in southwest Germany with the acquisition of local player Reifen Burkhardt.

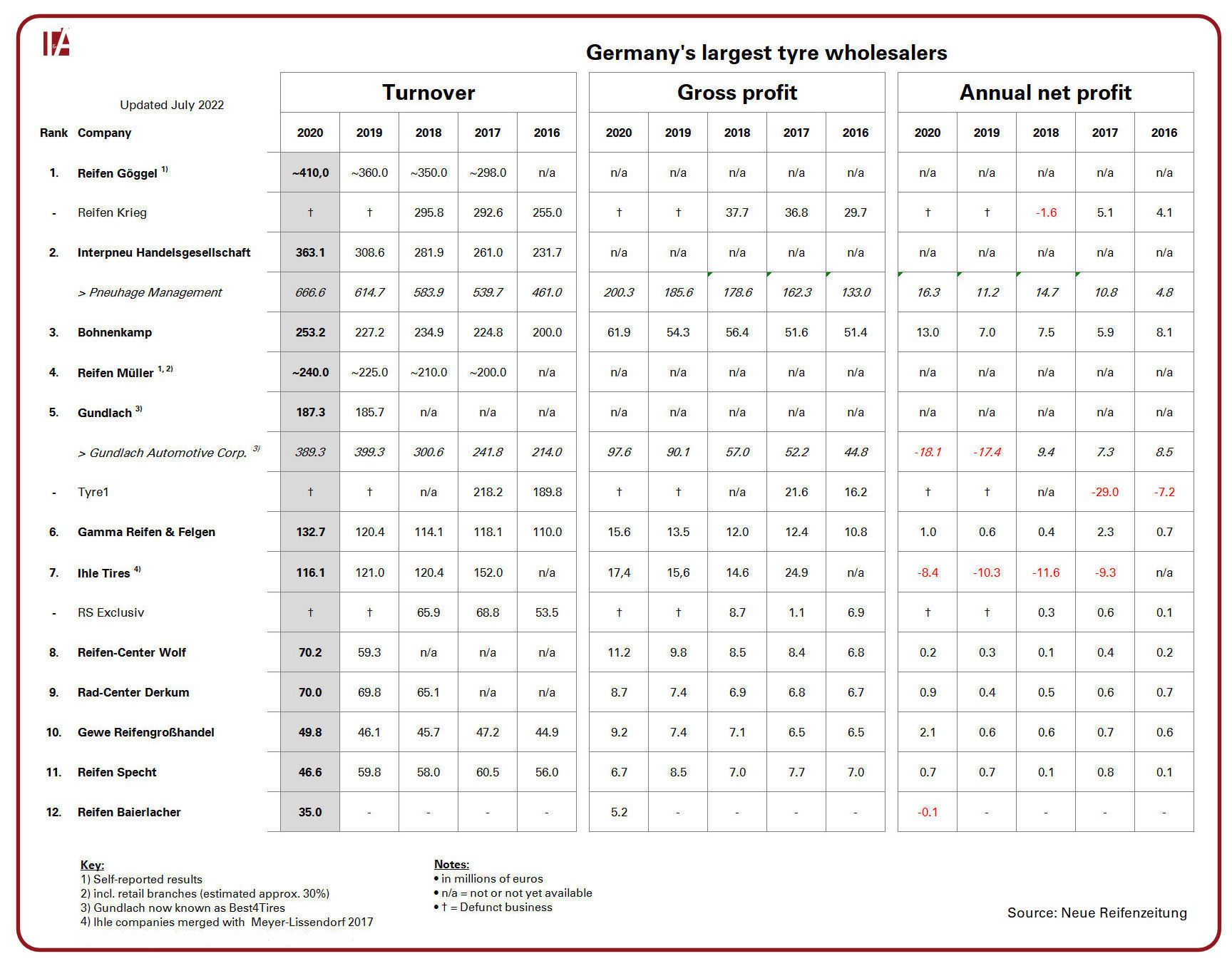

Both transactions are representative of a trend towards consolidation that seems to be picking up speed. Therefore, the question must be asked: Who are now the biggest domestic tyre wholesalers in Europe’s largest tyre market? Our sister publication Neue Reifenzeitung (NRZ) has investigated.

What NRZ found is that more than half a dozen German tyre wholesalers either lost their prior independence through acquisition or disappeared entirely due to bankruptcy or cessation of trading in the five years since 2016. Those that remain are increasingly dominating the national tyre wholesale market.

Reifen Göggel, Germany’s largest tyre wholesaler (and which recently made headlines thanks to a spectacular fire), informs that its turnover grew by 50 million euros, or 14 per cent, in the 2020 financial year. The number two in the market lags only slightly behind: Interpneu increased its turnover by 45 million euros in the previous year, growth of 18 per cent. If we adjusted these 2020 figures to include Reifen-Center Wolf, which Interpneu acquired at the start of this year, there’d be a new top dog wagging its tail in the German wholesaler ranking.

Regardless of who sits in first place and who occupies second, Reifen Göggel and Interpneu continue to dominate the German tyre wholesaling landscape and are increasingly able to benefit from retailers’ purchasing power.

Gone but not (yet) forgotten

Several of the largest players in 2019 exited the stage the following year and are absent from the 2020 figures. These companies were casualties of the disastrous departure of the Fintyre Group from Germany, a debacle that resulted in no less than 16 local tyre wholesale and retail firms applying for insolvency at the beginning of 2020. Affected wholesalers included Reifen Krieg (formerly the second largest German wholesaler), Tyre1 and RS Exclusiv. One further wholesaler, Reifen Specht, was ranked the 12th largest in 2020, but unexpectedly ceased trading at the end of August 2021; no buyer has been found for the business.

In addition to Reifen-Center Wolf, several other wholesalers of note have undergone a change of ownership in recent years. Reifen Müller has belonged to Hankook Tire Europe since 2018, while B+B Reifencenter was purchased by Reifen Helm last year. 1a Berlin-Tyre is being taken over by Best4Tires, but the new owner appears as Gundlach in the NRZ ranking as it didn’t adopt its current name until early 2022.

No clear trend can be identified when it comes to the gross profits of German tyre wholesalers; one company is gaining, the other is in decline. There is also scarcely any trend for profit and loss that we can meaningfully interpret. Perhaps the only interesting thing to note here is that Ihle Tires – which has belonged to Michelin since 2014 – has been recording heavy losses for years and can presumably afford to do so because of a “profit and loss transfer agreement” with the owner, as it is called in financial jargon.

NTDA

NTDA

Comments