The Top 20 online tyre brands 2022

(Photo: Adem AY; Unsplash)

(Photo: Adem AY; Unsplash)

11 years ago, we published our analysis of the impact of social media and price comparison on the tyre business. Back then in July 2011, Facebook was the number one social network, with 750 million users, of which a third accessed the site via mobile devices. As of July 2022, Facebook has 2.934 billion.

Similarly, the shape of the social media marketplace has altered immeasurably. In 2011, the top social networks looked like this: #1 Facebook (50.14% market share); #2 YouTube (22.54%); #3 Twitter (3.49%); #4 MySpace (0.44%); Others (23.39%), according to Experian data dated July 2011.

Now, it looks like this: #1 Facebook; #2 YouTube; #3 WhatsApp; #4 Instagram; #5 WeChat; #6 TikTok; #7 Facebook Messenger; #8 Telegram (with 700 million active users, eight-placed Telegram is not a long way off the total that took Facebook to pole-position in 2011); #9 Snapchat; #10 Douying; #11 Kuaishou; #12 Sina Weibo; #13 QQ; #14 Twitter; and #15 Pinterest.

In other words, now, no-one’s heard of MySpace, Facebook alone is twice the size of the whole market back then, and Sino-centric social media such as WeChat, Weibo and bunch of others are bigger than Twitter.

Over the years, our coverage of the sector has grown from rudimentary comparisons to more complex analyses based on multiple data points. During that time, we have worked with a number of third-party data tools. We have always sought to evaluate the impact of tyre brands across social media, but have sometimes been criticised for using Twitter handles as an entry point for evaluating Facebook and other social media data. This year our social media ranking is back and, based on your feedback, we have adopted a new approach. This means we now begin with key brands references across websearch, Facebook, Youtube, Instagram, LinkedIn and Twitter.

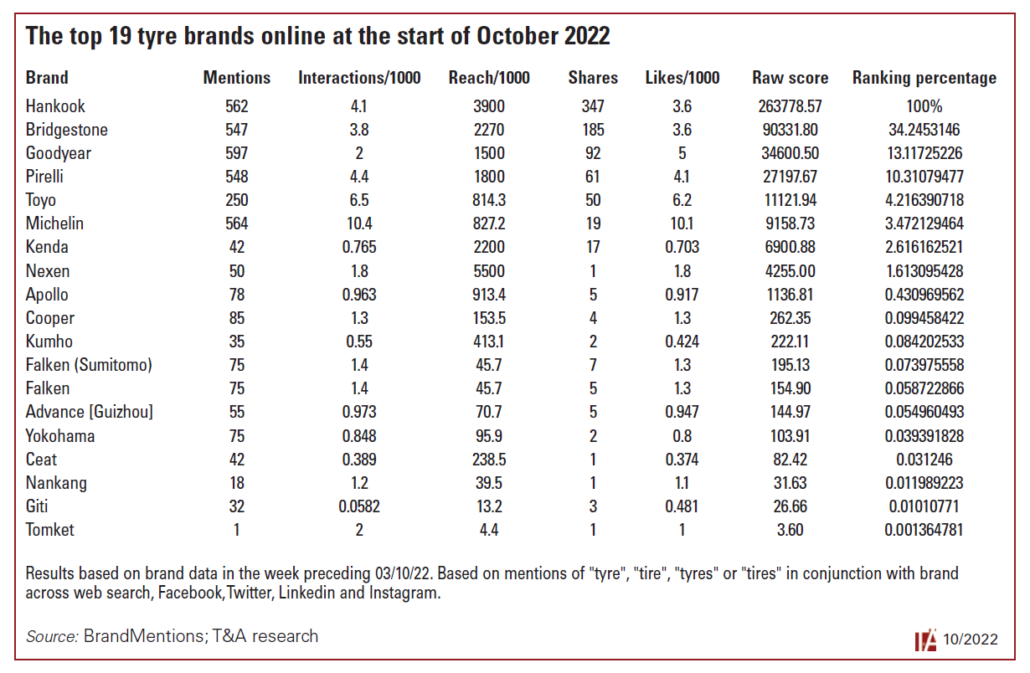

Our methodology begins by taking a snapshot of online mentions of the world’s top 30 tyre manufacturers and then cross-referencing their primary brand names with (“tyre”, “tire”, “tyres” and “tires”). Of course, that approach focuses our survey on the English language, largely filtering out what might be a very different picture in rapidly growing markets such as China, plus other non-anglo centric online environments. But we all also have to admit that online English usage does give us a pretty big global sample size. Indeed, Nielsen; GfK; ITU; Internet World data suggests English is the number one language used online worldwide, with a global market share of 25.9 per cent in June 2020.

From here, we took a snapshot of a week of active and tracked popularity metrics such as mentions of the tyre brand, overall reach as well as engagement metrics such as interactions, shares and likes. We then used a bespoke algorithm to qualify the level of exposure each brand achieved against its engagement level. In short, having a large number of followers alone wouldn’t be enough to get a high score, those followers would also have to be interacting with the brand as well. The idea is, that this approach results in a better measurement of influence each brand was having on consumers in a snapshot week. And finally, we removed any entrants that had scored less than one share during the period because otherwise the rest of the data would be skewed. The resultant scores are then turned into percentages of the first-place score in order to rank the brands’ respective performances during the snapshot period.

Hankook #1 online tyre brand at the start of October

Once that was all tabulated and calculated, the results suggest Hankook is top of the tree this year. The fact that Hankook has been strategically investing in promoting its iON range of bespoke electric vehicle tyres may well have something to do with the result. Indeed, the fact that the simultaneous launch of Hankook’s involvement with Formula E and the new iON winter tyre around the time of our online snapshot is something of a happy coincidence for Hankook. But that alone cannot account for the sheer scale of the brand’s online impact at this time plus the by far the highest number of shares recorded explain the win.

While the overall outcomes differ, our research shares certain commonalities with other third-party research – specifically, the finding that the Hankook tyre brand exhibits high levels of social media engagement.

Bridgestone takes the silver medal this time round. However, the fact that Bridgestone’s online reach was the second highest on record, plus the fact that it sits at the top table in terms of mentions, suggest that – in another set of circumstances – Bridgestone could come out higher next time round.

Goodyear came third in this year’s research. Again, the number mentions relative to a multi-million-person niche reach in the snapshot week helped the US-based tyre giant achieve its result. Indeed, it is worth noting that Goodyear achieved the highest number of mentions during the survey period, something that indicate that the brand is attracting a lot of attention.

Fourth-placed Pirelli and then Toyo round out the top five, but – with the second-highest number of mentions on the chart – Michelin are clearly part of the top table as well.

Overall, what the data shows is that some of the best-known brands continue to lead in cyber space. However others, such as Toyo, are arguably punching above their weight in online media terms. Of course, all the results have be qualified with the context of the timeframe in which the research has taken place. Some may have particularly benefitted from events around that time. Nevertheless, the huge gulf between the top and the bottom of the table cannot be ignored. And, while another 17 brands registered partial data in our research, those that weren’t on either list clearly have a virtual mountain to climb in the online marketing space.

Art Rachen; Unsplash

Art Rachen; Unsplash Anthony/Tyre Industry Publications Ltd.

Anthony/Tyre Industry Publications Ltd.

Comments