Stapleton’s presents Triangle tyres distribution deal to dealers at PalmerSport event

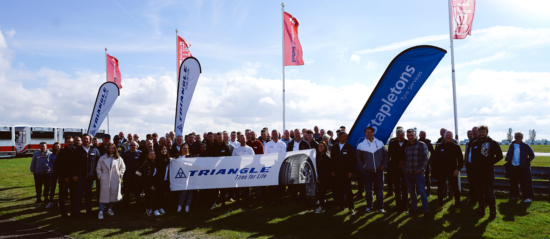

Stapleton’s launches its exclusive Triangle distribution partnership at a dealer event hosted by PalmerSport (Photo: Stapleton’s)

Stapleton’s launches its exclusive Triangle distribution partnership at a dealer event hosted by PalmerSport (Photo: Stapleton’s)

Managing director Andy Fern talks strategy as wholesaler hosts dealers to launch new exclusive arrangement

In September, Stapleton’s Tyre Services became the exclusive Great Britain distributor of Triangle passenger car and van tyres. The deal, which has been in the making for the last couple of years, will build on the strengthening relationship between Triangle Tyre and the UK’s largest tyre wholesaler. It was finalised after comprehensive testing of the Triangle range by Stapleton’s and its ultimate parent company Itochu. In recent years, the company has become the largest distributor of Triangle products in Europe. Stapleton’s states that Triangle is a “strong strategic fit in the economy segment” of its portfolio. It will make the brand available to “all customers in every channel.”

Unveiling the deal, Stapleton’s hosted key dealer customers and European representatives of Triangle at PalmerSport at the Bedford Autodrome. Tyres & Accessories also attended the event, taking the opportunity to speak to Stapleton’s managing director Andy Fern, who took the reigns in the first quarter of 2020 just before the Covid-19 pandemic disrupted business as usual, about the new deal and the evolution of the Stapleton’s business under his leadership. Introducing the brand to dealers, Fern said that Triangle would “fill in a gap that was missing in the Stapleton’s range” in the “premium-budget” segment. Detailing the key advantages of the Trangle range, Fern commented on the quality of the current range, the first to be developed in conjunction with its new European team, led by experienced tyre industry professional Corrado Moglia. He added that the breadth of the range, which now stretches over 300 SKUs, with sizes covering the lucrative 20”-plus size segment, represented a clear advantage of the brand.

Since Moglia and his team, which also includes Steve Eke, the former head of the brand’s speciality OTR and commercial tyre importer TYM International, formed the new European business unit, Triangle has improved its position considerably in light vehicle tyres. From 350,000 car, SUV and van tyre sales in 2017, Moglia revealed the brand reached 3 million in 2021. This growth was precipitated by new products, some of which are to be replaced imminently, with a new ultra-high performance in 54 sizes, 14 of which are SUV tyre sizes, leading these upgrades during quarter four of 2022.

New Triangle car and van tyres

Triangle’s new EffeXSport UHP tyre demonstrates performance and branding improvements (Photo: Tyrepress/Andrew Bogie)

Triangle has made heavy investments in its economy tyres for light vehicles in recent years. It has put into place an extensive research and development programme, bringing new products and sizes to the global tyre market regularly. Triangle displayed three new product lines for the European light vehicle tyre market at The Tire Cologne in May: the EffeXSport TH202, a new UHP product; the ReliaX TE307 touring tyre; and the SeasonX Van TA702, a new all-season tyre for light commercial vehicles. It said that further enhancements, increased fitments and new tread patterns are planned for the coming months. These product updates are now achieving consistently high European label scores.

Andy Fern, managing director of Stapleton’s, said: “We have seen a growing demand from customers for a well-supported, branded offering in the economy segment. Everyone understands the role brands play in the premium and mid-range sectors, but we believe that there is clear space for a strong brand at an entry level price point. Over the last two to three years, we have been assessing propositions in this segment which could complement our existing portfolio and Triangle fits the bill perfectly.

“We have carried out intensive testing on the Triangle line up and we have seen it deliver excellent performance at very competitive prices. We are delighted to be cementing our relationship with this exclusive agreement. This ensures consistent, nationwide supply throughout our network, which will allow our customers to plan their own sales and marketing programmes with confidence.”

Corrado Moglia, Triangle’s general manager for Europe, says: “The Triangle brand has been present in the British market for almost 20 years and this agreement is set to build on those foundations. Drivers are looking to reduce their costs, but still want to be able to choose products they can trust. We believe that strong brands can be a significant advantage in these lower price segments and our relationship with Stapleton’s will provide the platform to grow the Triangle brand across the country. We have the ambition to quickly build annual sales to one million tyres in the UK market, and Stapleton’s is the perfect partner to enable us to do this.”

- Triangle’s existing range was fitted to cars used in dynamic driving workshops, demonstrating its current performance (Photos: T&A/Andrew Bogie)

- Triangle’s existing range was fitted to cars used in dynamic driving workshops, demonstrating its current performance (Photos: T&A/Andrew Bogie)

- Triangle’s existing range was fitted to cars used in dynamic driving workshops, demonstrating its current performance (Photos: T&A/Andrew Bogie)

Andy Fern on Triangle’s past and future development

Speaking to Andy Fern during the dealer event that has launched the next phase of the relationship between the companies, Tyres & Accessories asked what was behind the decision to move to an exclusive distribution arrangement. While Stapleton’s has a long history of purchasing Triangle tyres, the current level of business between the firms is in “quite a different league,” Fern explains.

“It was Covid that triggered the change.” Going back to the end of quarter one in 2020, when Covid hit the UK in earnest, Fern explains that “like every tyre business, especially wholesalers, we had too many tyres straight away.” Such was the dynamism of the market that year, this “very quickly turned into not enough tyres” when pent-up demand was unleashed. It was at this point that Stapleton’s “saw massive variations” in the supply performance of tyre brands all across brand tiers. “If your supply chain was in good shape during that year, you were able to do well throughout that year; if it wasn’t, you were in trouble. Triangle’s performance was astounding; their ability to get tyres throughout all that trouble was incredible.”

This represented a major pull factor as far as Stapleton’s was concerned, but customer feedback that came with the increasing volumes was also good, which helped to build momentum, Fern says. The brand’s placement within Stapleton’s range was also an asset. Fern explains that the wholesaler had a strong reputation in the premium and mid-range tiers, especially considering its support of the growth of Nexen, for example, into a strong mid-range contender in the UK market. “Beneath that,” Fern continues, Stapleton’s identified “a bit of a gap.”

Yet excellent supply chain operations and synergy with the existing Stapleton’s portfolio would not cut it if the products could not meet the wholesaler’s parent company Itochu’s quality requirements. “Again, the quality of the Triangle product shone through,” Fern says. This gave the company the confidence to “increase the volumes,” which in turn made an exclusive distribution agreement “the last piece.”

Fern sees strong potential for Triangle to follow a brand journey with Stapleton’s similar to those travelled by Maxxis and Nexen. He also stresses the importance of the development curve – Nexen for example has built foundations for its current position over a decades-long development curve. “The thing we like about working with Triangle is that they are not trying to pretend to be a mid-range tyre just yet. They will be soon.”

Targeting 1 million sales

Triangle representatives are bullish about the potential volumes Triangle can reach in the UK car tyre market. They believe one million sales are a realistic target in the near future. Fern says this level “could be achievable quicker than even we think.” Stapleton’s is “already the biggest [Triangle customer] in Europe – it’s just a question of how quickly we’ll get there.”

Fern is similarly positive about product development. Looking at the brand’s ultra-high performance product line, the Triangle SporteX has yielded strong feedback over the course of its cycle, and is soon to be succeeded by the new EffeXSport, while the ReliaX touring tyre and SeasonX Van will add new lower rim size and light commercial fitments in 2023. These tyres offer labels “up there with the very best” Fern says, while the tyres also evidence Triangle’s ability “to broaden the range, and quickly,” for example by extending the range to increasingly important 20 and 21-inch sizes. Since Triangle is the manufacturer’s primary brand, “all the focus and attention” is on improving this range too, in contrast to the generally slower pace of change in second and third-line brands.

Looking at Stapleton’s range as a whole, Fern says: “Regardless of the current climate, there is always a place for a decent premium, a decent mid-range .” While the economic situation represents a challenge, low overall new car sales mean demand should remain good for replacement tyres from the higher brand tiers. With affordability issues for new cars, the UK parc is likely to age in the coming years, increasing the importance of the replacement market across brand tiers. The rapid increase in digital sales and online product research in the tyre market also means there is a need for brands to distinguish themselves from competitors in terms of trust, recognisability and performance, as far more data is made available to consumers at the point of purchase. Building a “premium-budget” brand to overcome the interchangeable presentation of lower-cost tyre brands can also require the sustained support of national distribution partners.

“It takes a long time,” Fern says. “And I think maybe we do see evidence of a brand wanting to get somewhere a bit too quickly. It takes years to build a brand.” Stapleton’s has a lot of experience in supporting brands’ development over the long term; some of its exclusive brands have gone from low-cost options to supplying premium original equipment manufacturers. While warning against getting ahead of themselves, Fern is convinced that “all the potential is there” for Triangle to develop in a similar way.

- The PalmerSport day included a varied programme of track driving (Photo: Stapleton’s)

- The PalmerSport day included a varied programme of track driving (Photo: Stapleton’s)

- The PalmerSport day included a varied programme of track driving (Photo: Stapleton’s)

Glen Carstens-Peters; Unsplas

Glen Carstens-Peters; Unsplas Hankook

Hankook

Comments