September van registrations improve, but YTD market -20% on 2021

(Source: SMMT)

(Source: SMMT)

Plate change sees first growth for British van market in 2022

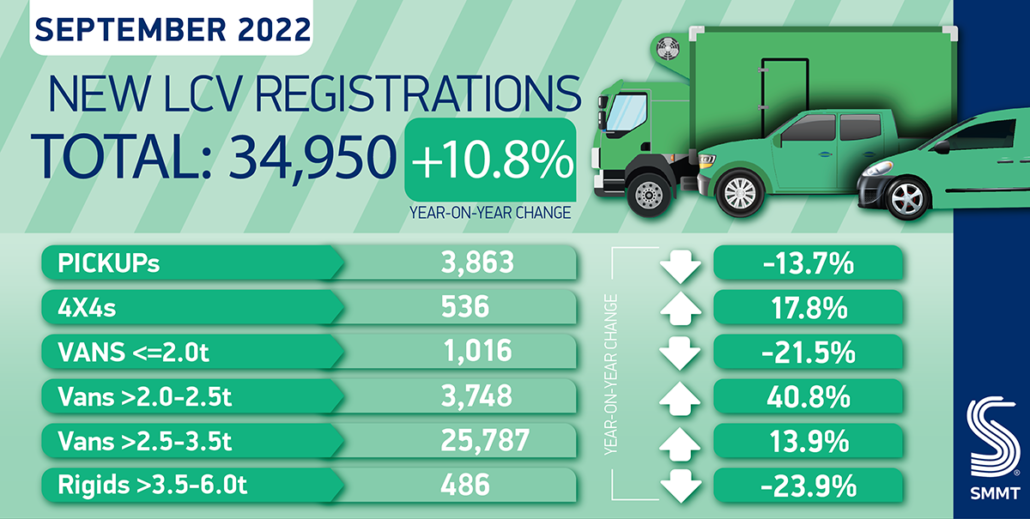

The light commercial vehicle (LCV) market grew by 10.8 per cent to 34,950 units in September – a popular month due to the plate change. Despite strong order books throughout 2022, September is the first month of growth in registrations this year, as supply disruptions have restricted model availability. The SMMT warned that this performance is artificially inflated versus 2021; this September remains -35.5 per cent below the five-year pre-pandemic average.

Growth was driven by vans weighing more than 2.5 tonnes, up 13.9 per cent to represent 73.8 per cent of the market. Registrations of vans weighing 2.0 to 2.5 tonnes rose by 40.8 per cent. However, vans weighing less than or equal to 2.0 tonnes were down -21.5 per cent.

Battery electric vehicle (BEV) deliveries, meanwhile, continued their upward trend, rising 70.0 per cent to a market share of 4.4 per cent – up from 2.9 per cent in 2021. An increasing number of operators are benefitting from lower taxation, purchase incentives and zone charge exemptions with more zero emission van models coming to market. As a result, BEV volumes increased by 52.9 per cent year on year from January to September.

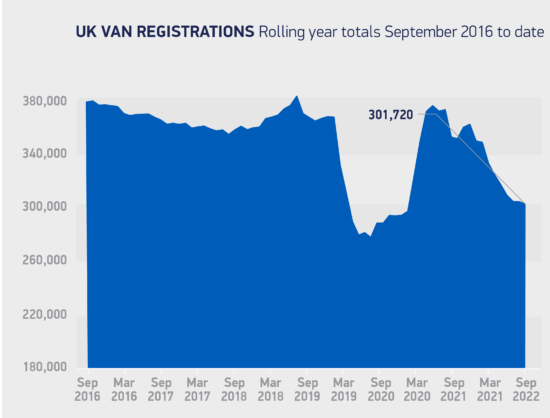

Overall, however, UK van registrations during 2022 to date are down -20.1 per cent year on year at 213,576 units, and some -24.8 per cent below the pre-pandemic five-year average, despite strong order books for the latest LCV models. While there are signs that pandemic-related component shortages are starting to ease for some manufacturers, supply issues continue to stymie the market, while economic headwinds add further pressures on recovery. Measures that address the UK’s economic sluggishness and boost operator confidence will be crucial to stimulating the demand needed to help transition the van market to a zero-emission future.

Mike Hawes, SMMT chief executive, said: “While the full recovery of Britain’s new van market remains some way off, September growth reflects van makers’ efforts to fulfil strong order books despite a paucity of supply. High energy costs and wider economic uncertainty, however, will undermine operator confidence, meaning that long-term measures to provide stability and growth are needed if the sector – so often a bellwether for business activity – is to return to its past success.”

NFDA reacts

“It is positive to see the first increase in van registrations this year, although taking into consideration September 2021 registrations were the lowest since 2009. Deliveries of new LCVs are still affected by component shortages, some of September’s registrations that were in stock were held back by customers who desired the new updated number plate,” said Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), commenting on the SMMT’s latest vehicle registration figures.

September registrations were up 10.8 per cent at 34.950 units. Overall, the year-to-date LCV market is 20.1 per cent behind last year’s registrations.

September registrations were dominated by the large van market, 2.5t – 3.5 tonne, that now represent a great proportion of overall market share (73.8 per cent). The year-to-date percentage is similar at 73.4 per cent. These maximum capacity LCV are used for all forms of delivery and trades enabling their users to stay outside the operator regulations of tachograph, O-licence and driving licence restrictions. While the small car-derived vans under 2.0t suffered a shortfall of 21.5 per cent, mid-size LCV 2.0t – 2.5t increased by nearly 41 per cent.

Electric LCVs continued their growth in the market with an upswing of 70 per cent to a market share of 4.4 per cent, up from 2.9 per cent last year. The growth in EV sales comes at the expense of diesel where registrations are now 92.4 per cent of the market, compared to 95.6 per cent last year.

Year to date figures reveal Ford’s Transit Custom and Large Transit dominate the registrations followed by the Vauxhall Vivaro in third place. As it was the plate-change month pick-up models such as the Ford Ranger took the third place for the month of September, as many of these due-purpose load vehicles are bought by private and the self-employed, where the number plate prefix is more in demand, although the pick-up market for the month was down -13.7 per cent.

Sue Robinson added: “Currently orders outstrip supply due to the shortages in key part components, but some manufacturers are finding that this is improving. The economic uncertainty could spark a lack of consumer confidence and impact the currently strong consumer demand, although this has not yet been recorded. Overall, van dealers are confident that current demand will hold up for the remainder of the year.”

Comments