New car market up as plate change September marks 1 million EV milestone

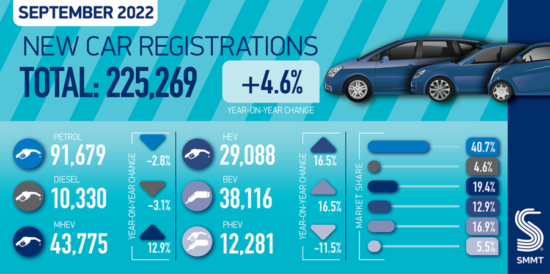

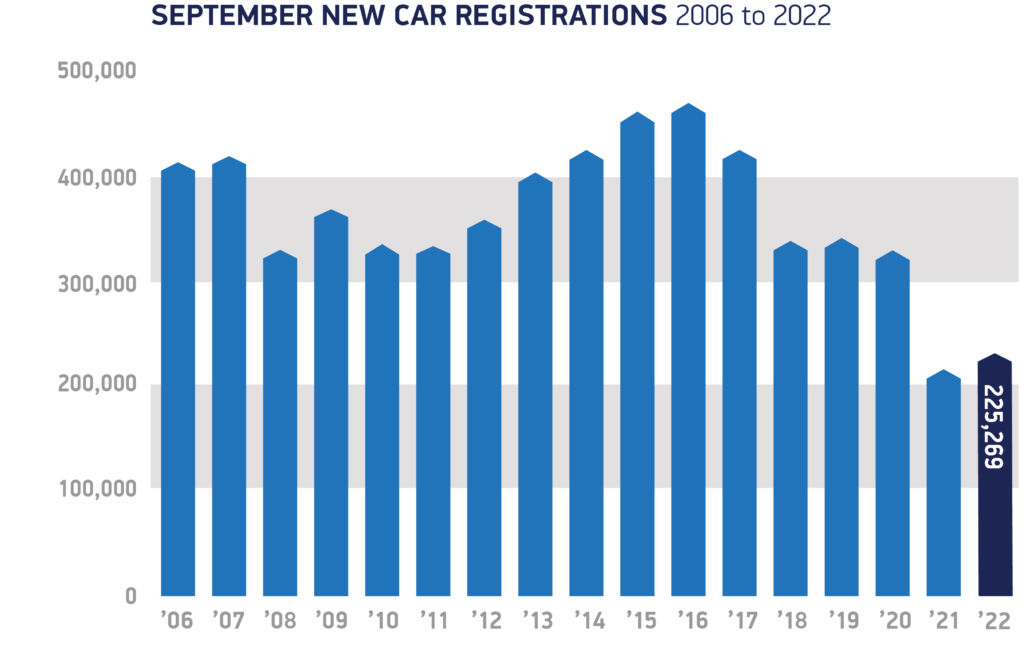

The UK new car market recorded its second successive month of growth in September (the second ‘plate change’ month of the year), with registrations rising 4.6 per cent, according to the latest figures released by the Society of Motor Manufacturers and Traders (SMMT). During what is typically the second biggest month of the year for the sector, 225,269 cars joined Britain’s roads. While this was a 9,957 unit increase on last year, when the industry recorded its weakest September since 1998, overall registrations for the month are still some -34.4 per cent below pre-pandemic levels as the industry continues to battle issues constraining supply to fulfil a backlog of orders.

Bucking recent trends, registrations by large fleets grew by 12.5 per cent or 11,315 units, although this still represents a significant (-39.7 per cent) decline on pre-pandemic volumes. Registrations to private buyers, meanwhile, fell by -3.6 per cent.

Electric vehicle uptake continued to rise, albeit at a slower rate of growth than seen earlier in the year, with the second highest monthly volume of battery electric vehicle (BEV) registrations in history, up 16.5 per cent to 38,116 units. Although registrations of plug-in hybrid vehicles (PHEVs) declined by -11.5 per cent to 12,281 units, overall plug-in vehicles accounted for more than one in five new cars joining UK roads in the month. As a result, almost quarter of a million (249,575) have now been registered in 2022 – meaning that UK drivers and fleets have now registered more than one million plug-in EVs, a quarter of which in this year alone.

In terms of segments, the largest growth was seen in multi-purpose vehicles, which rose 509.2 per cent, adding more than 10,000 units, to 12,068, a result of key new model availability. Superminis remained the most popular segment overall, accounting for 30.9 per cent of all registrations.

While growth is welcome following a torrid first half of the year, total registrations for 2022 remain down -8.2 per cent on a weak 2021 performance and more than a third (-35.1 per cent) below the first three quarters of pre-pandemic 2019, equivalent to 653,903 fewer units.

Commenting on the figures, Mike Hawes, SMMT Chief Executive, said:

“September has seen Britain’s millionth electric car reach the road – an important milestone in the shift to zero emission mobility. Battery electric vehicles make up but a small fraction of cars on the road, so we need to ensure every lever is pulled to encourage motorists to make the shift if our green goals are to be met.

“The overall market remains weak, however, as supply chain issues continue to constrain model availability. Whilst the industry is working hard to address these issues, the long-term recovery of the market also depends on robust consumer confidence and economic stability.”

NFDA welcomes latest figures

The National Franchised Dealers Association (NFDA) which represents franchised car and commercial vehicle retailers in the UK welcomed the latest SMMT new passenger car registration figures. Said Sue Robinson, NFDA Chief Executive: “September, an important plate change month for the motor retail industry, has seen an increase in registrations compared to 2021. This increase is a positive for the industry, particularly given the closure of dealerships due to the Monarch’s funeral and consumer uncertainty before the UK Government’s Energy Bill Relief Scheme.”

With sales of electric growing, diesel fell from 117,605 units to 67,023 (-43 per cent), and petrol has fallen from 621,598 units to 525,799 units (-15.4 per cent).

Sue Robinson added: “Flattening consumer demand, driven by rising inflation, combined with tight supply in both new and used vehicles, driven by macro-economic factors, will continue to create challenging trading conditions for all in the automotive sector. NFDA feels that the Government must act now to support this important sector for the UK economy, which employs over 540,000 people.”

Deloitte comments on SMMT new car registration figures

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, said that growth figures need to be put into the context of the low base comparison, with September 2022’s registrations remain below the pre-pandemic average.

“As a result, year-to-date sales at the end of Q3 are down -8.2 per cent on last year. With supply constraints still a reality and the cost-of-living crisis continuing, there is little sign of the industry being able to recover lost sales. Looking to Q4, rising interest rates will make the cost of financing a new car more expensive and many consumers will be delaying major purchases due to higher bills elsewhere. Although order books generally remain full for the rest of the year, it is likely that the number of enquiries will fall, raising questions amongst some dealers about prospects for 2023.

Electric vehicles

“Despite ongoing struggles experienced across the sector, battery electric vehicles continue to grow in popularity; volumes were up 16.5 per cent in September compared to the same period last year, accounting for a 16.9 per cent market share.

“Year-to-date, battery electric vehicles account for 14.5 per cent of all new cars sold. This can be explained, in part, by some manufacturers prioritising the production of battery electric vehicles as semiconductor supplies remain constrained.

“With rising energy prices taking effect, there has been some concern that the cost of charging an EV is now, per mile, comparable to filling a car up with petrol. However, these figures are based on the cost of public charging stations which is typically higher than charging at home.

“With new EV models coming to market, this should encourage more consumers to switch over time. In the UK, sales of battery electric vehicles continue to grow more quickly than plug-in-hybrids which are now seeing sales decline.

“In terms of cost, too, there are still major savings to be had by switching to an EV via a company car scheme. Based on the current Benefit-in-Kind tax scheme, an EV can be over 90 per cent cheaper than a petrol or diesel car if all the savings are passed on from the employer to the employee.”

SMMT

SMMT

Comments