Crypto bubble prompts 9.2% jump in UK luxury car ownership

Porsche is the most popular luxury car brand in the UK (Photo: RedCharlie; Unsplash)

Porsche is the most popular luxury car brand in the UK (Photo: RedCharlie; Unsplash)

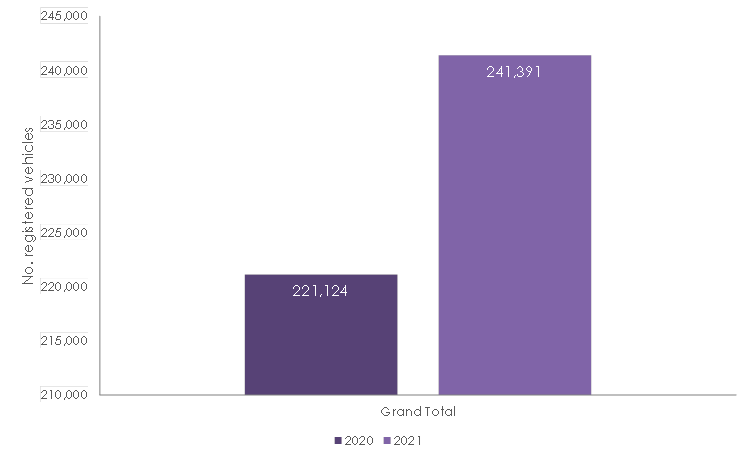

Ownership of Aston Martin, Rolls Royce, Maserati, Bentley and Porsche cars has increased 9.2 per cent in the UK in the past year, up from 221,124 in 2020 to 241,391 in 2021. Data from national accountancy group UHY Hacker Young shows that Porsche remains the most popular luxury brand with 173,523 vehicles on the road and the brand experiencing a 10 per cent increase on the total of 157,916 in 2020. Ownership of Maseratis is growing the quickest, with 10.3 per cent more on UK roads, from 10,078 in 2020, to 11,113 in 2021.

Previous research from UHY Hacker Young found that supercar ownership in the UK also increased in 2021, rising 19 per cent from 15,299 to a record high of 18,186 in 2021. The supercar category includes Bugatti, Ferrari, Koenigsegg, Lamborghini and McLaren.

David Kendrick, Partner at UHY Hacker Young, said windfalls from cryptocurrency may have boosted luxury car ownership before the market corrected. That explanation suggests investors would have quickly gained newfound wealth and chosen to spend it on high-status purchases like Bentleys and Maseratis.

David Kendrick adds that the increase in luxury car ownership in 2021 coincided with the bounce back in the economy following the pandemic. With interest rates near historic lows last year, options to purchase luxury cars on finance were widely available at attractive rates. This made luxury cars an option for many that couldn’t afford them previously.

However, “With interest rates soaring and the crypto bubble bursting, it is unlikely that people will have the appetite to spend so heavily on luxury vehicles. The luxury car market should expect a big challenge until some of the clouds lift from the economy.”

Still, 2021’s crypto-induced luxury car bubble is likely to positively impact high-end tyre demand in the next year or two as the vehicles bought during the aforementioned crypto bubble require replacement tyres. And that trend will be good news for tyre manufacturers, wholesalers and retailers alike.

(Source: UHY Hacker Young)

Comments