UK car production rises for 3rd consecutive month

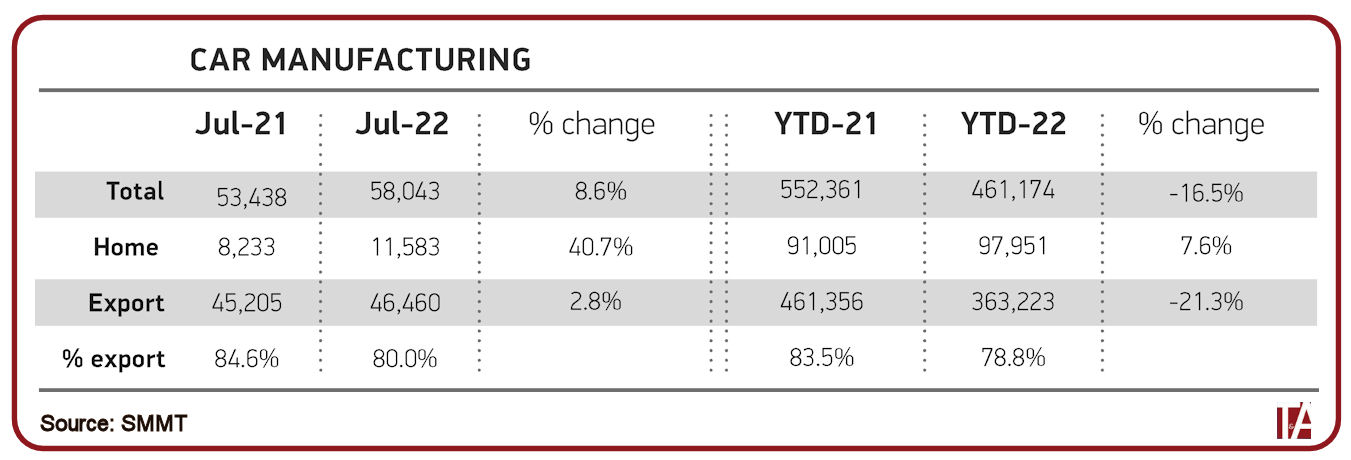

Car production in the UK rose for the third consecutive month in July, with figures published by the Society of Motor Manufacturers and Traders (SMMT) showing 8.6 per cent year-on-year growth to 58,043 units. But before the local industry pats itself on the back, the SMMT cautions that this performance must be set in context as it compares with July 2021, which thanks to the semiconductor shortage was the worst July since 1956.

Factories turned out 4,605 additional units in July 2022, a sign that component shortages may finally be beginning to ease. Output, however, still remains a hefty 46.4 per cent below pre-pandemic levels, illustrating that a full recovery is some way off. Production for the UK market surged 40.7 per cent to 11,583 units, with exports also up, but by a far more modest 2.8 per cent, in part reflecting the structural and model changes at play.

Shipments continue to drive the sector, accounting for eight out of ten cars made, though exports to top markets the EU and US were down 7.3 per cent and 22.8 per cent respectively. Orders from China rose 54.0 per cent while orders from Japan were up 40.1 per cent. Battery electric (BEV), plug-in hybrid (PHEV) and hybrid electric (HEV) accounted for 29.9 per cent of all cars made in July, a total of 17,356 units. BEV volumes were up 65.9 per cent.

Despite three months of growth, year-to-date UK car production is 16.5 per cent below the same period in 2021, at 461,174 units, representing a shortfall of 91,187 units. The decline is attributable to supply chain shortages, structural changes and weak exports, which fell 21.3 per cent to 363,223 units, with a 7.6 per cent rise in production for the UK unable to offset these losses. Some 78.8 per cent of all cars made in Britain since January have been shipped overseas, with 59.3 per cent destined for the EU.

“A third consecutive month of growth for UK car production is, of course, welcome and gives some hope that the supply chain issues blighting the sector may finally be starting to ease,” comments Mike Hawes, SMMT chief executive. “But other challenges remain, not least energy costs which are increasing at alarming rates. If we are to attract much needed investment to drive the production of zero emission vehicles, urgent action is needed to mitigate these costs to make the UK more competitive for manufacturing. This must be a priority for the next Prime Minister else we will fall further behind our global rivals, risking jobs and economic growth.”

Comments