Nankang and Federal’s cumulative operating revenue declined

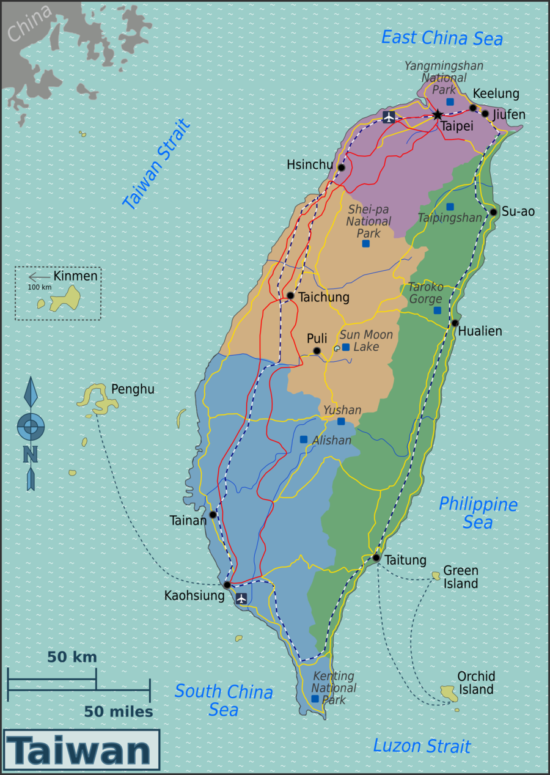

In October 2021, Nankang obtained Federal’s management rights. Nankang executives therefore control both Taiwan-based tyre manufacturers (Photo: WikiTravel)

In October 2021, Nankang obtained Federal’s management rights. Nankang executives therefore control both Taiwan-based tyre manufacturers (Photo: WikiTravel)

In the first week of August, Taiwanese tyre manufacturers Nankang and Federal successively released operating data for July 2022.

Nankang’s operating revenue in July was NT$660 million (about £18.22 million; 21.58 million euros), down 10.8 per cent from NT$740 million (about £20.42 million; 24.2 million euros) in the same period last year. From January to July, the tyre maker’s operating revenue was about NT$4.72 billion (about £130 million; 115 million euros), down 3.08 per cent year-on-year.

Tyrepress found that Nankang’s operating condition in 2022 fluctuated wildly. The tyre maker’s operating revenue in the first quarter was lower across the board than a year earlier. From January to March, Nankang’s monthly operating revenue decreased by 20.8 per cent, 28.42 per cent and 8.19 per cent year on year. However, in the second quarter, Nankang’s operating conditions seem to have improved, with monthly operating revenue from April to June increasing by 20.9 per cent, 7.74 per cent and 22.62 per cent. In the first month of the third quarter, the tyre company’s operating revenue was again less than a year earlier. At present, Nankang has not disclosed the reasons for July’s fluctuation.

Control of Federal Tire now lies in the hands of Nankang executives. In July 2022, Federal’s operating revenue was approximately NT$185 million (about £5.11 million, 6.05 million euros), an increase of 54.07 per cent over the same period last year. From January to July, the company’s operating revenue reached NT$924 million (about £25.5 million, 30.21 million euros), a year-on-year decrease of 7.84 per cent.

From January to February, Federal’s operating revenue fell by 55.43 per cent and 39.29 per cent year-on-year, dragging down the tyre manufacturer’s performance this year. In the following five months, Federal’s monthly operating revenue was more than 10 per cent higher than the same period last year, but it still failed to achieve positive growth in cumulative operating revenue.

Point S

Point S Davanti Tyres

Davanti Tyres

Comments