Goodyear: Sales, income up in Q2 2022

Image: Goodyear

Image: Goodyear

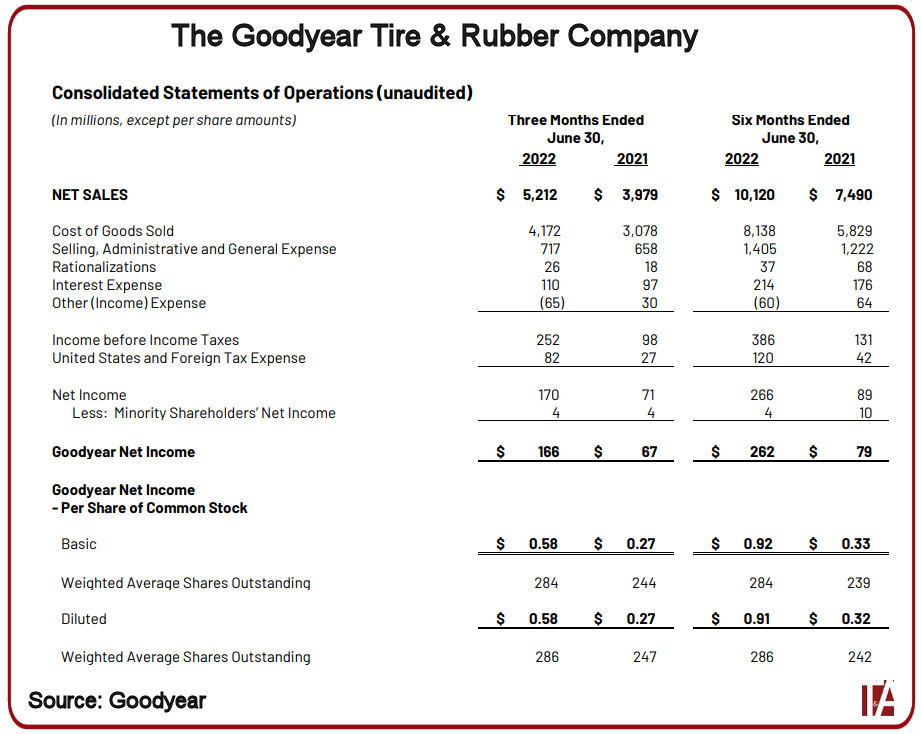

Larger than ever following its acquisition of Cooper Tire in 2021, Goodyear Tire & Rubber reported year-on-year net sales growth of 31 per cent in Q2 2022. Sales amounted to US$5.2 billion in the three months to 30 June 2022, and Goodyear states that even excluding the Cooper transaction, this figure reflects year-on-year growth of over 15 per cent. Other factors driving this increase included improvements in price/mix, higher volume, and increased sales from other tyre-related businesses.

Tyre unit volumes totalled 45.6 million, up 21 per cent from the second quarter of last year. Replacement and original equipment tyre unit volumes increased 23 per cent and 17 per cent respectively, reflecting both the addition of Cooper Tire unit volume and growth in Goodyear’s legacy business.

Second quarter 2022 net income was $166 million (58 cents per share) compared to net income of $67 million (27 cents per share) a year ago. Goodyear notes the presence of “several significant items” during the period, including, on a pre-tax basis, a one-time gain of $95 million on a sale and leaseback transaction related to retail properties in the Americas and a gain of $14 million related to a tariff-rate change, partially offset by rationalisation charges of $26 million and pension settlement charges of $18 million.

Second quarter 2022 adjusted net income was $131 million compared to adjusted net income of $79 million in the prior year’s quarter. Adjusted earnings per share were $0.46, compared to $0.32 in the prior year’s quarter. Per share amounts are diluted.

The company reported segment operating income of $364 million in the second quarter of 2022, up $65 million from a year ago. The company also reported merger-adjusted segment operating income of $372 million, which excludes certain costs triggered by the Cooper Tire merger, up $23 million from a year ago. The increase in segment operating income primarily reflects improvements in price/mix, the Cooper Tire merger (including the non-recurrence of other transaction-related items in the prior year) and the impact of higher volume. These factors were partly offset by higher raw material costs, inflationary cost pressures in wages, benefits, energy and transportation and the non-recurrence of a $69 million benefit in the prior year related to a Brazilian Supreme Court ruling with respect to indirect taxes.

Highest in a decade

“Our second quarter and first half sales were the highest in a decade, reflecting the recent addition of Cooper Tire, the benefit of strong pricing actions across many of our key markets, and volume growth,” said Richard J. Kramer, chairman, chief executive officer and president.

“With the increase in our top line, we continued to grow earnings despite elevated inflation and COVID-related disruptions in China. I am pleased with the agility and execution our teams demonstrated through the first half of the year.”

Year-to-date results

Goodyear’s sales for the first six months of 2022 were $10.1 billion, a 35 per cent increase from the same period of 2021, primarily due to the Cooper Tire merger, improvements in price/mix, higher volume and increased sales from other tyre-related businesses.

Tyre unit volumes totalled 90.6 million, up 25 per cent from 2021. Replacement tyre shipments increased 29 per cent. This growth included additional tyre unit volume related to the Cooper Tire merger, which closed on 7 June 2021 as well as the benefit of stronger industry demand and growth in Goodyear’s legacy business. Original equipment volume increased 13 per cent, driven by higher vehicle production and new fitments.

First half net income was $262 million (91 cents per share) compared to net income of $79 million (32 cents per share) in the prior-year period. The first half of 2022 included several significant items, including, on a pre-tax basis, a one-time gain of $95 million on a sale and leaseback transaction related to retail properties in Americas and a gain of $14 million related to a tariff-rate change, partially offset by rationalization charges of $37 million and pension settlement charges of $18 million.

Goodyear’s adjusted net income for the first six months of 2022 was $236 million (83 cents per share), compared to adjusted net income of $184 million (76 cents per share) a year earlier. Per share amounts are diluted.

The company reported segment operating income of $667 million for the first six months of 2022, up $142 million from a year ago. The company also reported merger-adjusted segment operating income of $683 million, which excludes certain costs triggered by the Cooper Tire merger, up $108 million from the prior year. The increase in segment operating income primarily reflects the impacts of improvements in price/mix, the Cooper Tire merger, including the non-recurrence of other transaction-related items in the prior year, and higher volume. These factors were partly offset by higher raw material costs as well as inflationary cost pressures in wages, benefits, energy and transportation.

Americas business segment

Second quarter sales in Goodyear’s Americas business segment amounted to $3.1 billion and were nearly 40 per cent higher than in the same period of the previous year. This increase was driven by the Cooper Tire merger, improvements in price/mix, and increased sales from other tyre-related businesses. Tyre unit volume increased 22 per cent. Replacement tyre unit volume increased 24 per cent, driven by the addition of Cooper Tire volume to the company’s reported results. Original equipment unit volume increased almost 13 per cent, reflecting an improvement in vehicle production.

Operating income of $293 million was up $60 million from the prior year’s quarter. The increase was driven by improvements in price/mix and the Cooper Tire merger. These factors were partially offset by higher raw material costs, inflationary cost pressures and the non-recurrence of a $69 million benefit in the prior year related to a Brazilian Supreme Court ruling with respect to indirect taxes.

Europe, Middle East and Africa

Sales in Goodyear’s Europe, Middle East and Africa (EMEA) region increased 22 per cent year-on-year in Q2 2022 to $1.5 billion, primarily due to improvements in price/mix, higher volume and the Cooper Tire merger. Tyre unit volume increased 21 per cent. Replacement tyre unit volume rose 25 per cent due to ongoing industry recovery from the pandemic whilst original equipment unit volume increased seven per cent, reflecting improved vehicle production and share gains.

Second quarter 2022 segment operating income of $52 million was up $9 million from the prior year’s quarter, driven by improvements in price/mix and the impact of higher volume. These factors were partially offset by higher raw material costs and inflationary cost pressures.

Asia Pacific

Asia Pacific’s second quarter 2022 sales increased 15 per cent to $568 million, driven by higher volume, the Cooper Tire merger and improvements in price/mix. Tyre unit volume increased 20 per cent due to the addition of Cooper Tire’s units and growth in the consumer business outside of China. Replacement tyre unit volume increased ten per cent. Original equipment unit volume increased 38 per cent due to new fitments.

Second quarter 2022 segment operating income of $19 million was down $4 million from the prior year’s quarter, driven by higher raw material costs and inflationary cost pressures, partly offset by improvements in price/mix, higher volume and the Cooper Tire merger.

Comments