Global aftermarket set to grow 13% in 2022, UK and EU also up

With new vehicle supply still being hampered by the global chip shortage, drivers are running their cars for longer and therefore spending more money on repairs and maintenance (Photo: Artem Podrez; Pexels)

With new vehicle supply still being hampered by the global chip shortage, drivers are running their cars for longer and therefore spending more money on repairs and maintenance (Photo: Artem Podrez; Pexels)

Halfords Autocentres’ recent expansion into the top-table of tyre retail is indicative of a wider move towards mechanical work in tyre-orientated garages. Now, many fast fits generate somewhere around 50 per cent of their income from non-tyre business.

According to the latest SMMT data, the UK aftermarket turns over an annual £21.1 billion – making it the ninth largest in the world. And what’s more there are said to be north of 40,000 points of sale in the UK, which means the wider tyre business’s recent shift towards more mechanical work means that aftermarket space is as competitive as ever. Still, the ongoing outlook is good and the aforementioned growth figures are increasing at the same rate as the UK’s growing car parc. As a result, SMMT projections suggest the UK aftermarket sector’s value is set to rise to £28 billion by 2022.

But how does this look in the context of the last few pandemic years? What does the future hold? And how do all the figures sit within the global and European context? Tyres & Accessories recently put the SMMT numbers in dialogue with figures from other well-known third-party data in order to answer those questions and illustrate the current shape and scale of the aftermarket.

First a couple of definitions. When we say “aftermarket” the MarketLine data we consulted counts a wide range of components including: air filters, alloy wheels, brake parts, exhausts, oil, shock absorbers, tyres, wipers and more. Values are calculated in terms of retail selling price (RSP) including tax including labour. Data is collected from channels including: fast fits, autocentres, garages, tyre specialists, crash repair centres and online sales.

Global aftermarket growth has been “moderate” during the last five years, supported by period of what might be described as post-pandemic recovery growth of 14 per cent in 2021. From here on, the market is forecast to see healthy growth this year, slowing after 2022.

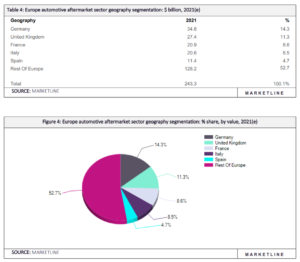

The Asia-Pacific aftermarket is the largest sub-market, accounting for 34.2 per cent of the global market’s value. The European aftermarket comprises 26.3 [per cent, while the Middle East only amounts to a share of 3.8 per cent.

The global automotive aftermarket is expected to generate $924.1 billion in 2021, representing a compound annual growth rate (CAGR) of 2.9 per cent between 2017 and 2021. That figure compares with what the SMMT calls “a total global opportunity” of £500 billion ($601 billion) for exporting UK aftermarket businesses. Even when the UK’s £21.1 billion value is added back on and when foreign exchange is taken into account, there is still a big difference between the two figures – something that is most likely explained by different counting methods, probably differences of opinions relating to what should be counted as aftermarket. But whichever way you look at it, the scale is huge and growing.

In comparison, the Asia-Pacific market is predicted to increase with a CAGR of 3 per cent, and the US market will decline with a CAGR of -0.2 per cent, over the same period, to reach respective values of $315.7 billion and $164.5 billion in 2021. The market shrank by 11.2 per cent in 2020, largely due to the COVID-19 pandemic, which severely hampered car

manufacturing, leading to a decline of 15 per cent.

Moving forward, the global aftermarket is expected to accelerate, with an anticipated CAGR of 7.8 per cent for the five-year period between 2021 and 2026. That growth is expected to drive the global market to a value of $1,347.2 billion by the end of 2026. That’s comparatively faster than the Asia-Pacific and US markets, which are predicted to experience CAGRs of 6.3 per cent and 6.9 per cent respectively over the same period, reaching respective values of $428.4 billion and $229.8 billion in 2026.

On a global level, now is the time for aftermarket growth. Indeed, a 13 per cent uptick is predicted by the end of the year. There are two reasons. Firstly, pent-up demand from the pandemic period. And secondly, due to the global semiconductor shortage. In short, new car supply problems mean drivers are running their cars for longer and therefore repairing and maintaining them for longer. Something similar was seen in 2021 immediately after pandemic-related lockdowns the year before. However, the flip-side is also true. Such aftermarket benefits may turn into disadvantages when supply improves since new cars require less maintenance.

UK aftermarket still the second-largest in Europe

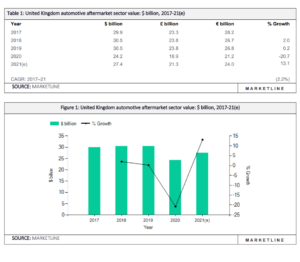

The European automotive aftermarket is expected to generate $243.3 billion in 2021, a CAGR of 0.8 per cent between 2017 and 2021. In comparison, the top two markets – Germany and the UK (see chart 1) – are expected to decline with compound annual rates of change (CARCs) of -1.2 per cent and -2.2 per cent respectively, to values of $34.8 billion and $27.4 billion in 2021.

Roughly in parallel with what we know of the tyre market, the European aftermarket as a whole experienced a contraction of 15.4 per cent in 2020. Mirroring global supply trends, 2021 saw a significant rise in demand in the aftermarket, driving growth.

Within the total aftermarket figures,

the components segment accounted for the market’s highest value in 2021 ($193.2 billion), equivalent to 79.4 per cent of the market’s overall value. And that means labour amounted to $50.2 billion in 2021 – 20.6 per cent of the market’s aggregate value.

The European aftermarket is not expected to grow as fast as the global aftermarket, but acceleration is still on the horizon. This means an anticipated CAGR of 7.8 per cent between 2021 and 2026 to a value of $355.0 billion. Meanwhile, the German and UK markets are predicted to grow with CAGRs of 3.9 per cent and 4.4 per cent respectively, reaching values of $42.1 billion and $33.9 billion respectively.

UK aftermarket to grow >11% in 2022

MarketLine data shows that the UK aftermarket has shrunk over the past five years, despite growth of 13.1 per cent in 2021. Moving forward, the UK aftermarket is expected to experience strong

growth of 11.8 per cent in 2022 before dropping down a gear for the rest of the years between now and 2026.

The UK automotive aftermarket market is reported to have hit $27.4 billion (£22.74 billion) in 2021, a compound annual rate of change (CARC) of -2.2 per cent between 2017 and 2021. That figure is roughly comparable with the SMMT’s estimate of £21.1 billion ($25.41 billion), suggesting the UK analysis is more reliable than the global estimates.

In comparison, the French and German markets are said to have declined with CARCs of -0.3 and -1.2 per cent respectively, hitting $20.9 billion and $34.8 billion respectively in 2021.

The UK aftermarket’s growth of 13.1 per cent in 2021 was driven by a substantial rise in the sale of used cars, as consumers moved away from new cars

due to higher prices and long lead times in 2020.

The components segment accounted for the market’s highest value in 2021. At $19.9 billion, that’s equivalent to 72.6 per cent of the market’s overall value. The labour part of the calculation contributed $7.5 billion in 2021, 27.4 per cent of the overall figure. As we have seen, moving forward UK aftermarket growth is forecast to accelerate with an anticipated CAGR of 4.4 per cent in the 2021 – 2026 period. As a result, the market value is expected to total $33.9 billion by the end of 2026 (see chart 2).

When it comes to projections for 2022 performance, the UK market is broadly keeping pace with the impressive acceleration of the global market and is forecast to witness growth of 11.8 per cent in 2022, as the global semiconductor shortage continues. And that, in turn, means tyre specialists that have branched out into mechanical work – as well as those that were already doing it – would do well to make hay while the sun shines during the second half of 2022 and into 2023.

Comments