Sixth month of decline for UK van market

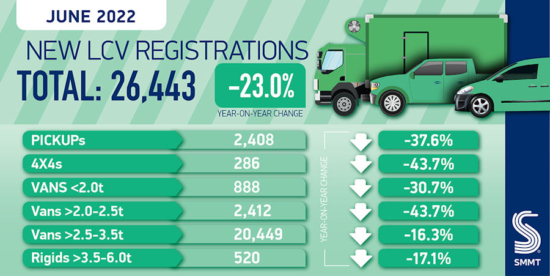

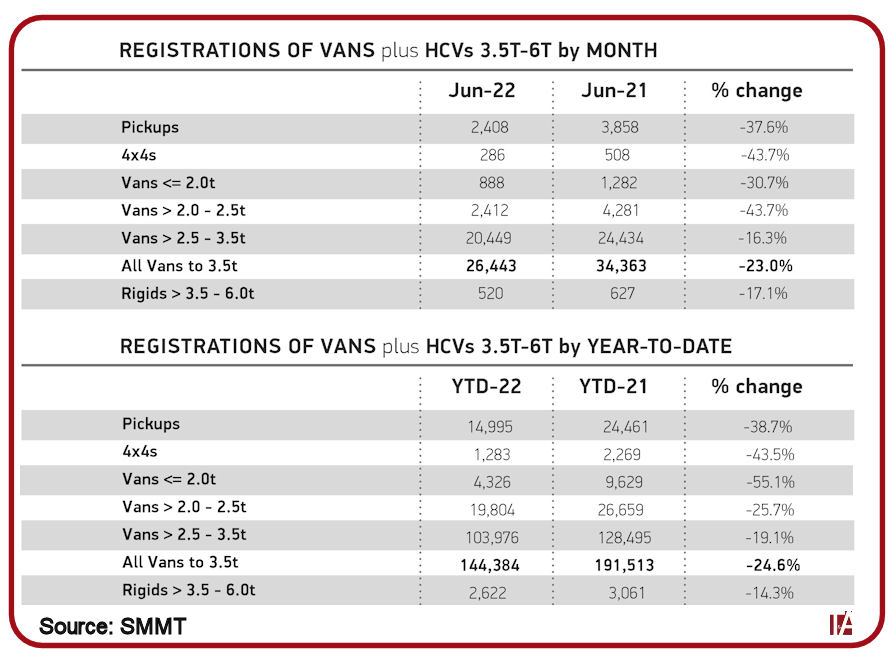

Figures released by the Society of Motor Manufacturers and Traders (SMMT) yesterday show that the UK new light commercial vehicle (LCV) market declined for the sixth consecutive month in June. New registrations fell by 23.0 per cent to 26,443 units. Amid ongoing global supply chain shortages, 144,384 new vans, pickups and 4x4s were registered during the first half of 2022, 24.6 per cent fewer than in the same period last year.

The half-year decline is in part exacerbated by comparison with 2021, which saw the third best start to a year as pent-up demand for online delivery vehicles and a bounce-back in the construction sector boosted registrations. While demand has been robust for most of this year, shortages of components have impacted deliveries and lead times, with the market remaining 26.5 per cent below pre-pandemic levels.

Decreases in registrations occurred across all segments in June. New registrations of vans weighing above 2.5 tonnes up to 3.5 tonnes declined 16.3 per cent to 20,449, while the number of vans weighing 2.0 tonnes or less joining UK roads dropped 30.7 per cent and those weighing between 2.0 tonnes and 2.5 tonnes by 43.7 per cent.

Despite the ongoing supply challenges, growth in battery electric vans (BEVs) continued in June, up 52.4 per cent to 2,015 units – a trend seen across the first six months of 2022, with registrations at 8,100 units representing a 60.0 per cent increase over the same period last year. However, BEVs still represent only one in 13 new van registrations in the UK this year.

“The impact of the global shortage of semiconductors is severe, constraining supplies and extending lead times for commercial vehicles,” says Mike Hawes, SMMT chief executive. “While electric vehicle registrations are growing in response to an ever-wider choice of plug-in models, a successful transition means accelerating uptake at pace, and this task could not come at a more difficult time. With inflation and energy costs hitting the pockets of UK van buyers, as well as the industry, operators need to be assured that charging infrastructure can meet their needs and that fiscal and grant incentives are in place for the long term.”

Comments