Michelin publishes H1 2022 results, maintains full-year guidance

Photo: Tyrepress.com/Stephen Goodchild

Photo: Tyrepress.com/Stephen Goodchild

In a market hit by the systemic impacts of the conflict in Ukraine and the health crisis, the Michelin Group reports that its net income fell by 18.3 per cent despite a year-on-year increase in sales. The tyre maker nevertheless considers this a good result “in an extremely unsettled environment.”

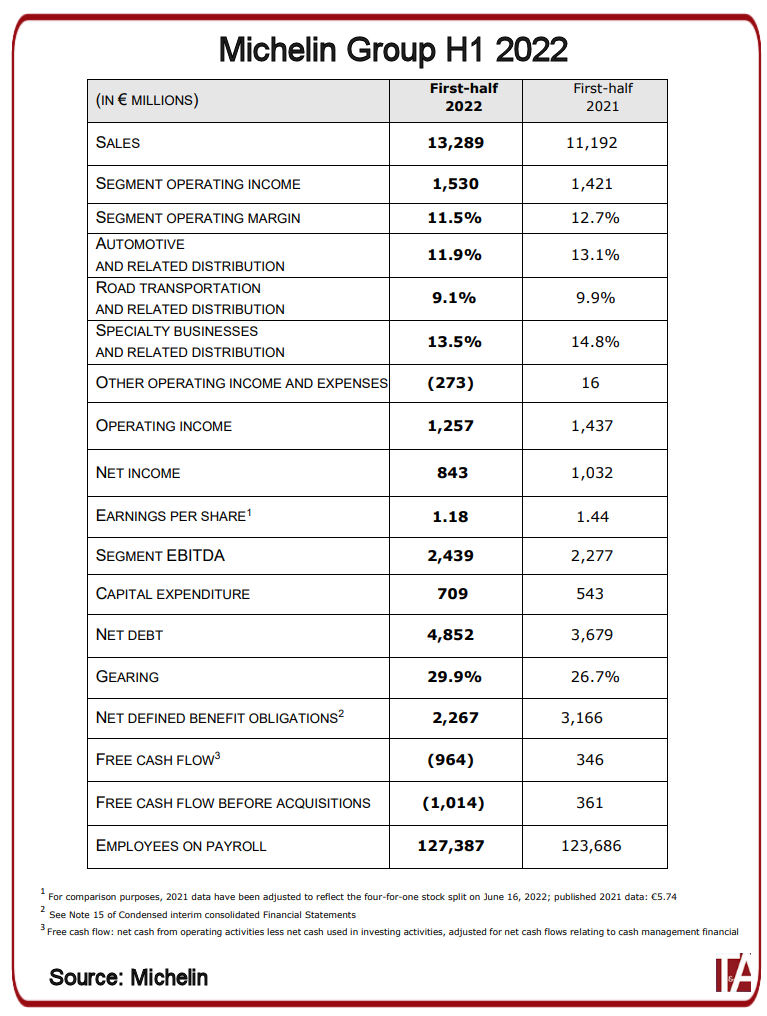

Tyre volumes decreased by 2.2 per cent compared with the first half of 2021; excluding sales in Eastern Europe and China, these volumes were stable. Sales rose 18.7 per cent to 13.289 billion euros, and Michelin reports that its non-tyre business accounted for a higher proportion of the total; this rose by 19 per cent at constant exchange rates. Tyre price-mix effect stands at 13.9 per cent, a level that Michelin says reflects the “Group’s determination to offset cost inflation.” The company recorded a positive currency effect of 5.2 per cent, due primarily to the US dollar.

Operating & net income

Segment operating income improved in every reporting segment and stood at 1.530 billion euros, or 11.5 per cent of sales. The operating margin reflected a 1.2 point dilutive effect from the price increases introduced to offset inflation.

Net consolidated result landed at 843 million euros, including a 202-million-euro impairment related to our operations suspension in Russia. Net income amounted to 843 million euros; a year-on-year decrease of 18.3 per cent.

Free cash flow before acquisitions came to a negative 1.014 billion euros, as the improvement in EBITDA to 2.439 billion was offset by the impact of inflation on working capital requirement. Back to a usual seasonality, Michelin anticipates that a Group cash surplus for the year will be generated by business in the second half.

Steering operations in challenging circumstances

“We’ve delivered good results in an extremely unsettled environment, led by the remarkable commitment of all our teams,” says Florent Menegaux, Michelin Group managing chairman. “The uncertainties of today’s world make it difficult to express a medium-term outlook. However, we can count on our clear and value-creating strategy, on our resilient business model, and on our employees’ outstanding agility to steer our operations in such challenging circumstances.”

Guidance maintained

Market projections have been lowered to reflect global economic growth uncertainties. Passenger car and light truck tyre markets are now expected to end the year between plus and minus two per cent, truck tyre markets to expand by between two per cent and six per cent, and the specialty markets to grow by between four per cent and eight per cent.

In this scenario, and barring any new systemic impacts, Michelin maintains its guidance for 2022, with full-year segment operating income above 3.2 billion euros at constant exchange rates, and structural free cash flow of more than 1.2 billion euros.

Tyre sales by segment:

In the first six months of 2022, the global original equipment and replacement passenger car and light truck tyre market was broadly unchanged year-on-year, but remained three per cent down on first-half 2019. The worldwide truck tyre market shrank by nine per cent in the first half of 2022, dragged down by the 36 per cent plunge in Chinese demand. Excluding China, the market ended the first six months up six per cent year-on-year and up eight per cent on first-half 2019.

OE – car & light truck

In the original equipment segment, demand varied widely by region during the period, and globally was down two per cent year-on-year and 15 per cent compared with 2019.

Europe was the regional market most affected by the multitude of crises, experiencing the impact of the war in Ukraine first-hand and contracting seven per cent year-on-year, for a total 29 per cent drop compared with first-half 2019.

In China, the COVID-19 resurgence in April and May caused demand to hit new lows before rebounding past 2019 levels in June as the country reopened. Over the half, demand was stable year-on-year, and down just one per cent on first-half 2019.

The North American market expanded by five per cent year-on-year, albeit from a very favourable basis of comparison, but remained 17 per cent lower than in first-half 2019.

OE – truck

The global original equipment truck tyre market contracted by 28 per cent in the first half of 2022. Excluding China, the market rose by 13 per cent over the period and was unchanged compared with first-half 2019.

In Europe and the Americas, robust economic growth and driver shortages continued to prompt trucking companies to massively upgrade their fleets, to the extent that manufacturers’ order books are filled till early 2023. Compared to first-half 2019, demand was down one per cent in Europe, down five per cent in North America and up 25 per cent in South America.

Replacement – car & light truck

Global demand for replacement tyres was generally unchanged in the first half of 2022, with year-on-year gains in every region except China and Russia. Compared to first-half 2019, the global market was up two per cent.

In Europe, the market grew by seven per cent overall in the first half of 2022, but momentum slowed during the period, from nine per cent in the first quarter to five per cent in the second. Demand ended the full six months up six per cent on first-half 2019.

In China, mobility restrictions weighed on demand all through the half, pushing the market down 16 per cent year-on-year and down 20 per cent on first-half 2019.

Robust economic growth in North America kept demand very high throughout the period, lifting the market one per cent year-on-year and a full ten per cent on first-half 2019.

Replacement – truck

The global replacement truck tyre market declined by two per cent in the first half of 2022. Excluding China, the market ended the first six months up five pe cent year-on-year and up ten per cent on first-half 2019.

Demand was especially strong during the period in Europe and in the Americas, gaining an aggregate ten per cent year-on-year and 30 per cent compared with first-half 2019.

Specialties

Mining tyres: Demand for surface mining tyres remained very high in the first half, in a market limited by a lack of supply and tyre manufacturers’ reduced capacity to produce and ship products.

Agricultural & construction tyres: Markets rose over the period, particularly in the replacement segment. Original equipment demand, however, was more or less impacted by supply chain disruptions, depending on the OEM.

Two-wheel tyres: Demand remained high during the first half, impelled by an upturn in Asia.

Aircraft tyres: Markets rebounded in the first half from still favourable prior-year comparatives. In the second quarter, growth was led by the Americas and Europe, which picked up the pace from China. The General Aviation market continued to expand, in line with 2021 trends.

Conveyer belts: The market remained robust in every region, both in the mining segment, driven by strong demand for commodities, and in the manufacturing segment, supported by economic growth and high capital spending.

Specialty polymers: Demand continued to expand in the leading markets, including industry, aerospace, energy and medical applications.

Click here for full details of Michelin’s H1 2022 financial results

Comments